The S&P 500 was flat and the Nasdaq marginally higher on June 13, just hours after the monthly inflation report came in higher than expected.

This is a pretty mixed report. Both core CPI and the overall CPI came in above the year-over-year and month-over-month expectations. That’s bad.

But core CPI on the year-over-year measures has now declined for three straight months. So have the personal-consumption expenditure measures, as have hourly wages.

Additionally, oil prices have come tumbling lower — down 8% this week and more than 22% from the June high — while gasoline prices continue to retreat as well.

We’re not fully in the clear, though.

Worries for a recession continue to grow, while odds are now increasing that the Fed delivers a 100-basis-point (1-percentage-point) rate increase later this month.

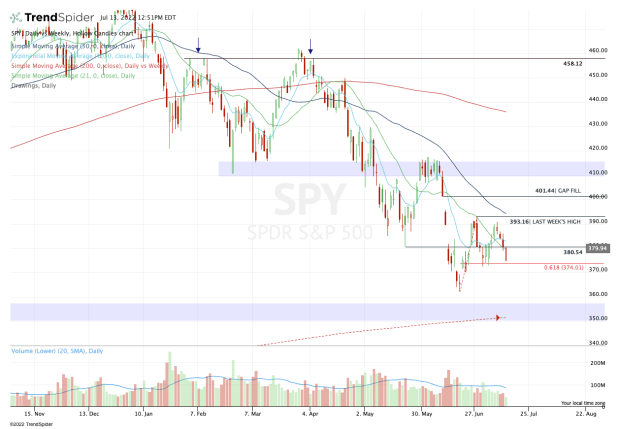

Trading the S&P 500

Chart courtesy of TrendSpider.com

The market is trading like this could be a peak-inflation result. That’s not to say the bottom is in or that these gains can’t reverse by the end of the week. But the price action is certainly different from the past few reports.

When the May report came out, the S&P 500 was near the end of a 10% skid in just six trading sessions (five of which ended lower). In June, it was in the middle of a five-day free fall, where the index again fell more than 10%.

So to see it rally from negative territory near today's open to positive territory in the afternoon is an improvement.

As far as where we go from here, two key levels stand out: $380.50 on the upside and $374 on the downside.

The latter was nearly tested at the open, but earlier this month this level was strong support over a three-day stretch. The $380.50 level has been a key pivot since May, and as you can see today, it’s playing a role as well — this time as resistance.

If the SPDR S&P 500 ETF (SPY) can’t reclaim $380.50, then $374 remains vulnerable. Below $374 and the SPY may need to retest the low near $362. Below that and the 200-week moving average looms as a potential support zone.

On the other hand, if it can reclaim the $380.50 pivot and the 10-day moving average, the bulls may be able to drive it up to the $390 to $393 zone.

Above that area and the 50-day moving average puts $400 and the $401.54 gap-fill on the table.

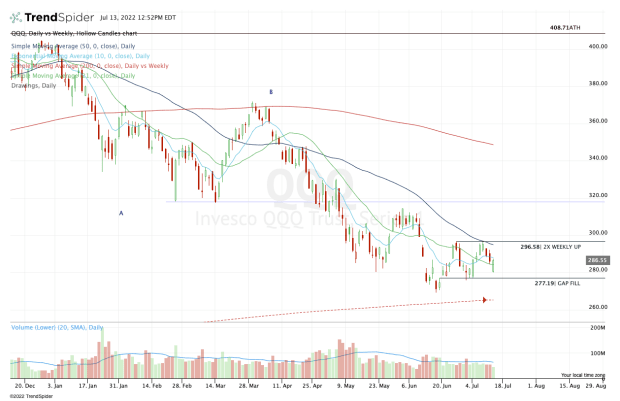

Trading the Nasdaq

Chart courtesy of TrendSpider.com

As this morning’s price action unfolded, it was interesting that risk-on assets like the Ark Innovation Fund (ARKK) — which still hasn’t made new lows, by the way — semiconductors, and small caps were leading the way.

This risk-on reaction may not hold up in the coming days, but it is something that could work in the bulls’ favor if they can gain some momentum.

Looking at the Invesco QQQ ETF QQQ, the levels are crystal clear.

On the upside, the bulls need to clear the 50-day moving average and the $296.50 area. If they do this, we could potentially see a strong move into the $310 to $315 area.

On the downside, a break and close below $277 puts the 2022 low in play near $269, along with the 200-week moving average.