The cannabis equity capital market is highly challenging: For the first 42 weeks of 2022 only $72.5M of equity issues were closed by the U.S. Cultivation & Retail sector compared to $2.03B for the same period in 2021.

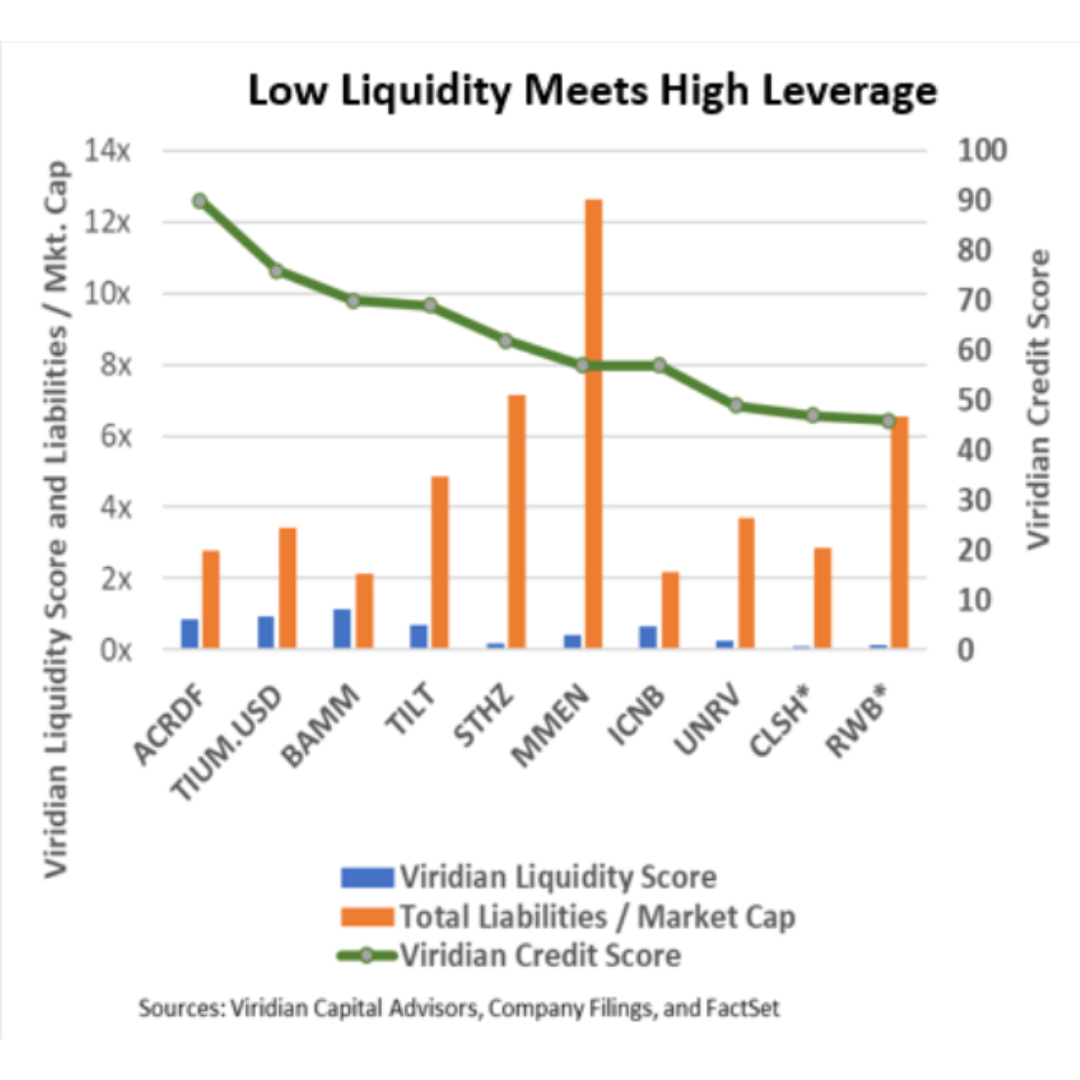

We screened the 61 companies in the Viridian Credit Tracker database with market caps between $10M and $300M for two characteristics that might indicate a need for debt restructuring:

-

Low liquidity as measured by a Viridian Liquidity Score of under 1.2x.

-

High leverage as calculated by a Total Liabilities to Market Cap of over 2x.

-

The resulting ten companies appear on the graph.

The blue bar represents the Viridian Liquidity Score, an average of a simple current ratio and a current ratio where the numerator is modified by adding annualized free cash flow, effectively taking into account the current cash burn rates of the companies. The red bar depicts total liabilities to market cap. The green line shows the Viridian Credit Score for each company, arranged with the best credits on the left.

Companies with an asterisk in the graph have already taken concrete steps to fix their liquidity/leverage issues.

-

Red White & Bloom (OTC:RWBYF) fixed its near-term maturity problem by pushing about $87M of maturities to 2024. That should alleviate the liquidity stress but not relieve its over-levered balance sheet.

-

CLS Holdings (OTC:CLSH) agreed with its December convertible debenture holders to allow for mandatory conversion of $7.9M out of $13.2 at $.07125 per share. The company also extended the maturities of ½ the remaining debentures to December 2024. When completed, conversions will significantly lower CLS’s market leverage from 2.9x to about 1.1x.

-

Tilt (OTC:TLLTF) completed a $15M sales leaseback on its Pennsylvania cultivation and has over half the cash it needs to retire its bond issues. The company continues to work with bondholders toward a stabilized capital structure.

Unrivaled (OTC:UNRV) and StateHouse (OTC:STHZF) appear vulnerable with tight liquidity, high leverage, and a California marketplace that stubbornly refuses to turn around.

Cansortium (OTC:CNTMF) and Body & Mind (OTC:BMMJ) both have severely underperforming stocks, amplifying their market leverage, but both have attractive assets to sell if required. Liquidity is tight, but with some operational improvements and reduced capital spending, both could squeeze through.

Investors need to focus closely on liquidity in the upcoming quarterly releases.

The Viridian Capital Chart of the Week highlights key investment, valuation and M&A trends taken from the Viridian Cannabis Deal Tracker.

The Viridian Cannabis Deal Tracker provides the market intelligence that cannabis companies, investors, and acquirers utilize to make informed decisions regarding capital allocation and M&A strategy. The Deal Tracker is a proprietary information service that monitors capital raise and M&A activity in the legal cannabis, CBD, and psychedelics industries. Each week the Tracker aggregates and analyzes all closed deals and segments each according to key metrics:

-

Deals by Industry Sector (To track the flow of capital and M&A Deals by one of 12 Sectors - from Cultivation to Brands to Software)

-

Deal Structure (Equity/Debt for Capital Raises, Cash/Stock/Earnout for M&A) Status of the company announcing the transaction (Public vs. Private)

-

Principals to the Transaction (Issuer/Investor/Lender/Acquirer) Key deal terms (Pricing and Valuation)

-

Key Deal Terms (Deal Size, Valuation, Pricing, Warrants, Cost of Capital)

-

Deals by Location of Issuer/Buyer/Seller (To Track the Flow of Capital and M&A Deals by State and Country)

-

Credit Ratings (Leverage and Liquidity Ratios)

Since its inception in 2015, the Viridian Cannabis Deal Tracker has tracked and analyzed more than 2,500 capital raises and 1,000 M&A transactions totaling over $50 billion in aggregate value.

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.