Fastly (FSLY) shares soared more than 70% on Feb. 12, after the content delivery network (CDN) specialist posted a blockbuster Q4 that saw earnings print at more than double the consensus of $0.06.

As agentic artificial intelligence (AI) continues to drive traffic to CDNs, the Nasdaq-listed firm said its revenue will push some 19% higher to $171 million in the current quarter, handily beating estimates.

Fastly stock is now up more than 100% versus its year-to-date low.

Technical Breakout Supercharged FSLY Stock

A technical breakout amplified the post-earnings surge in FSLY stock even further on Thursday.

As investors reacted to the company’s strong Q4 release, its share price pushed past major moving averages (50-day, 100-day), triggering algorithmic buying that accelerated bullish momentum.

Then came the next catalyst: A constructive note from Raymond James analysts that said Fastly’s fourth-quarter report suggests its turnaround is gaining momentum.

Other than the rise of large language models (LLMs) and agentic AI, they cited management’s decision to switch from a “pay-as-you-go” model to fixed contracts as a major positive.

This makes FSLY’s income more predictable and prevents sudden drops in revenue, the investment firm added.

Record Margins Drove Fastly Stock to a 52-Week High

Fastly shares exploded higher following the Q4 earnings report because the underlying metrics signaled a business reaching a critical inflection point.

According to the company’s earnings release, adjusted gross margin popped some 650 basis points to a record 64%, proving management’s focus on operational discipline has started paying off.

Additionally, FSLY ended the quarter with remaining performance obligations (RPO) worth about $354 million, offering significant future visibility.

With a sticky customer base that taps on its solutions to manage the high-intensity traffic generated by AI agents, Fastly is proving into a high-growth edge computing powerhouse.

How Wall Street Recommends Playing Fastly

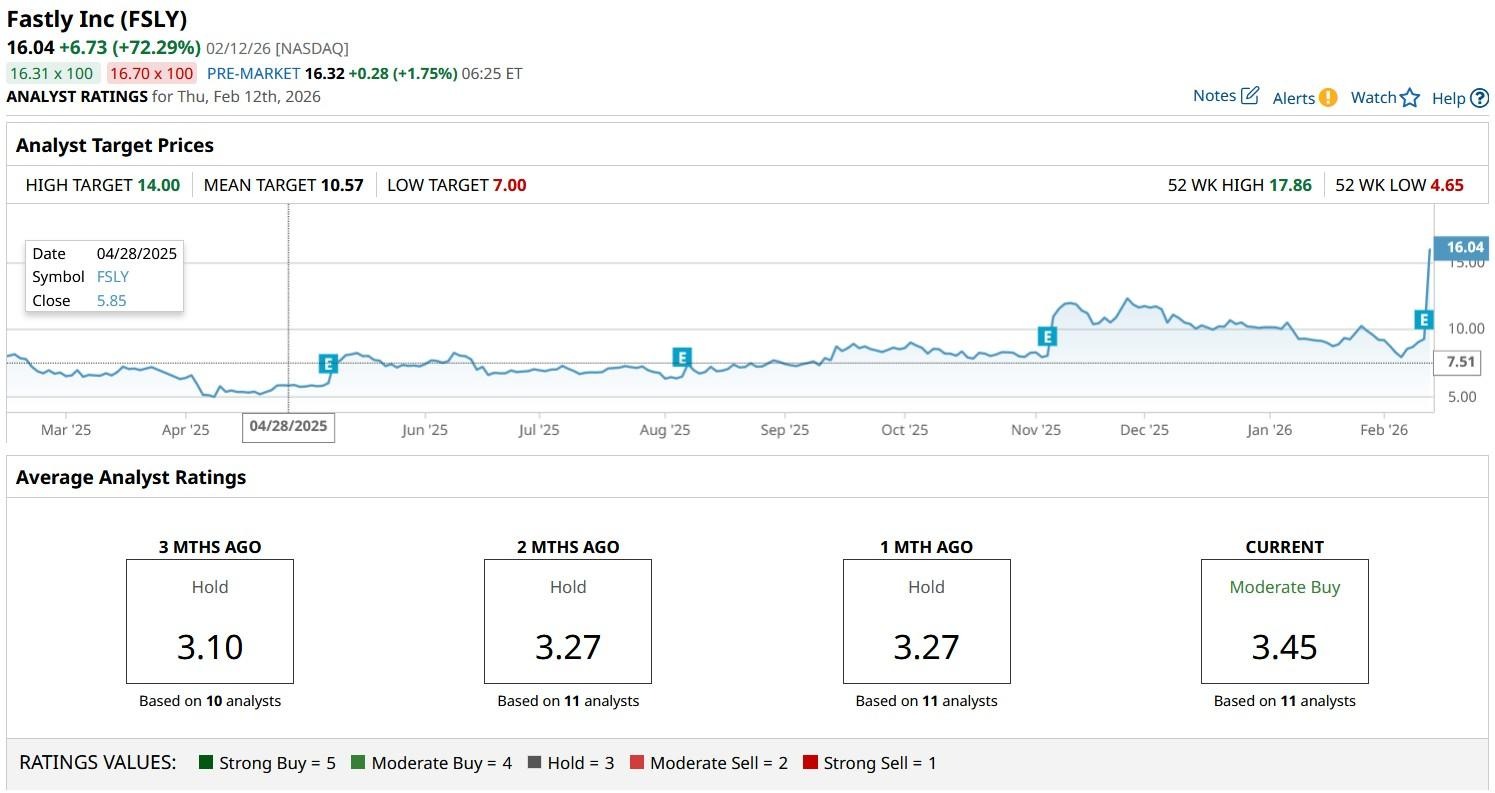

While the post-release rally has already pushed FSLY shares above the Street-high price objective of $14, it’s reasonable to assume that upward revisions will follow in the days ahead.

Meanwhile, the consensus rating on San Francisco-headquartered Fastly remains at a “Moderate Buy,” according to Barchart.