A strong dollar gives, and a strong dollar takes away. Many investors are feeling the pain of the latter scenario this earnings season.

Businesses exporting products and services from American shores to international customers are likely to see currency headwinds negatively impact revenue, earnings, and cash flows. That's because customers in Europe or Asia may find their purchasing power has been diminished when converting local currencies into U.S. dollars. Similarly, companies converting international business transactions into U.S. dollars could see meaningful negative impacts when compiling quarterly financial results.

This headwind is most often discussed in the context of large, international businesses. However, the negative impacts could be most acute for small, fast-growing companies with significant international reach. That includes 10x Genomics (TXG) , which is valued at a mere $3.2 billion.

The company was forced to significantly reduce full-year 2022 revenue guidance in August when it reported Q2 operating results. Sales guidance for the current year fell from a previous midpoint of $615 million to a new midpoint of $510 million. A strong U.S. dollar was one of the primary culprits.

Unfortunately, the greenback has only grown stronger since the end of June, which suggests investors may need to leave room for further downward revisions in guidance or similarly weak guidance for 2023.

A Powerful Technology Platform

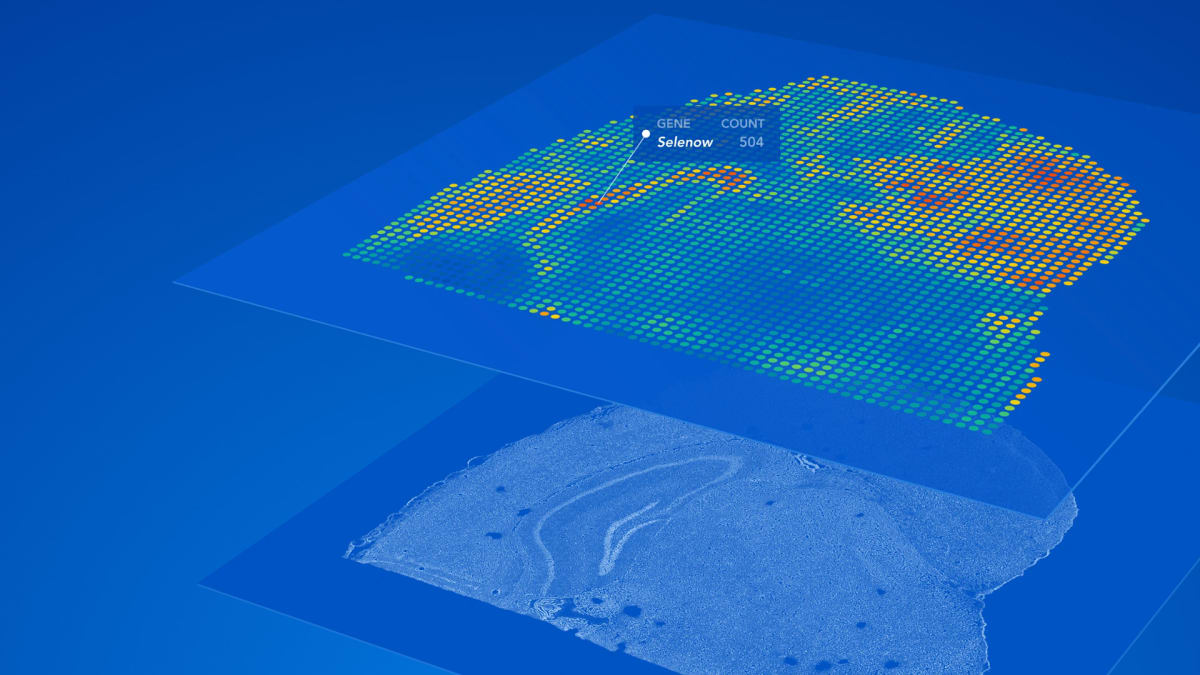

10x Genomics provides lab hardware and software for single-cell analysis experiments. Think of it as providing researchers with all the powerful data from DNA sequencing, but across all the different cell types within a sample. Customers can also generate data from RNA (transcriptomics) and proteins (proteomics), too.

For example, scientists developing new lung cancer drugs may need to understand how lung tumor cells interact with healthy lung tissue and immune cells. Single-cell analysis is even more powerful when researchers can understand how gene activity changes within different cell populations across time and space, rather than looking at a single snapshot from only one tiny region of a tumor. That's what the company's products help customers to do.

The ability to design experimental workflows around existing DNA sequencing infrastructure from Illumina (ILMN) has helped the business achieve impressive growth in recent years. 10x Genomics grew revenue from $246 million in 2019 to $490 million in 2021. Not many lab hardware companies can double revenue in such a short timeframe – and with a global pandemic sandwiched in between.

A Painful Speed Bump for Growth Stocks

Despite the company's impressive trajectory in recent years, the markets got a little carried away with valuations for genomics stocks in 2021. 10x Genomics saw its market cap peak at over $22 billion, valuing the lab hardware business at roughly 45 times sales. That was never sustainable considering the valuations of the top-tier companies in the space tend to max out near 10 times revenue. Historically speaking, even that's a little frothy, which investors have found out the hard way.

10x Genomics sports a market cap of roughly $3.2 billion heading into the Q3 2022 operating results announcement. That's much more reasonable, representing a valuation near six times full-year 2022 revenue. It certainly provides a more attractive margin of safety for individual investors thinking with a long-term mindset.

However, it's important not to anchor expectations to the all-time peak valuation of $22 billion, which won't be reclaimed for many years. Individual investors need to take into consideration rising interest rates and currency headwinds.

- Interest rates are likely to remain above zero for the foreseeable future given shifting demographics, the decline of globalization, and other sticky factors. That's likely to exert downward pressure on valuation metrics and premiums compared to the historically unusual period of the last decade or so.

- Currency headwinds are a derivative of rising interest rates, primarily caused by central banks outside the United States chasing the Federal Reserve higher. The good news is these headwinds will only be temporary. The not-so-great news is these headwinds could exert downward pressure on valuations through the end of 2023, suggesting valuations haven't quite bottomed out just yet.

The single-cell analysis pioneer generated 53% of full-year 2021 revenue from customers in the United States, which is relatively low compared to other lab hardware businesses. It's a sign of the company's dominance within its valuable niche, but that could hurt in the near term. 10x Genomics generated 22% of revenue from EMEA, 15% from China, and 9% from Asia Pacific last year.

For the business to achieve its greatly reduced full-year 2022 revenue guidance of $510 million, it would need to achieve 23% revenue growth in the second half of the year compared to the first half of the year. That could prove difficult given its geographic revenue mix and broader currency headwinds.

The risk is that these temporary challenges could cause full-year 2022 revenue to barely grow compared to the prior year – or even potentially decline – which is not an attractive trait for what's supposed to be a growth stock. The bigger risk is that full-year 2023 revenue guidance could be negatively impacted as well, which would prolong the pain experienced by shareholders. According to estimates compiled by Yahoo! Finance, Wall Street analysts expected full-year 2023 revenue of $632 million, or growth of 24%. That could prove too high a bar.

This doesn't mean 10x Genomics is a bad business. Rather, it's just caught in a temporary slump caused by factors that are mainly out of its control.

Investors eager to see a return to growth should pay close attention to mentions on the Q3 2022 operating results conference call of a new platform, called Xenium, that's expected to launch commercially soon. It promises to provide customers with the most powerful single-cell analysis capabilities in the industry, and it could be just what 10x Genomics needs to keep its growth engine humming along for the next few years.