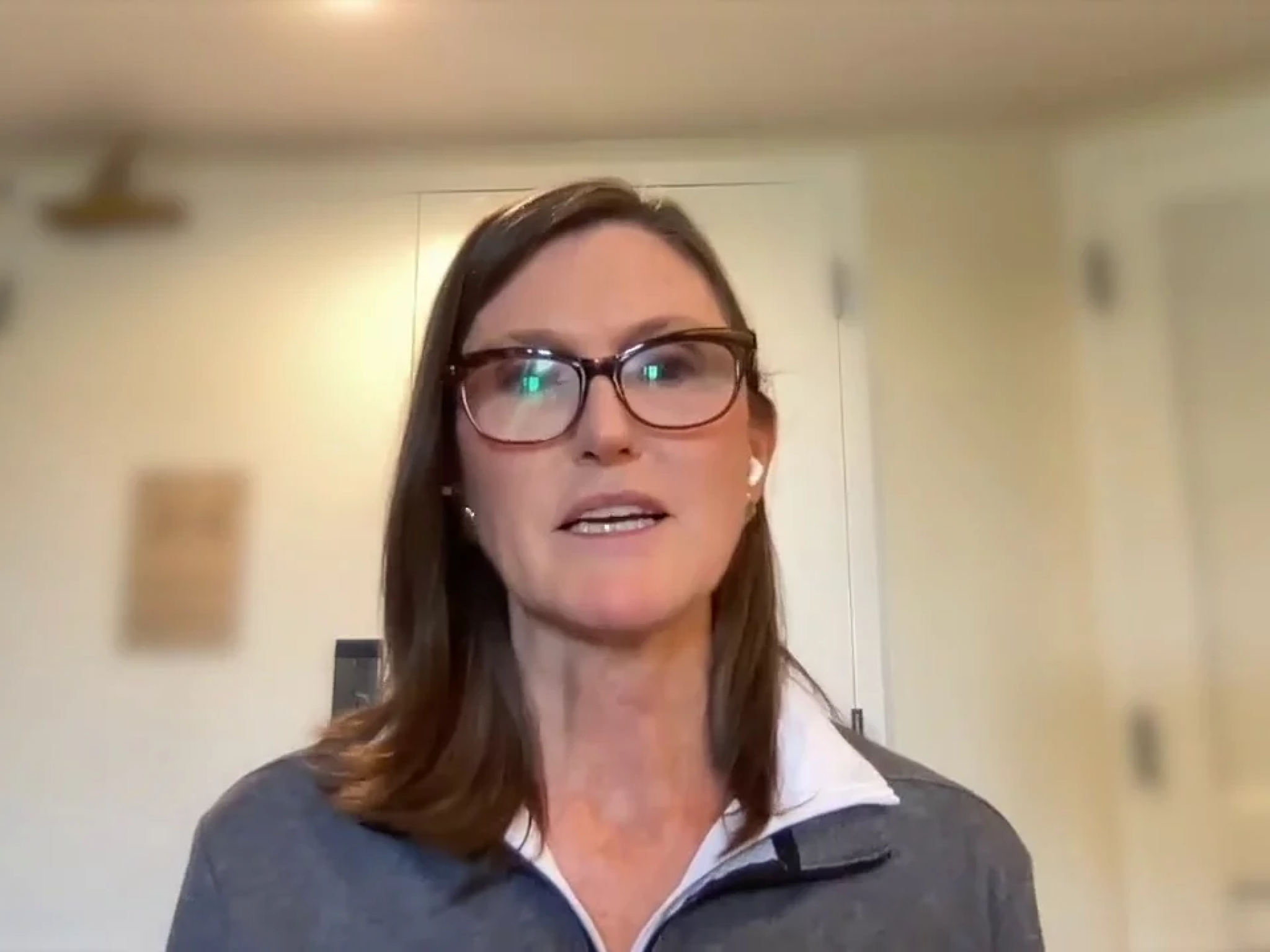

Cathie Wood continues to remain bullish on its top holding, Tesla Inc (NASDAQ: TSLA), despite fears of a U.S. recession and the recent shutdown at Giga Shanghai due to citywide lockdowns, Reuters reported on Tuesday, citing the popular stock picker.

What Happened: Tesla’s expansion into autonomous driving will help it further deliver “truly exponential growth for many, many years.”

A Tesla super-bull, Wood is expected to reveal a new model and price target on the Elon Musk-led electric vehicle company in the coming days.

Wood last year had said she expects Tesla to reach $3,000 per share by 2025. Ark Invest had in its valuation models then said it believes that Tesla is going to deliver between 5 and 10 million vehicles as soon as 2025.

Wood’s latest comment comes at a time when yields of two-year Treasuries have moved above those of 10-year Treasuries in recent weeks, implying the U.S. could be staring at a recession.

Austin, Texas-based Tesla’s Shanghai plant has been shut down since the beginning of the month due to citywide measures to curb the recent spike in COVID-19 cases in China.

See Also: Analyst Sees Tesla Taking 8% Volume Hit In Q2 From China COVID-19 Lockdowns

Why It Matters: Tesla recently bought online Giga Berlin and Giga Texas, raising its capacities by 1 million more electric vehicles a year.

The EV maker delivered a record 936,172 vehicles last year, a jump of 87% over 2020.

Loup Ventures founder-analyst Gene Munster has estimated Tesla’s volume could take a hit of 8% in the second quarter due to a production halt of about a month at Giga Shanghai.

Price Action: Tesla stock closed 1.1% higher at $986.9 a share on Tuesday.