“The story of the human race is war,” said Winston Churchill. “Except for brief and precarious interludes, there has never been peace in the world; and before history began, murderous strife was universal and unending.”

In recent decades, policymakers and business leaders who attended gatherings at Davos and had the ears of western leaders were inclined to think otherwise. After the fall of the Berlin Wall in 1989, a near-consensus prevailed among them that peace was the natural condition of the developed world and that globalisation was immune from geopolitical risk.

This confidence extended to a belief that generating prosperity through trade was conducive to democracy in developing countries — a notion that played an important part in the west’s decision to welcome China into the global economy and grant it membership of the World Trade Organization in 2001. There is, of course, a superficial plausibility in a logic that echoes Shakespeare’s Julius Caesar, who declared “Let me have men about me that are fat” because he feared the “lean and hungry look” of the murderous Cassius.

The extraordinary post-cold war climate of optimistic liberal internationalism was accompanied by notable complacency among central bankers and mainstream economists, who trumpeted a decline in macroeconomic volatility that they dubbed the “Great Moderation”. There followed the great financial crisis of 2007-09.

Now war in Ukraine and strategic competition over Taiwan with an enduringly undemocratic China have given a new edge to Churchill’s Hobbesian observation — all the more so since Vladimir Putin’s announcement this week of a partial mobilisation of reserves, together with hints that Russia might now deploy nuclear weapons. And then there is the possibility that Xi Jinping’s increasingly assertive China could inflict further damage on western industrialists and investors. The question is: how did the developed world sleepwalk into this mercantile trap?

John Maynard Keynes famously remarked, in his General Theory of Employment, Interest and Money: “The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else.” The big idea behind western capitalism’s growing economic interdependence with authoritarian, nuclear-armed bedfellows is one usually attributed to the French enlightenment thinker Montesquieu, best known for his advocacy of the separation of powers incorporated in the US constitution. In De l’Esprit des Lois, published in 1748, he claimed: “The natural effect of commerce is to bring peace. Two nations that negotiate between themselves become reciprocally dependent, if one has an interest in buying and the other in selling.”

This economic brand of liberal internationalism, which was shared by such thinkers as Adam Smith, Voltaire and Spinoza, reached its apogee in the first great period of globalisation that lasted from the 19th into the early 20th century. John Stuart Mill believed commerce was making war obsolete, while the pacifist and anti-imperialist Richard Cobden, campaigner for the repeal of the Corn Laws, declared: “I see in the free-trade principle that which shall act on the moral world as the principle of gravitation in the universe — drawing men together, thrusting aside the antagonism of race and creed and language, and uniting us in the bonds of eternal peace.”

The seminal text of this idealist, liberal tendency was a book published in 1910 called The Great Illusion, by the British journalist and politician Norman Angell. Its theme was the futility of war in conditions of economic interdependence. Angell argued that the gains of victory were always outweighed by the costs. Then came the assassination in 1914 of Archduke Franz Ferdinand of Austria by the Bosnian Serb student Gavrilo Princip. This and the ensuing great war dealt a catastrophic blow to liberal economic internationalism. It demonstrated precisely that nationalism and tribal instinct can trump economic interest.

The war also exposed the failure of such thinkers to understand the European balance-of-power system. This was inherently unstable because war was the ultimate mechanism for addressing any power disequilibrium. In the first half of the 20th century, disequilibrium occurred because Germany, after unification in 1871, was too big and assertive to be contained by balance-of-power coalitions within Europe. It took interventions by the US and the Soviet Union to put an end to its hegemonic ambitions.

The curious thing is that the devastation wrought in two world wars did not prove fatal for Montesquieu’s nostrum. In proposing the establishment of the European Coal and Steel Community in 1950, French foreign minister Robert Schuman declared that he wanted a process of European economic integration to “make war not only unthinkable but materially impossible”. That process, aimed at preventing further war between France and Germany and cementing a broader peace across Europe, paved the way for the EU.

Today, Ursula von der Leyen, president of the European Commission, and fellow members of the Brussels elite like to refer to the EU as a peace project. This is the great half-truth of the postwar settlement. The reason peace has prevailed in Europe — the Balkans apart — is, first, that after losing two catastrophic world wars Germany was never going to adopt a third-time-lucky stance and send the tanks rolling outwards. France and Germany were anyway united after 1945 by a common enemy in the shape of the Soviet Union. Nuclear weapons added a further constraint on military aggression. And if Europe was protected from external threats it was thanks to the US security guarantee embodied in Nato, not the EU.

