Investors in Snowflake (SNOW) are wishing the stock was reacting to earnings the way Salesforce (CRM) stock is.

At last check, shares of Snowflake stock were down 12% on Thursday, while shares of Salesforce are up 12%. Salesforce is now running into key resistance on the chart, while Snowflake is hoping a key support level holds.

Don't Miss: EV Stocks Stumble as Nio, Rivian Earnings Disappoint. What's Next?

It’s clear that Salesforce reported a strong earnings result and Snowflake investors are left wanting more.

While the data-warehousing and analysis provider delivered a top- and bottom-line beat, the guidance is weighing on the stock.

Management provided first-quarter and full-year revenue guidance that came in below analysts’ expectations.

Now that Snowflake stock is back under pressure, will the bulls step in at a key point on the chart?

Trading Snowflake Stock on Earnings

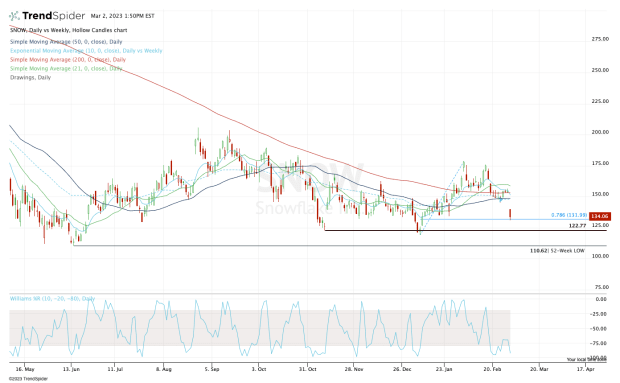

Chart courtesy of TrendSpider.com

Just a few weeks ago, Snowflake stock was trading above all its daily moving averages and continuing to bump up against $175.

Now it’s below all its daily moving averages and on the precipice of testing major support.

Don't Miss: Kohl's Chart: 7% Dividend Yield Can't Buoy the Stock

Aggressive bulls can consider buying as Snowflake stock bounces from the 78.6% retracement. If it can hold $130, then the post-earnings high near $140 is back in play.

Above that level and the stock can begin filling the gap up toward $153. The space between $150 and $153 contains a lot of key measures, including the 10-day, 10-week, 50-day and 200-day moving averages.

On the flip side, a move below $130 opens the door down to the $120 to $123 area.

That’s where strong support sits, as includes both the fourth-quarter and first-quarter lows.

A break of this zone would be very detrimental to the charts, opening the door down to the 52-week low near $110.50.

If that happens and the overall market is under heavy selling pressure, I wouldn’t be surprised to see a test of the $100 level.

That said, let’s wait to see how things shake out. Go level to level and see how the $130-ish area holds.

If it does hold as support, bulls can salvage the trade, although Salesforce surely looks more attractive at the moment.