By Rafael Loureiro, co-founder and CEO of wealth.com

Consider this: almost 90% of Americans use some sort of fintech. Financial technology is now baked into the lives of most people you know, not just early adopters.

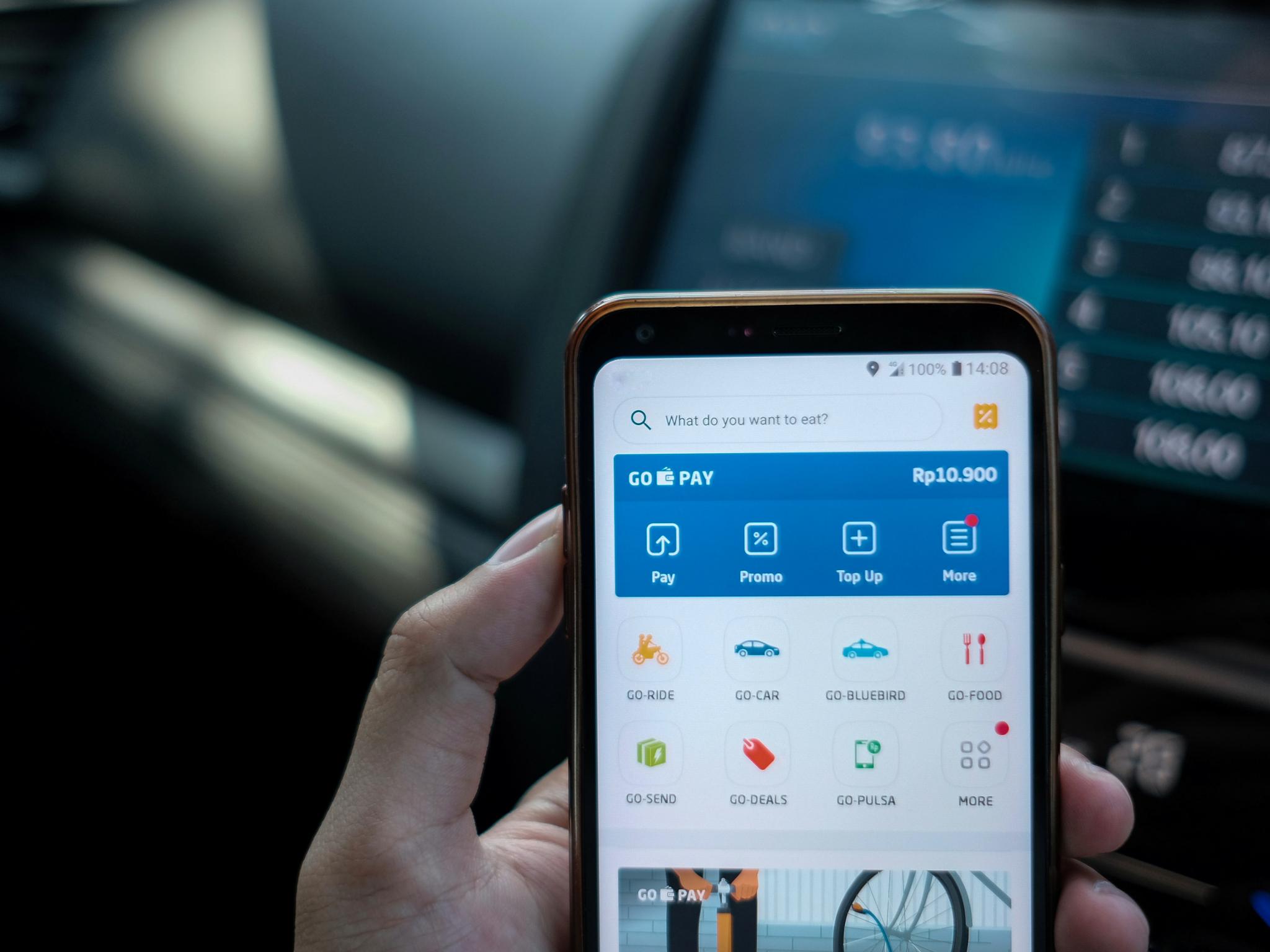

This mass adoption has also fueled growth in the total number of financial smartphone apps people are using, as demonstrated by this data from Statista:

“In 2021, users in the United States opened approximately 2.15 finance apps on their mobile devices per month, up by more than 32 percent compared to 2019.”

This growth indicates that people are generally feeling more confident in both their ability to effectively use multiple digital financial products and the ability of fintech companies to keep their information secure.

This rapid innovation in financial technology creates tremendous opportunity for both investors and people who benefit from improved financial literacy and increased access to financial products. However, with the benefits that come from a robust market of fintech offerings there are also downsides.

The proliferation of many different financial products, underscored by the usage growth data above, has created a fragmented environment for consumers who often find themselves confused and frustrated without an easy way to see all of their assets in one place.

Think about it this way, someone having access to a bunch of different new and better tools doesn’t necessarily mean they have a toolbox that organizes the tools in a way that makes building easier. If new saws, drills, hammers, etc. do their individual jobs better builders will start using them, but an uptick in usage doesn’t mean that the better individual tools fit well together within an aggregated system.

People like new tools that help them better their financial circumstances so it makes sense that adoption of digital financial products is on the rise. This doesn’t negate the need for an aggregated toolbox or tools that are designed based on the entire ecosystem.

The frustration that occurs from trying to navigate an increasingly complex digital financial landscape can end up undoing the gains in accessibility we all want to achieve. It also adds security risks. The more our industry tilts towards increased fragmentation, the more opportunities we create for nefarious actors to gain access to people’s information. Expecting everyday people to manage a complex suite of finance apps and platforms that frequently struggle to integrate is a recipe for fatigue and worst-case scenario: that fatigue leads to user carelessness and security issues.

The solution for reducing fragmentation isn’t to centralize everything. Competing companies, products, and diverse choices are ultimately a good thing for consumers. The solution is instead to think holistically about how a product fits within the user's life outside of their transactions with the product. Fintechs that win moving forward will do so by delivering both standalone value and seamless integration with the totality of people’s existing lives. Making sure your product doesn’t force people to further fragment the attention they allocate to their finances is mission-critical.

People want to be able to easily and securely understand their entire financial journey from their checking accounts to their estate plan. Without having to log in to a dozen different portals and dashboards simultaneously.

This is evidenced by the niche my company, Wealth.com, operates in currently. If you have a hard time tracking all your unbundled finances, imagine how difficult it would be for your family if you are not here to tell them which accounts are where? People don’t want to have to worry about their loved ones wrangling their finances across fragmented accounts and not too long ago digital estate planning wasn’t something that was feasible.

Now innovation in digital estate planning has not only made it widely available from various companies, but our own innovation is making it more comprehensive than ever before. An estate plan could contribute to further stretching people’s attention (one more financial thing to remember to look at and keep updated) or it could integrate with the rest of their financial lives and give them a holistic view of their assets.

We’ve chosen the latter path because we understand that the existing fintech options people have to choose from, as well as amazing new emerging technologies, are only going to increase over the next decade.

So too will the need to reduce the friction that fragmentation creates, which is why asset aggregation truly is the future of fintech. That doesn’t mean that the only fintechs that succeed long term will be asset aggregators or even have asset aggregation as a core product offering. It does mean that fintechs will fail unless they understand and build around people’s fundamental desire for less fragmented ways to view and manage assets across the various financial products they’re using.

The bottom line: even if you’re not offering asset aggregation specifically, take the time to understand how your product can better fit within an aggregated ecosystem. Building with the entirety of your customers' financial lives in mind, beyond just your core product, will reduce friction and drive success.