Robinhood Markets Inc (NASDAQ:HOOD) shares are trading lower after U.S. Securities and Exchange Commission chair Gary Gensler outlined proposed changes that could impact brokerage businesses.

Instead of continuing to allow payment for order flow, Gensler suggested an alternative involving "open and transparent auctions," Wednesday at Piper Sandler's "Global Exchange & Brokerage Conference."

“I’ve asked staff to make recommendations for the commission’s consideration around how to enhance order-by-order competition," Gensler said. "This may be through open and transparent auctions or other means.”

Related Link: SEC Chair Gensler Proposes 'Open And Transparent Auctions' As Alternative To Controversial Payment For Order Flow

In the first quarter, Robinhood generated more than 70% of its revenue from payment for order flow.

Gensler also targeted cryptocurrency exchanges, warning that several crypto platforms may be operating "outside of the law." Last month, Robinhood introduced new non-custodial, web3 crypto wallets, as the company continues to expand its crypto capabilities.

HOOD Price Action: Robinhood shares have a 52-week high of $85 and a 52-week low of $7.71.

The stock was down 3.84% at $8.39 at press time, according to data from Benzinga Pro.

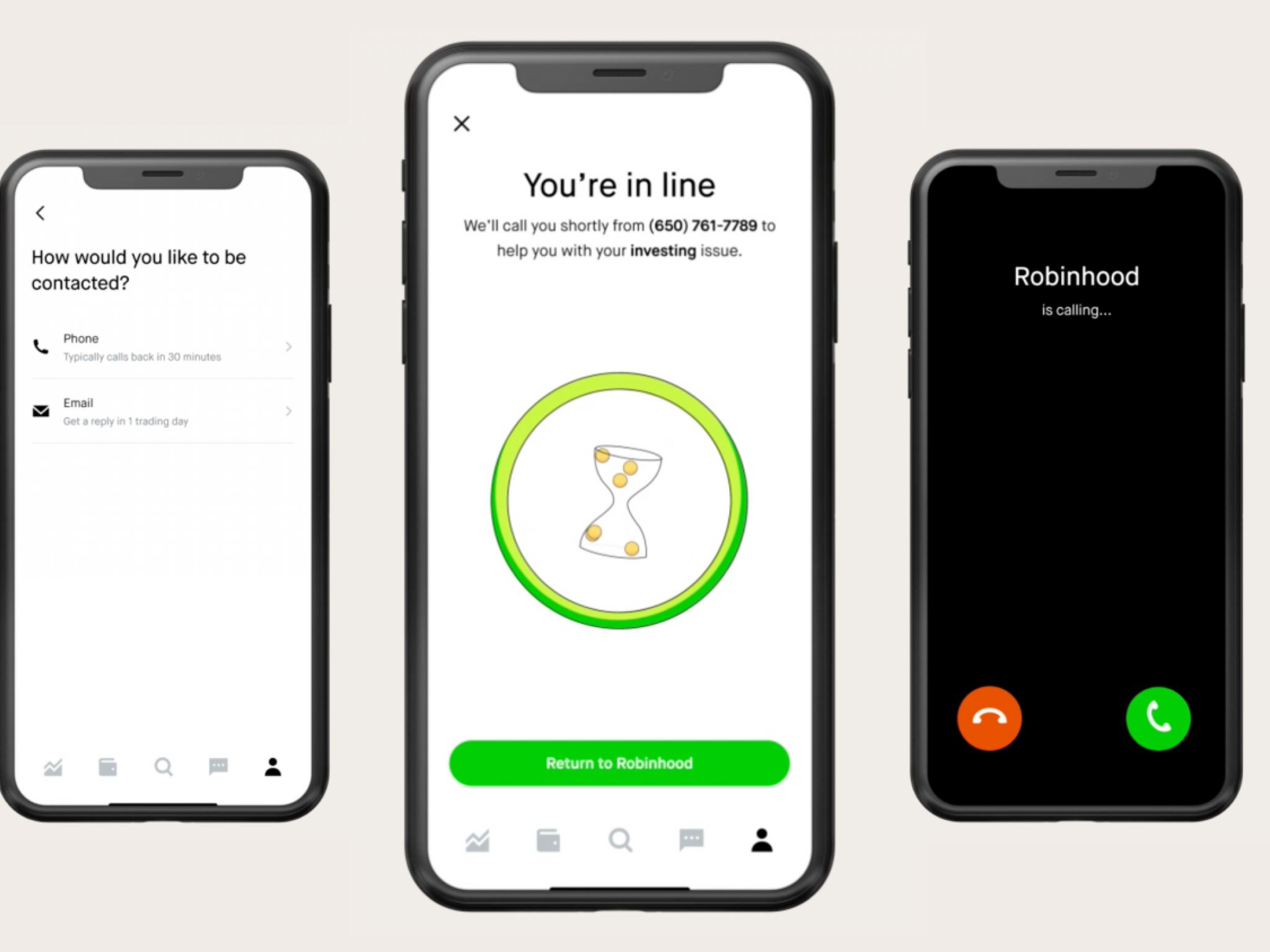

Photo: courtesy of Robinhood.