The overall markets have been volatile lately as investors try to navigate rate hike expectations from the Federal Reserve. The volatility creates opportunity for options traders like Market Rebellion co-founder Pete Najarian.

"Trading the options right now, particularly on some of these names where maybe it's a high multiple or whatever, I'm sure going to be in those types of trades," Najarian said Wednesday on CNBC's "Fast Money Halftime Report."

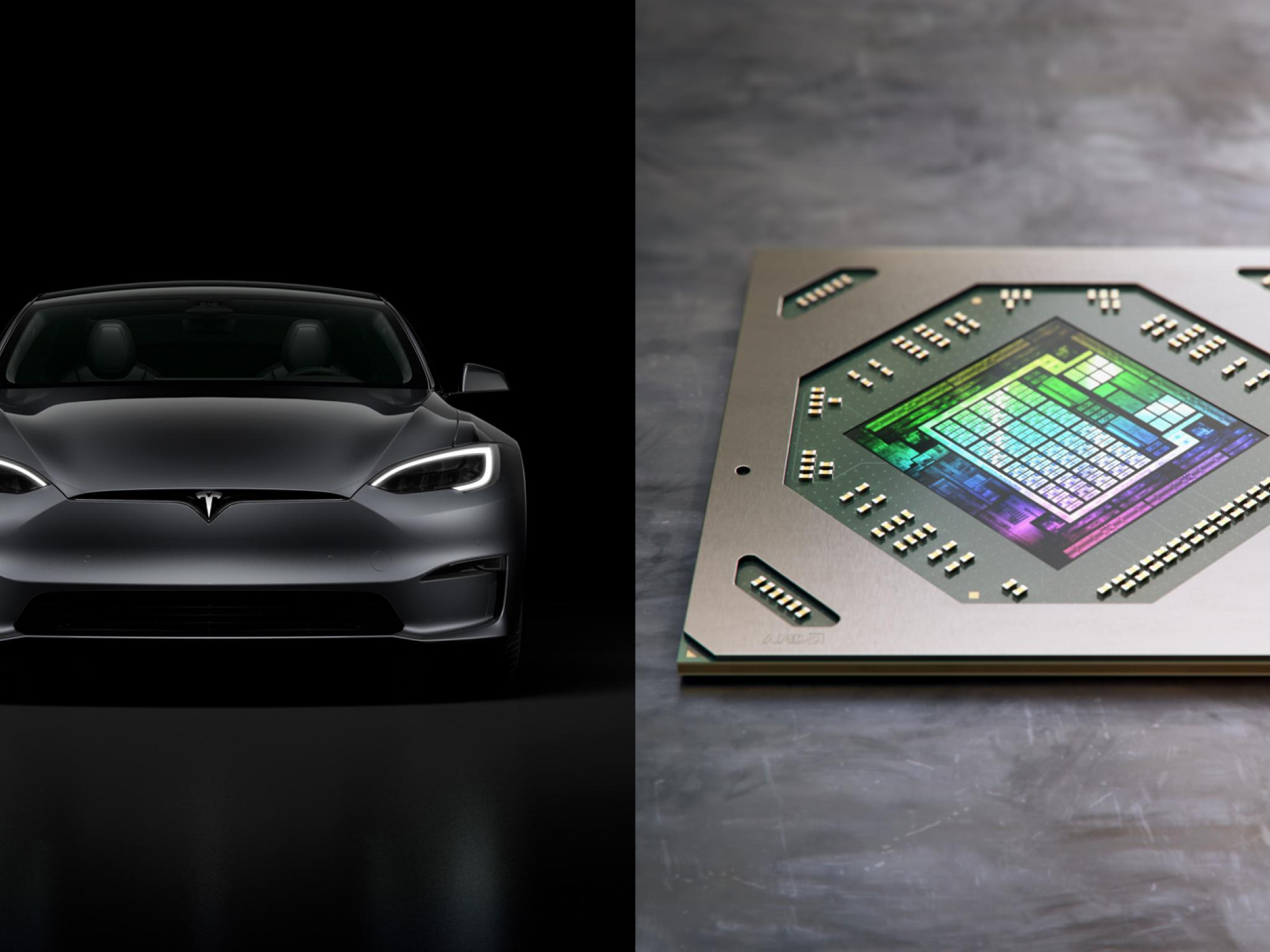

He told CNBC that he bought call options in both Tesla Inc (NASDAQ:TSLA) and Advanced Micro Devices Inc (NASDAQ:AMD) after seeing others pile into the trades.

Tesla has been acting as a barometer for the Nasdaq, leading it higher and lower, according to Najarian.

"That seems to be the leader, so I've been staring at that name every single day, and we had huge call buying in there," he emphasized. "That actually is what triggered me to get back in there."

See Also: Indian Government Lays Out Precondition For Tesla's Import Duty Cut Request

AMD is another stock Najarian has been watching. He said he is seeing "positive inflections" from options traders in the semiconductor space.

Nvidia Corp (NASDAQ:NVDA) is set to announce earnings results after the market closes, and Najarian is seeing a large amount of upside call buying.

"We've seen bullish buying in that name, bullish buying in AMD ... you go across the board, those types of names in the semiconductor space have been seeing that," Najarian said.

"I continue to be much more aggressive" when it comes to buying options, he said. "It is a tradable market, and we are seeing the ups and downs every single day."

Najarian did not specify the strikes or expiration dates of the Tesla and AMD call options he purchased.

TSLA, AMD Price Action: At publication time, Tesla was down 2.13% at $902.76 and AMD was down 5.44% at $114.87.

Photos: courtesy of Tesla and AMD.