Stocks may have booked the bulk of their gains amid one of the longest pauses between Federal Reserve interest rate moves on record, leaving investors to pin hopes for a second-half rally on the strength of corporate earnings and profit forecasts over the coming months.

The S&P 500 gave back some of its year-to-date gains in early April amid concerns that sticky inflation readings and a resilient job market would keep the Fed from delivering on its forecast of three quarter-point rate cuts.

However, the index has largely clawed back those declines in May, rising just over 3% to extend its year-to-date advance to 8.8%.

The S&P 500's last all-time closing high, recorded on March 20, pegged the benchmark at 5,224.62 points, just 0.4% from its current level, suggesting a fresh record run is firmly on the cards.

Better-than-expected corporate earnings, particularly from the so-called Magnificent 7 tech heavyweights, have powered much of the recent advance, while a pullback in Treasury bond yields tied to Fed Chairman Jerome Powell's assurance that rate increases aren't on the table anytime soon has also helped.

With around 80% of the S&P 500 reporting March-quarter earnings, collective profits are forecast to rise 7.1% from a year earlier to $466 billion. In the June quarter, they're estimated to grow 11.1% from a year earlier to $496.6 billion.

Meanwhile, last week's April jobs report offered what Wall Street calls a Goldilocks assessment of the world's biggest economy that's typically tied to solid near-term stock performance.

Employers added 175,000 new jobs last month, a tally that showed enough of a slowdown from the upwardly revised 315,000 in March to quash fears of renewed wage pressures but still suggested solid hiring momentum into the summer.

That's helped benchmark 10-year Treasury-note yields, one of the most important valuation metrics on Wall Street, shed nearly 0.3 percentage points from their late-April peak to trade at their current level of around 4.485%.

Bond yields are easing

As a proxy for a risk-free borrowing rate, a lower 10-year yield is generally associated with higher asset prices (such as stocks and bonds) while higher yields generally add to downward market pressures.

"The Fed is now accepting [that] rates need to stay high for longer given sticky inflation. It also pushed back against hikes," said BlackRock in its weekly market commentary, led by Jean Boivin. "Yet greater macro volatility makes it harder for both markets and policymakers to predict what’s ahead."

"That’s why we rely on new data, instead of Fed policy signals, to shape our view of the likely policy path," he added.

Related: Jobs report may show red-hot market, that’s defied Fed rate hikes, is cooling

Rate traders, meanwhile, now see the Fed executing the first of likely two 2024 rate cuts in September, taking the benchmark Federal Funds level to between 5% and 5.25% as the economy slows and inflation cools.

