Sports leagues will continue to garner increases in their media-rights contracts, three experts said at Gabelli Funds’ sports business symposium Thursday.

“Most media content is garbage. And as technology continues to improve, viewers will edit out commercials,” said Sal Galatioto, president of Galatioto Sports Partners, the New York financing firm in the sector.

“But viewers watch 99.5% of sports live. There’s no other content like it, and it will continue to grow, regardless of how it’s distributed. That’s the main reason why asset prices will continue to rise.”

The assets in question are teams and other sports properties.

Last year, Galatioto was involved in the sale of stakes in two Major League Baseball teams and one National Basketball Association team, he said. “In every one, [the team’s] value was way above what the original owners paid.”

The price equation for sports teams is simple, Galatioto said. “The supply of these things [teams] is static. At the same time, capitalism keeps making more billionaires. And if there are more buyers into static supply, the price goes up.”

The National Football League and the NBA are the most attractive leagues for broadcasters, said Mike Ozanian, assistant managing editor at Forbes Media. The NBA’s current $2.6 billion TV deal expires in 2025, and he predicts that figure will double in the next deal.

In addition to higher team values, more expensive media-rights deals can mean TV viewers will pay more to watch their favorite teams. That’s because broadcasters may charge their customers higher prices to pay for more expensive content.

Rising media-rights prices also can push up player salaries, which in turn can lead teams to raise ticket prices to help finance those higher salaries.

Don't Miss: Here's How Much the Super Bowl Brings in Each Year

LIV-PGA Merger a Major Topic of Conversation

Among other issues the sports experts discussed was this week’s merger announcement involving the PGA -- the Professional Golfers Association -- and Saudi-backed golf tour LIV.

Galatioto said the deal was predictable. “When you have a duopoly, and the entities start to impact each other, they merge,” he said. “It was the same thing with the [American Football League] and NFL in football and the American and National Leagues in baseball.”

The golf combination represents “a tremendous moment for the sport,” said Michael Levine, co-head of CAA Sports, a unit of Creative Artists Agency, the sports-entertainment giant.

“The PGA mishandled communications with the players. But player unrest will be quieted. Players who stayed loyal will be made whole.” Some players who stayed with the PGA rather than defecting to LIV felt blindsided by the merger news.

While LIV has faced heavy criticism for its Saudi backing because of the nation’s human-rights issues, “the Mideast isn’t going away and will become more prominent in sports for years to come,” Levine said.

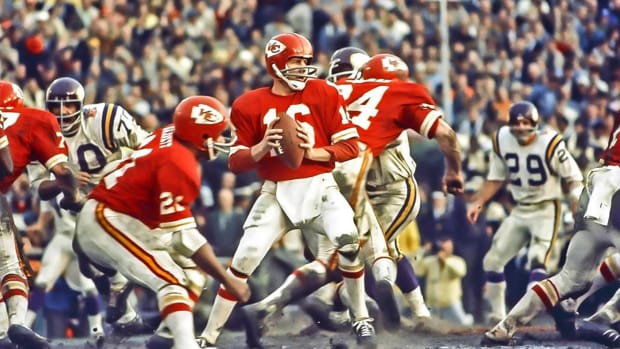

Roy Inman/Kansas City Star/Tribune News Service via Getty

Mideast nations have plenty of oil money they can put to work investing in sports. And they’ve already done so, including the 2022 soccer World Cup in Qatar.

Investment in U.S. sports properties will come from nations worldwide, the experts said. “Anytime asset prices grow to these levels, the pool of [U.S.] buyers is smaller,” Levine said. “So there is more global participation.”

Private Equity Will Be a Bigger Player in Sports

When it comes to ownership structure, private-equity funds will play a growing role as team owners, experts say.

It’s already happening in the NBA, the MLB and the National Hockey League. And it will spread to the NFL, too, they say. “This new money will be a big catalyst for the industry,” Levine said.

Ozanian said more ownership groups will control more than one team. He cited Josh Harris, whose Harris Blitzer Sports and Entertainment owns the Philadelphia 76ers and the New Jersey Devils.

Harris, co-founder of the private-equity stalwart Apollo Global Management, also is leading a group that has agreed to buy the NFL’s Washington Commanders.

“These groups view sports teams as intellectual property,” Ozanian said. “They tie the value of the teams together. And instead of being valued at four to six times revenue, teams could get valuations like tech companies.”

For example, semiconductor-titan Nvidia is trading at 37 times sales, according to Morningstar.

'You're More Engaged With Money on a Game'

It’s hard to talk about sports these days without including the explosive growth of gambling. “It’s working,” Levine said. There have been gambling scandals recently, and there will be more, he said.

“But there’s zero doubt you’re more engaged when you have money on a game. The multiple gambling options within a game are unbelievably compelling,” Levine said.

“They [teams/leagues and gambling companies] are building the engagement that they hoped they would. It will only become more a part of pro sports.”

And what about one of the hottest topics of the day, artificial intelligence? How will it affect the sports industry?

“I hope it can’t replace the action on the field,” Levine said.