A more fundamental point is that wealth in modern economies, which relates more to people than natural endowments, is much harder to steal through force than was the case with agricultural and early industrial societies. The decline in the value of disputed territory relative to technological innovation means that the proceeds of resource theft via conquest are increasingly threadbare — a point indicating that Angell’s thinking was not entirely without substance, even if its predictive power was nugatory. It also highlights that hacking government computer systems and stealing corporate intellectual property are low-cost alternatives to warfare.

Indeed, globalisation itself may have reduced the spoils of territorial conquest by making it easier to acquire resources via markets rather than the use of force. Had there been a global energy market in 1941, Japan might not have felt a need to attack Pearl Harbor in a preventive action designed to secure access to energy and natural resources in the Pacific region.

Big European powers no longer want to fight for territory, still less to bear the costs of acquiring subject populations. Resource-based conflict is now largely confined to developing or downright poor countries. As for Russia’s invasion of Ukraine, it looks like an anachronistic throwback. Putin’s motivation appears primarily concerned with destroying an independent Ukrainian state and rebuilding a Russian empire, not economic plunder. The success of the Ukrainian counter-offensive has highlighted the unexpectedly high cost of his imperial ambitions.

The genius of Schuman and the founding fathers of what became the EU was rather that they established a reconciliation process in a continent where history provided grounds for extreme mistrust. That mistrust has been ameliorated by institutional checks and balances together with international co-operation and shared sovereignty.

Yet Europe remains a continent in which it can be convenient to believe in commerce as a substitute for foreign policy, particularly in the case of Germany. The country makes a striking case study on the trade and peace thesis, given its chronic export dependency and extensive overseas investments. Understandably, in the light of history, postwar German politicians have not wished to play a foreign policy role commensurate with Germany’s size in the world economy. They have cloaked themselves in the mantle of the EU.

Under chancellors Gerhard Schröder and Angela Merkel, the country pursued a policy of Wandel durch Handel, or “change through trade”. This led to extreme energy dependence on Russia. It was, in effect, an outgrowth of Ostpolitik, the policy of engagement with the Soviet Union pursued by chancellor Willy Brandt in the 1960s and 1970s.

The snag is that trade brought the wrong sort of change. By waving a green flag to the Nord Stream 2 Russia-to-Germany gas pipeline after Russia’s annexation of Crimea in 2014, Germany sent a signal to Putin that he could probably invade Ukraine with impunity. It pursued a similar “change through trade” policy towards China, sharing the US assumption that integrating China into the global economy would make it more politically liberal. Yet China failed to oblige western expectations.

The two states now find themselves at odds over Hong Kong, Taiwan and the South China Sea. This sits uncomfortably with German industry’s huge investment in China, especially in the motor industry. More than a third of total sales of Volkswagen, BMW and Mercedes-Benz take place there. VW is estimated to rely on the country for at least half of its annual net profits.

This entails a marked geopolitical vulnerability. And as VW’s recently fired chief executive Herbert Diess remarked last year: “China probably doesn’t need VW but VW needs China a lot.”

Rafał Ulatowski, a foreign policy specialist at the University of Warsaw, argues that Germany’s Indo-Pacific strategy in recent years shows that economic ties do not determine the behaviour of states. While in the short term, close economic relationships may have a moderating effect on a state’s behaviour, he adds, in the long run strategic interests prevail.

Another point overlooked by liberal internationalists is one made by Keynes in the interwar period as he retreated from his earlier liberalism. He worried that economic interdependence could increase the scope for friction between countries, even to the point of provoking war. Interestingly, economic relations within the eurozone often resemble war by other means. Germany looks to its eurozone partners (and other foreigners) to bridge the huge gap between what it produces and what it consumes, which is reflected in an astonishing current account surplus that was running at 7 per cent of gross domestic product at the start of the pandemic. This surplus is the counterpart of an excess of German savings over investment. Those savings were channelled into financing balance of payments deficits in southern Europe before the eurozone debt crisis of 2009-12.

German export dependency has often been a drag on the eurozone economy but, far from being grateful to the countries running counterpart deficits, Germany berated them in the eurozone debt crisis for supposedly profligate fiscal policies, while helping inflict savage shrinkage on the Greek economy and austerity more generally. In effect, argues Michael Pettis of Peking university, these peripheral countries absorbed the shortfall in German demand by increasing their unemployment and relaying excess German savings into investment booms that resulted in serious misallocations of capital.

What was striking about the second great period of globalisation was its much greater intensity than in the first episode before 1914. This was reflected in the larger number of countries participating in the global trading system, very complex cross-border industrial supply chains and the frenetic internationalisation of finance.

