The US Federal Reserve has announced that it will raise interest rates by 25 basis points, with fixed mortgaged costs in the US now exceeding 4%. The Bank of England, fearing inflation could hit 10% this year, has hiked rates to 0.75%. The US and UK are well behind the developing world, with interest rates in Turkey at 14% and in Brazil at 10.75%.

But our own Reserve Bank of Australia (RBA) is nowhere to be seen, with interest rates remaining at an all-time low of 0.10%. This is despite near record-low unemployment levels and the inflation genie being well out the bottle, given existing demand-side pressures coupled with supply shortages caused by Russia’s invasion of Ukraine.

The RBA’s negative real interest policy (remember, inflation is 3.5% under the current dubious recording methods) is another (underhanded) way to transfer wealth from the young to the old and wealthy — alongside our fiscal responses like JobKeeper, better described as welfare for billionaires.

As your columnist has been pointing out for well over a decade, Australia’s 20-year housing bubble boom is not a function of limited supply but of the RBA’s continued insistence of destroying the value of money.

Why? Because house prices have very little to do with supply and everything to do with demand — that is, property buyers simply bid up the price of housing depending on their capacity to pay. That capacity is almost solely based on how much banks are willing to lend, and that willingness is based on the serviceability of the mortgage. As rates drop, bank lending is based more on the same income level. It’s not a complicated concept.

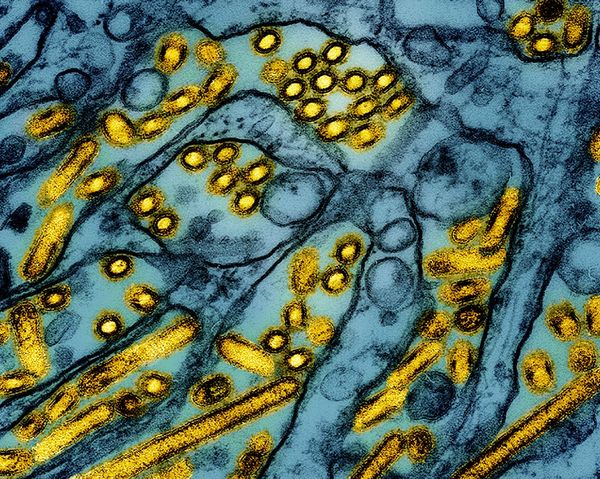

Let’s go back to March 2020, when the world was (somewhat justifiably) fearing a global depression as a result of the novel coronavirus. Back then, RBA boss Philip Lowe announced that interest rates would be slashed to a historic low of 0.25% (from an already historic low). The RBA stated:

The board will not increase the cash rate target until progress is being made towards full employment and it is confident that inflation will be sustainably within the 2-3% target band.

The RBA also started its own money printing (quantitative easing) process under the guise of “providing liquidity to Australian financial markets”. These measures had the direct and immediate effect of causing an already overpriced housing sector to explode, with house prices nationally jumping by 22% in 2021, effectively locking out an entire generation from the property sector and further enriching many property owning baby boomers.

The “emergency” economic conditions used by Lowe to justify the extraordinary interest rate settings ended well over a year ago. Now we have the opposite type of emergency, with inflation exploding globally where it is now impacting consumer goods rather than just assets like property, cryptocurrencies and shares.

Inflation is well above Lowe’s desired band, while the unemployment rate fell to a 14-year low of 4.1% (with the economy basically at full employment).

So according to Lowe’s (and his predecessor Glenn Stevens’) own commentary, there is absolutely no justification for this absurd interest rate setting.

Historically, the rate of interest is set at a premium to inflation. As inflation looks set to rocket above 4%, the normalised interest rate level should be around 7%.

This would have the twin effects of rewarding responsible savers (who have seen their cash investments decimated since 2008) and of quickly adjusting the price of housing stock to a level where those aged under 40 are able to afford a property without a life of indentured servitude.

But the goal of several generations of RBA boards and governors has not been about ensuring price stability. Quite the contrary. The intent of the RBA has been and remains to ensure the housing bubble remains inflated and to ensure the wealthiest class of Australians remains completely unimpacted by economic realities.