TheStreet aims to feature only the best products and services. If you buy something via one of our links, we may earn a commission.

Now that the Federal Reserve has cut interest rates, can you look forward to lower credit card bills?

While the Fed doesn't directly control credit card rates, the good news is that changes in the Fed funds rate do have some effect on credit cards.

Don't miss the move: Subscribe to TheStreet's free daily newsletter

The bad news is that credit card interest rates probably won't drop by as much as the Fed funds rate. Also, the benefits of any drop in credit card rates won't be felt equally by all credit card customers.

If you're looking for a break on the credit card interest you're paying, there are few things you can do beyond just waiting for Fed rate cuts. The benefits of these moves could not only enhance Fed rate cuts but may even exceed those cuts' benefits.

DON'T MISS: Important information about credit cards

• How to eliminate credit card debt

• Does single credit card use lead to less debt and better credit?

• How to start building credit

Related: One major credit card crisis is a growing problem

How will a Fed rate cut affect my credit card rate?

On Sept. 18, the Federal Reserve announced that it was cutting the Fed funds rate by 0.5%. To understand the impact on credit card rates, think of it as a chain reaction. When the Fed funds rate is cut, the bank prime lending rate tends to fall by the same amount. Many credit card rates are based on the prime rate, with an additional amount added.

Beyond this rate cut, the Fed updated its economic projections for the future. These projections now show the Fed expects to cut rates again by 0.5% or so by the end of this year, and for rates to fall by an additional 1% by the end of 2025.

This means credit card rates will likely fall steadily over the next year. However, before consumers get too excited, they should understand that credit card rates probably won't fall by as much as the Fed funds rate. And they won't fall equally for all credit card customers.

History gives some insight into the relationship between Fed rate cuts and credit card rates.

When the Fed cuts rates, it doesn't usually do it all at once. Instead, it makes a series of rate cuts over time. The last two such series of rate cuts were in 2019-20 and 2007-08.

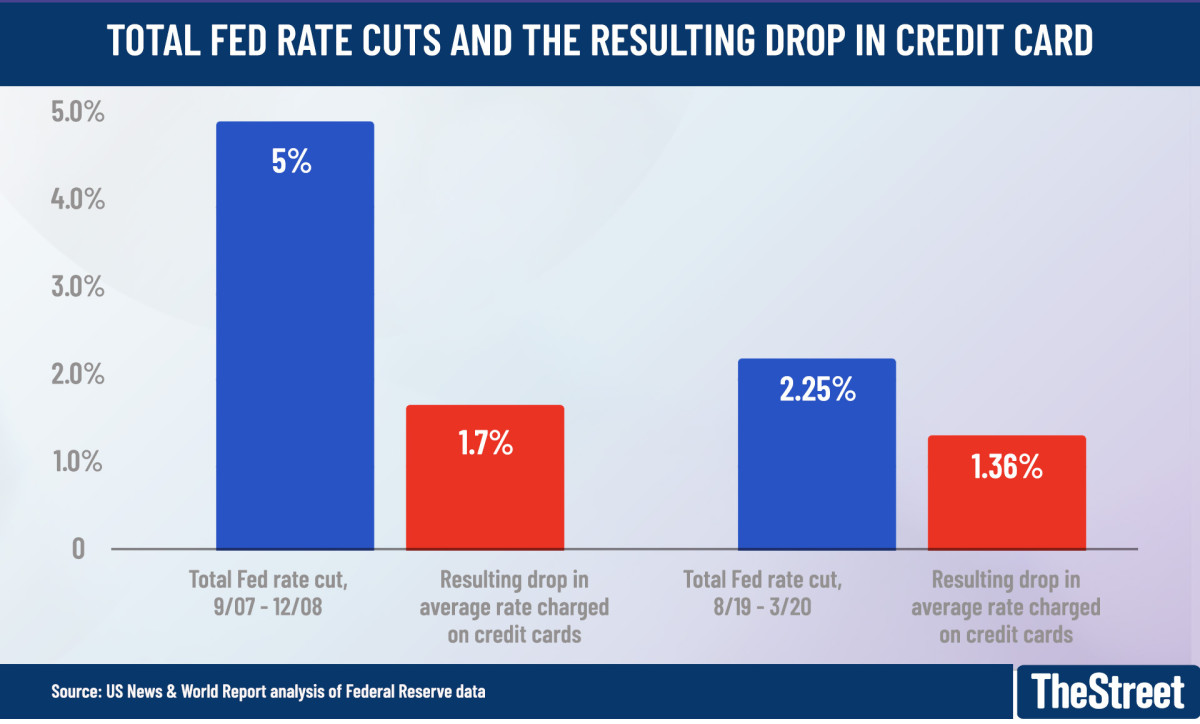

The following chart contrasts the total value of each series of Fed funds rate cuts with the resulting drop in the average credit card rate:

The blue bars in the chart show the total size of each of the last two series of Fed rate cuts. The red bars show how much the average interest rate charged on credit cards changed in response to those rate cuts.

In each case, credit card rates fell considerably less than the Fed funds rate. This is because the Fed funds rate is just one of the factors credit card companies consider when setting rates.

One of the most significant factors is credit risk.

"There is a substantial spread between credit rates for people with good credit and rates for people with poor credit," explains Martin Gasparian, owner and attorney at Maison Law.

Credit card rate data from CardRatings.com shows that as of mid-2024, several credit cards charged rates that were 10% or more higher for people with poor credit than their rates for people with excellent credit.

Related: How much credit card debt do Americans have on average?

This extra cost for people with poor credit may get bigger.

"When credit conditions worsen, the spread widens, as lenders want to protect themselves from potential defaults," says Gabe Kahn, director of credit at Arro, a financial literacy site and credit card service.

Unfortunately, those conditions have been worsening in recent months.

According to data from the Federal Reserve Bank of New York, consumer debt is at an all-time high. In addition, the percentage of credit card balances that are 90 days or more overdue is now the highest it's been in over a dozen years. Federal Reserve statistics show the bank charge-off rate on consumer credit has been the highest since 2011. Charge-offs represent defaulted payments that lenders have given up trying to collect.

"Rising delinquencies and increased debt are signals that credit conditions may be getting worse," explains Kahn.

These worsening credit conditions could cause people with low credit scores to pay higher interest rates.

At times like these, "Banks will prioritize lending to people with good credit scores at lower rates while increasing the rates for people with poor credit scores," says Gasparian.

Shutterstock

Four ways to pay less credit card interest

Even with a Fed rate cut, interest rate reductions on credit cards are not a sure thing for all customers, especially those with poor credit. If you're looking to pay less interest, here are four things to consider:

- Shop around. With the Fed having just cut interest rates, you'll find that different credit card companies respond differently. This is an excellent time to shop for a better credit card APR.

- Improve your credit score. Building a better credit record can pay off by earning you lower credit card interest rates. A lot can be gained when rates can be 10% higher or lower, depending on your credit score.

- Pay down your credit card balance. Of course, how much your credit card rate affects you depends on how much you owe. Reducing your balance should allow you to pay less interest, regardless of what rates do.

- Refinance your credit card debt. If you can't pay down your balance right away, see if you can get a lower interest rate by refinancing you credit card debt into a loan or another card with a lower interest rate.

The Fed's first interest rate reduction since 2020 is a positive move for consumers, but if you have credit card debt, it won't solve all your problems. There are plenty of ways to take matters into your own hands instead of just waiting for the next Fed rate cut.

Related: Veteran fund manager sees world of pain coming for stocks