Market Rebellion co-founder Jon Najarian decided to add to his Apple Inc (NASDAQ:AAPL) position as stocks fell on rising geopolitical tensions at the beginning of the year. Despite the sharp recovery near all-time highs, he sees more upside ahead for the tech giant.

"We thought that this was an opportunity and I still think it is even right here just shy of $3 trillion," Najarian said Wednesday on CNBC's "Fast Money Halftime Report."

Who Was Selling Apple? With Apple being one of the most widely held stocks in the market, people turned to Apple stock to raise cash amid Russia-Ukraine fears, Najarian explained.

"When people got scared about the war ... they were lightening up on positions across the board and this was one of the big piggy banks," he said.

When a stock falls with the broader market and nothing changes internally, that's usually an opportunity to buy the high-quality names, Najarian said.

"You can only make that end-of-the-world bet once and be right."

What's Next: Apple is also one of the first stocks people look to buy when fear and uncertainty subsides, hence the sharp recovery.

Related Link: Apple Vs. Microsoft: A Race To New All-Time Highs

When Apple releases new products or upgrades existing ones in the fall, Najarian told CNBC that the stock will likely be trading around $200 per share.

He reiterated that he believes Apple shares can still be bought at current levels.

AAPL Price Action: Apple has traded between $118.86 and $182.94 over a 52-week period.

The stock was down 0.86% at $178.10 at time of publication.

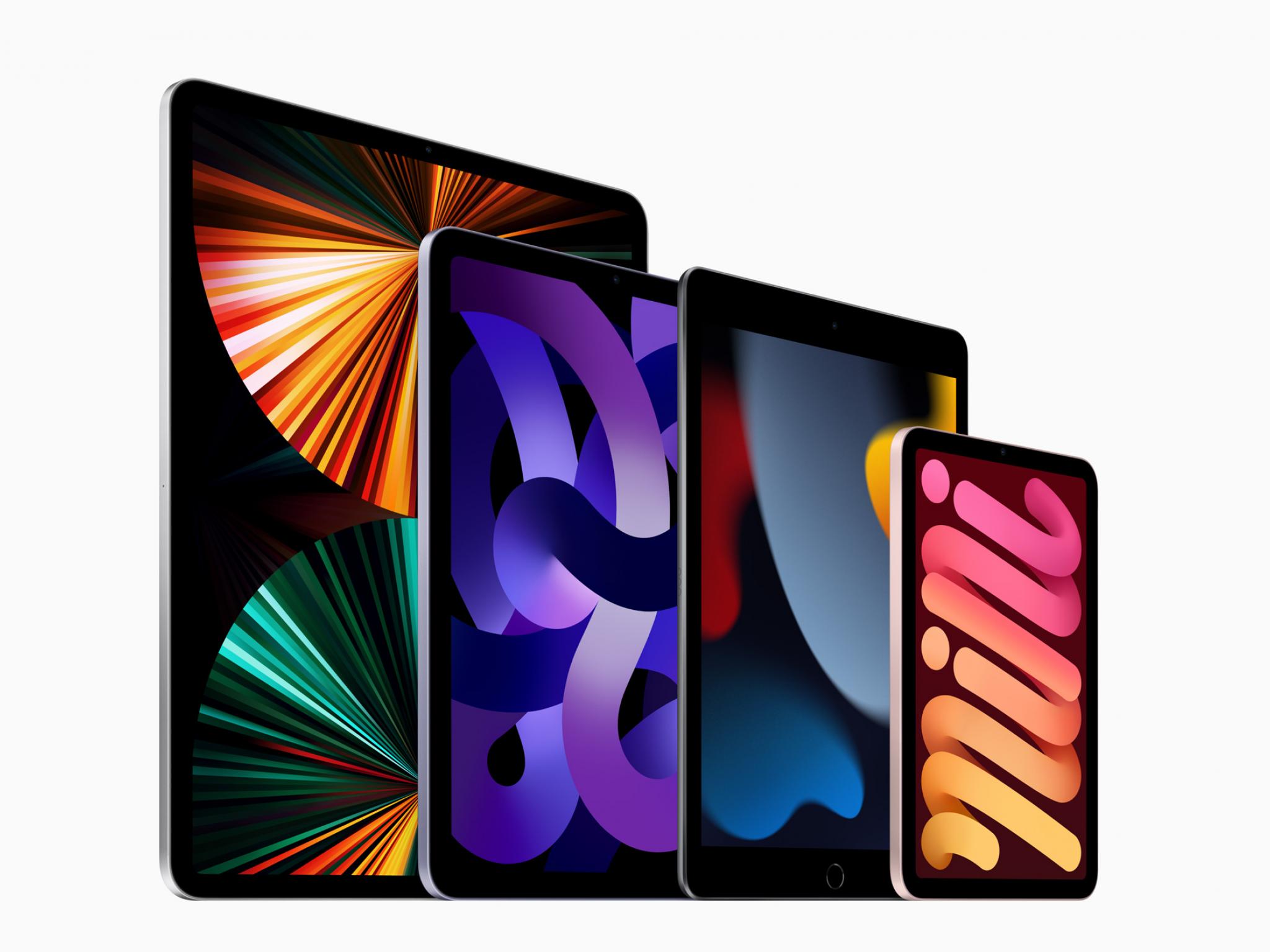

Photo: courtesy of Apple.