When it comes to investing, I am generally a proponent of buying high-quality companies at reasonable prices, regardless of the short- or intermediate-term noise.

One could argue that a case in point is Nvidia (NVDA), a stock that suffered a peak-to-trough decline of 68.8% and bottomed in mid-October.

No one knows for sure what will come next for the market or the economy. Inflation is getting back under control, but coming at the cost of economic output and market liquidity.

Both of those realities have pressured the graphic-chip specialist's business, as well as its peers like Intel (INTC), Advanced Micro Devices (AMD) and others.

Taiwan Semiconductor (TSM) is reacting favorably on Thursday to its earnings report, but the quarter certainly highlights some challenges within the industry.

For Nvidia specifically, the stock has been trading much better lately. At one point, the shares were up more than 73% from the lows. What’s next for the chip giant?

Trading Nvidia Stock

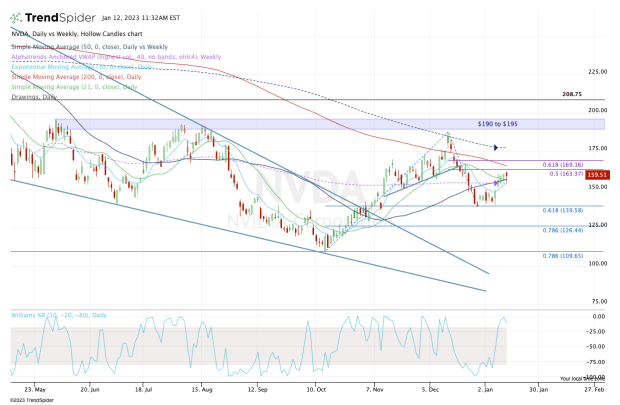

Chart courtesy of TrendSpider.com

If one is investing in Nvidia, it’s best just to get a good price, hold onto the stock and let the long-term time frames work in your favor. If you’re trading, though, entries and exits must be much more precise.

When Nvidia went on a monstrous rally in the fourth quarter, it rallied in seven out of eight weeks before tagging the 50-week moving average and retreating.

Ultimately, the shares filled the gap near $142 and found support at the 61.8% retracement. They're now consolidating in a rather tight four-day range.

From here, a 15% gain will send Nvidia stock back toward the fourth-quarter highs. Conversely, a 15% decline will drop the shares back down to the recent lows and prior support near $140.

As we’re in the middle of that range, it’s tough to know which way this one will fall. On the upside, keep an eye on the $163.50 to $165 area. There we find the 50% retracement and the 200-day moving average.

If Nvidia can clear these levels, then $169 is in play, opening the door back to the 50-week moving average and the December high near $188.

On the downside, it’s even clearer. The $154.50 to $155 area has been key support and today’s low is right in that range at $154.92.

As long as Nvidia stock holds this zone, it looks fine on the long side.

However, a break of this area means the stock will not only lose today’s low and recent support, but also the 10-day, 21-day and 50-day moving averages, as well as the daily VWAP measure.

That puts the gap-fill in play near $150, then a potential decline into the low-$140s.

When trading, do your best to keep it simple and go level to level. It may help to note price action like this: “If $154.50 fails, that’s a sign that buyers lack strength and puts $150 in play. Below $150 and bears gain momentum, putting $142 in play.”

The opposite can applied on the upside.