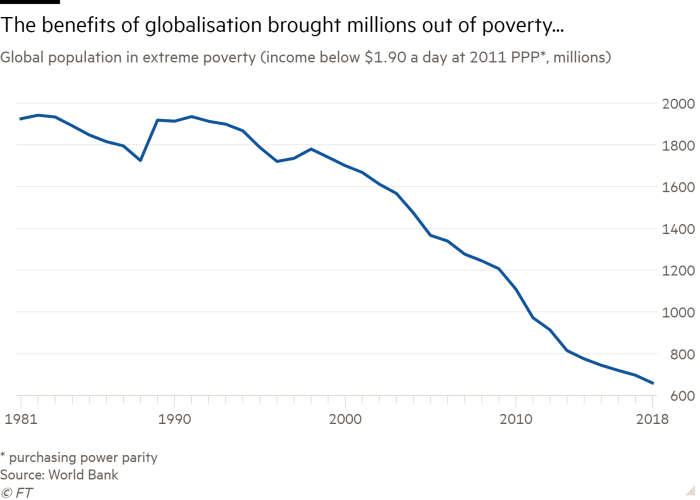

It was all hugely successful in increasing global welfare. In a recent blog, the IMF’s Kristalina Georgieva, Gita Gopinath and Ceyla Pazarbasioglu say the forces of integration “boosted productivity and living standards, tripling the size of the global economy and lifting 1.3bn people out of extreme poverty”.

But these successes, they add, came at the cost of widening inequalities and social dislocation in many countries. By creating losers as well as winners, globalisation thus made for a backlash. Populist politicians, most notably Donald Trump, sought an answer in welfare-reducing trade wars with China, among others.

The second great globalisation also tended to confirm Keynes’s misgivings about trade because its sheer intensity increased the potential for weaponising trade and financial relations. The western sanctions in response to Putin’s invasion of Ukraine were unprecedented in their ferocity, covering not only companies, banks and Putin’s crony oligarchs, but also squeezing Russia out of the dollar-based global financial system. This was done by freezing much of Russia’s war chest of $600bn of reserves. Several Russian commercial banks have been excluded from the Swift messaging system for cross-border payments.

Russian vulnerability is apparent in the World Bank’s mid-year forecast that by the end of 2022 Russia’s real gross domestic product will be 8.9 per cent lower.

What does this all mean for the world? The Russian economy is not globally significant, though individual sectors such as oil and gas do matter. The big worry is simply that we face what the IMF authors quoted earlier call a potential “confluence of calamities”, including Ukraine and the pandemic, which pose a sharply increased risk of geoeconomic fragmentation. Since the war started, IMF monitoring indicates that about 30 countries have restricted trade in food, energy and other key commodities.

At another level, the risk is that strategic competition between the US and China could lead to the division of the world into US-centric and China-centric blocs. Eddy Bekkers, a research economist at the World Trade Organization, and Carlos Góes of the University of California, San Diego, estimate that the projected welfare losses for the global economy of such a decoupling could be drastic — as large as 12 per cent in some regions — and would be largest in lower-income regions as they would benefit less from technology spillovers from richer areas.

This is a world in which the need for resilience in the face of hard geopolitical realities will impose heavy costs on business, especially in relation to supply chains. Multinationals’ manufacturing operations around the world are being shifted from potentially hostile to more friendly but more expensive countries. Economic efficiency will be impaired. People and businesses will also face new transaction costs if countries develop parallel, disconnected payments systems to mitigate the risk of economic sanctions.

George Magnus, an associate at Oxford university’s China Centre, has long warned of the risks of closer western engagement with China and argues that encouraging its economic rise has manifestly not made it less threatening. “The upshot of all this,” he says, “will not be so much a collapse in world trade but a significant stall in growth — beyond what’s been going on anyway — and, importantly, a shift in patterns. While China’s overall size and role in world trade is unlikely to change soon and some things cannot change quickly, I suspect all the rhetoric about China being the engine of global exports and growth is pretty much over.”

What is clear is that the high tide of the second great globalisation has passed. While the prospect might not be quite as bleak as in Churchill’s Hobbesian vision, the world is undoubtedly a more dangerous place than it was before the confluence of calamities. There can be no denying that economically liberal internationalism has, at least in aggregate, enhanced global welfare. But it has once again delivered a very disappointing political outcome.

John Plender is an FT columnist. Illustrations by Bill Butcher. Data visualisation by Keith Fray

Follow @ftweekend on Twitter to find out about our latest stories first