Every parent wants to ensure their children have the best start in life, whether that’s by instilling core values, providing them with a good education, or helping them achieve financial stability. However, some of them give so much to their kids that they unnoticeably start sacrificing everything for them.

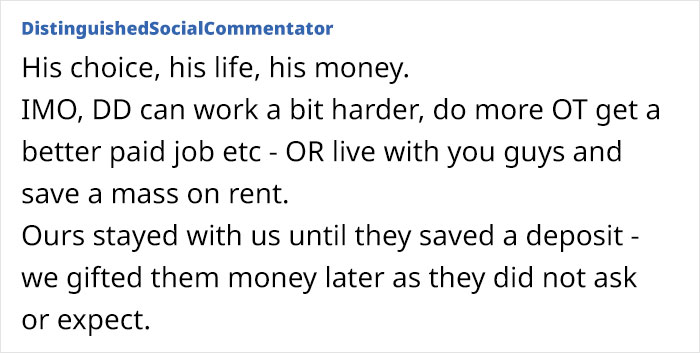

When this father finally wanted to do something for himself—retire early—his wife wasn’t all too pleased. Instead, she wants him to continue working so he can pay for her daughter’s down payment, which she can’t afford. This situation shared online split the internet in two, resulting in many interesting opinions.

Every parent wants to provide their children with everything they need to have a good start in life

Image credits: Marcus Aurelius / Pexels (not the actual photo)

This parent was even encouraged to give up his early retirement so her daughter could have a house

Image credits: Lesbeavinu

Image credits: Alena Darmel / Pexels (not the actual photo)

36% of young homebuyers expect to receive support from their parents to fund their down payment

Many young adults report not being able to make it on their own financially. With high food and housing costs, lower wages, and larger student loans, millennials and Generation Z are facing more economic challenges than their parents did at their age.

As a result, many caregivers feel the need to step in and help. In fact, a Savings.com report revealed that nearly half (47%) of parents provide their children over 18 with at least some financial support, from buying food to paying phone bills or covering health and auto insurance. On average, they are spending $1,384 a month in money aid for their kids.

Even though Generation Z is more educated, especially women, who are also earning more, 61% of adults living at home don’t contribute to household expenses at all. In addition, Redfin has found that 36% of young homebuyers expect to receive support from their parents to fund their down payment.

16% say they’ll use inheritance money for this purpose. Meanwhile, 13% plan to live with their parents to help save for it. Those who don’t have family money to support them are often shut out of homeownership because the houses on the market are too expensive.

Image credits: RDNE Stock project / Pexels (not the actual photo)

Supporting grown-up children often puts parents’ retirement at risk

However, supporting grown-up children often puts a strain on parents, leading to their retirement being at risk. As a matter of fact, 58% of them said that they sacrificed their own financial security for their children, a figure 37% higher than the year before, Savings.com found.

While it’s true that they will receive Social Security benefits during their retirement, they will only replace about 40% of their preretirement earnings. That’s not nearly enough for most people to live on, as the average payments for old people are barely above the federal poverty line.

As a result, prolonged financial support for adult children may cause parents to work longer to save the necessary amount for retirement. However, they might not always succeed in doing that due to health issues or a loss of a job because of age.

To ensure a stress-free retirement period, parents should “have a good financial plan for themselves, then budget how much they can give their kids,” said Carolyn McClanahan, a certified financial planner and founder of Life Planning Partners.

As a general rule, they should set aside money for their retirement and emergency fund first and then allocate the amount they can devote to kids. To succeed, they might want to establish some boundaries, like setting a limit on the sum they’re willing to provide, specifying the instances in which they’re comfortable offering financial support, or outlining the expenses they’ll have to contribute to while living at a family home.

Offering financial support to children isn’t always bad; the parents just have to make sure they can afford the help and learn to prioritize their dignity in old age. If children have an income and a job, they can learn to save – they won’t always have their parents to fall on when times get tough.

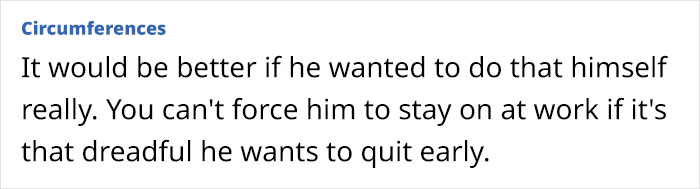

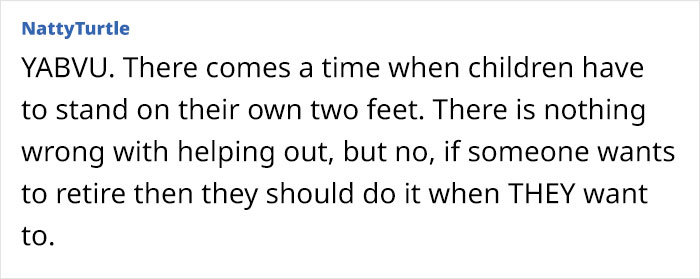

Some readers supported the husband

Meanwhile, others agreed with the wife