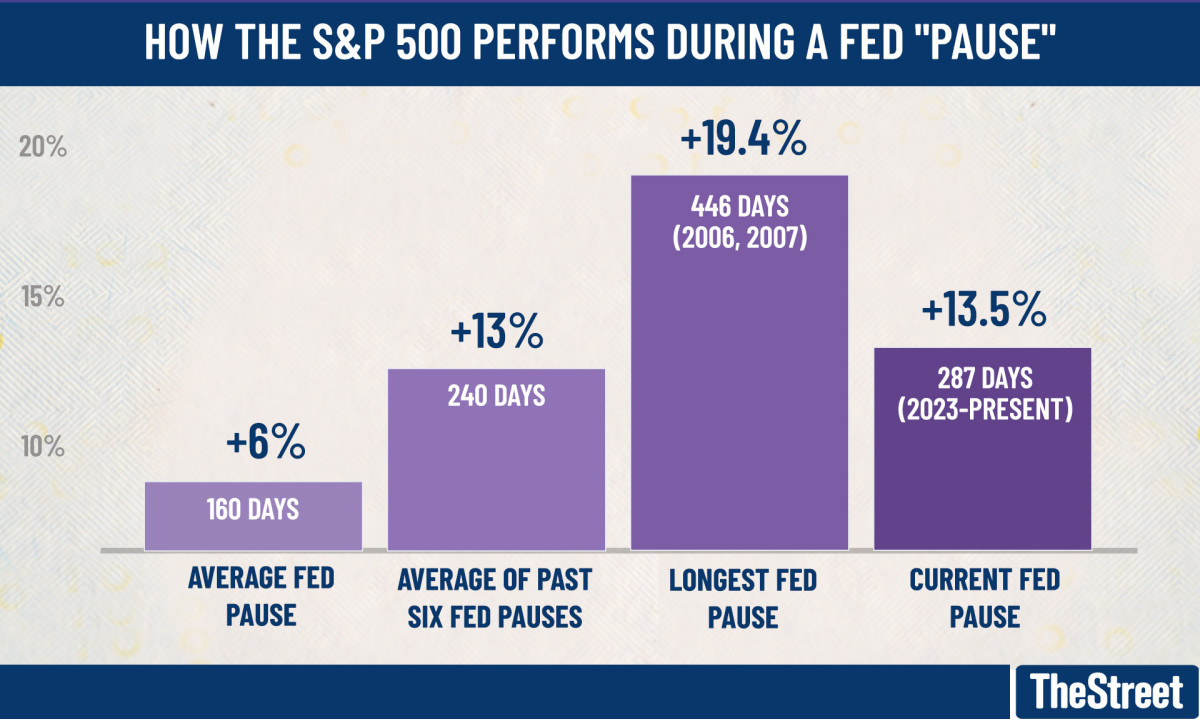

That would mark a gap of around 420 days since the previous Fed rate hike, which was unveiled in July 2023 and would be the second-longest pause in Fed policy on record.

"Long pauses have historically been pretty good environments for stocks, and we’re in one right now, even if it ends this summer (which is far from assured)," said Jeff Buchbinder, chief equity strategist at LPL Financial.

Financial- and energy-sector stocks have generally outperformed their peers during a pause in Fed policy, rising on average 16.9% and 15.1%, respectively, over the past six instances.

The pause that refreshes

Buchbinder also notes that the average S&P 500 gain during an average Fed pause is 6%, citing data collected over the past five decades.

Longer pauses, however, have produced better results: Buchbinder says the average gain over the past six policy gaps, going back to 1989, has been slightly more than 13%.

We're already ahead of that.

The broadest benchmark of U.S. blue-chip shares has gained more than 13.5% since the Fed hiked in July last year, while the tech-heavy Nasdaq has gained 15.2%.

"It’s important to remember, however, that monetary policy is only one factor influencing markets," cautioned Buchbinder. "There are other key fundamental drivers such as the economy, earnings, and, in the long term, valuations."

David Bahnsen, chief investment officer at Bahnsen Group in Newport Beach, Calif., agrees. He argues that current market gains are "more driven by 'fear of missing out' than confidence about fundamentals" now that the Fed is deeply entrenched in wait-and-see mode.

"With no rate cuts possible until July, and not likely until September, and the next earnings season two months from starting, there are no apparent catalysts to change the near future direction of stocks other than speculation," he said.

That likely leaves investors to focus on stock and sector valuations as a driver of near-term performance

"Every category of backdrop — macroeconomic to fiscal to monetary, geopolitical — screams for a focus on value and quality right now," said Bahnsen.

Stocks are rich but earnings are improving

LSEG data pegs the S&P 500's 12-month price-to-earnings multiple, a key Wall Street valuation metric, at 20.1 times, a level that sits around 2 points north of its recent five-year average but well below the 24.4-times peak recorded in summer 1999.

But Boivin at BlackRock says that level shouldn't spook investors. He notes that he and his team are tactically overweight U.S. stocks, thanks to solid earnings support and neutral long-term-bond yields.

"Higher interest rates usually hurt U.S. stock valuations," said Boivin at BlackRock. "Instead, strong first-quarter earnings have supported stocks even as high rates and lofty expectations raise the bar for what can keep markets sanguine."

Related: Fed faces fine-line walk between inflation hawk and slow-growth realist

Earnings will need to continue to improve, however, if the Fed is minded to remain on hold deep into the year, or possibly beyond, and at the same time inflation remains as stubbornly sticky as it has been.

LSEG data peg 2024 earnings growth at 10.4%, improving to 14% in 2025.

More Economic Analysis:

- Watch out for 8% mortgage rates

- Hot inflation report batters stocks; here's what happens next

- Inflation report will disappoint markets (and the Fed)

That might not be too difficult to achieve if consumers continue to spend, argues Jason Pride, chief of investment strategy and research at Glenmede. He says earnings improvements "should be a tailwind for most equity markets in 2024."

"Despite the pessimism expressed in surveys, U.S. consumers continue to spend their money at a healthy clip," he said in a note penned with the investment firm's vice president of investment strategy, Michael Reynolds.

"Consumption growth has now outgrown personal income in four of the last five months, reflecting a willingness of consumers to spend even if their incomes aren’t quite keeping up," the pair said.

Related: Veteran fund manager picks favorite stocks for 2024