At the end of September 2021, Leichtman Research Group estimated that among the cable operators and wireless companies controlling 96% of the U.S. home broadband market, MSOs accounted for a nearly 70% market share.

Then nascent 5G fixed wireless access services, recently launched by T-Mobile and Verizon at the time, didn't even factor in LRG's third-quarter tally that year, which saw accounted for U.S. cable companies add nearly 600,000 high-speed internet customers.

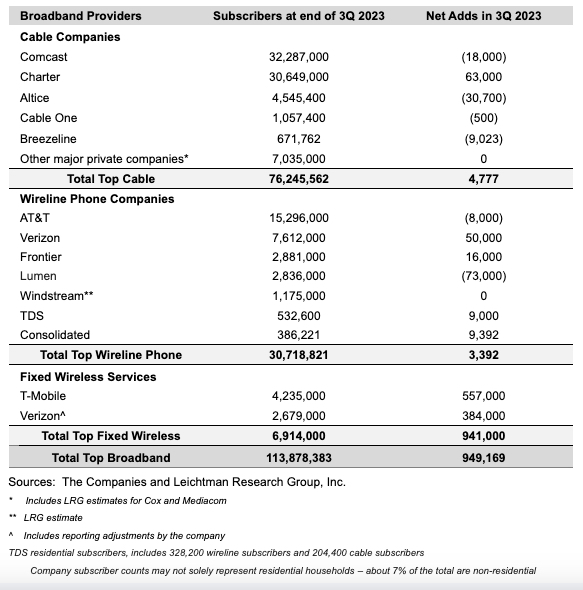

Jump forward to LRG's Q3 2023 tally of the top ISPs serving 96% of the U.S. market, and T-Mobile and Verizon added another 941,000 FWA users. The two companies now collectively reach a base of over 6.9 million home internet customers, mostly at 5G speeds. And that's not accounting for AT&T's recent entry into the fixed-wireless market and the 25,000 subscribers it added inQ3.

Very quickly, FWA has grown to control around 6% of the U.S. home internet market.

Cable operators, meanwhile, added fewer than 5,000 new wireline broadband customers between them in Q3. Their share of the market has dipped to about 66%.

Of course, a converse narrative is emerging in the U.S. consumer mobile market, where cable company MVNO-based services now control the bulk of new customer additions every quarter.