Arcos Dorados Holdings Inc. (ARCO), the world’s largest independent McDonald’s Corporation (MCD) franchisee, experienced a notable share price increase in recent months to trade above the respective 50-day and 200-day averages of $7.85 and $7.74, respectively.

The company is expanding with gross restaurant openings, reaching 66 new units in 2022, including 59 free-standing units, with 40 gross openings in Brazil. Despite macroeconomic pressures, ARCO also achieved an impressive milestone in the fourth quarter of 2022, with quarterly total revenue surpassing the $1.0 billion mark for the first time in its history. Ahead of its first-quarter earnings report next week, pertinent financial trends are worth considering.

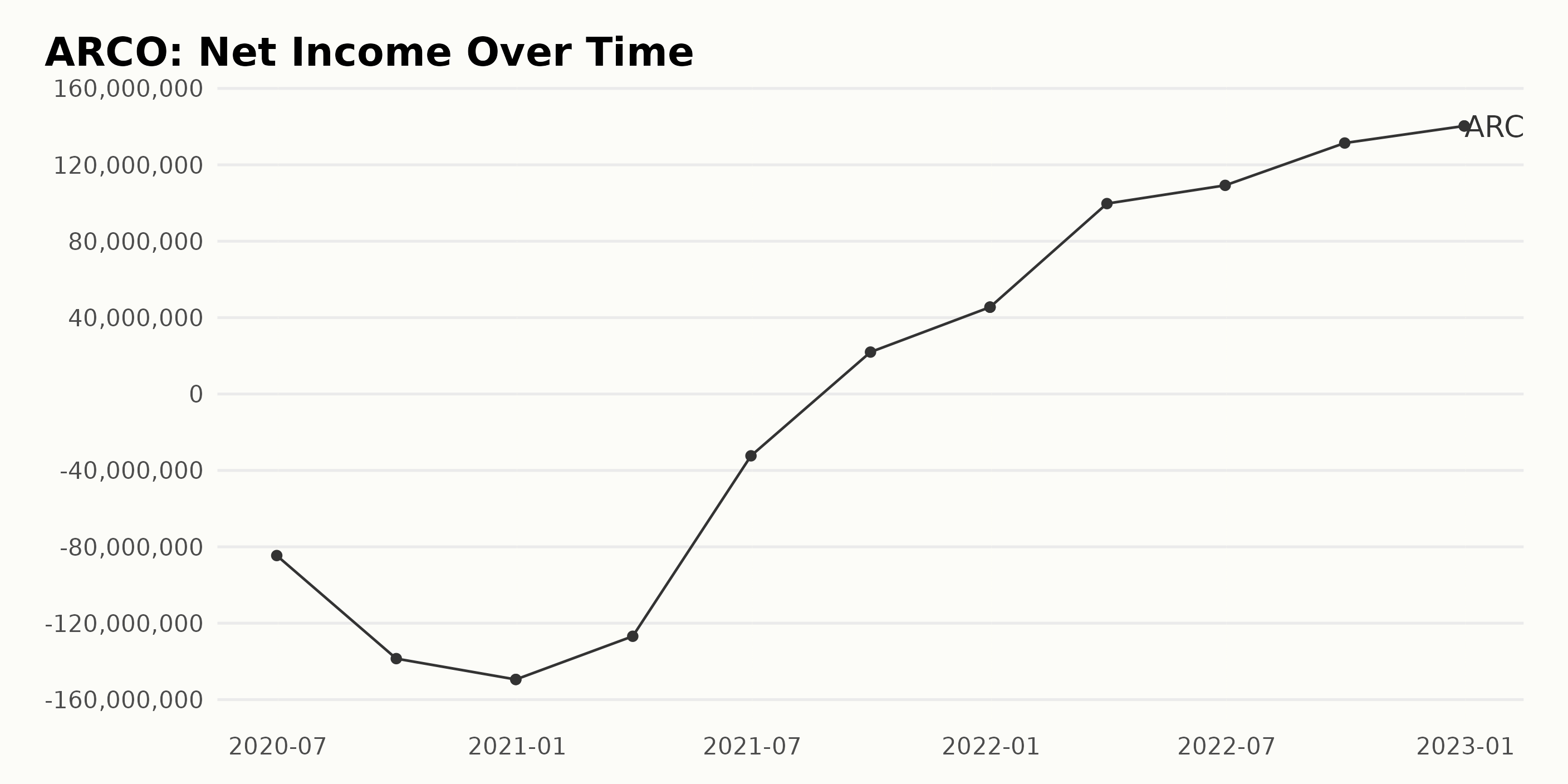

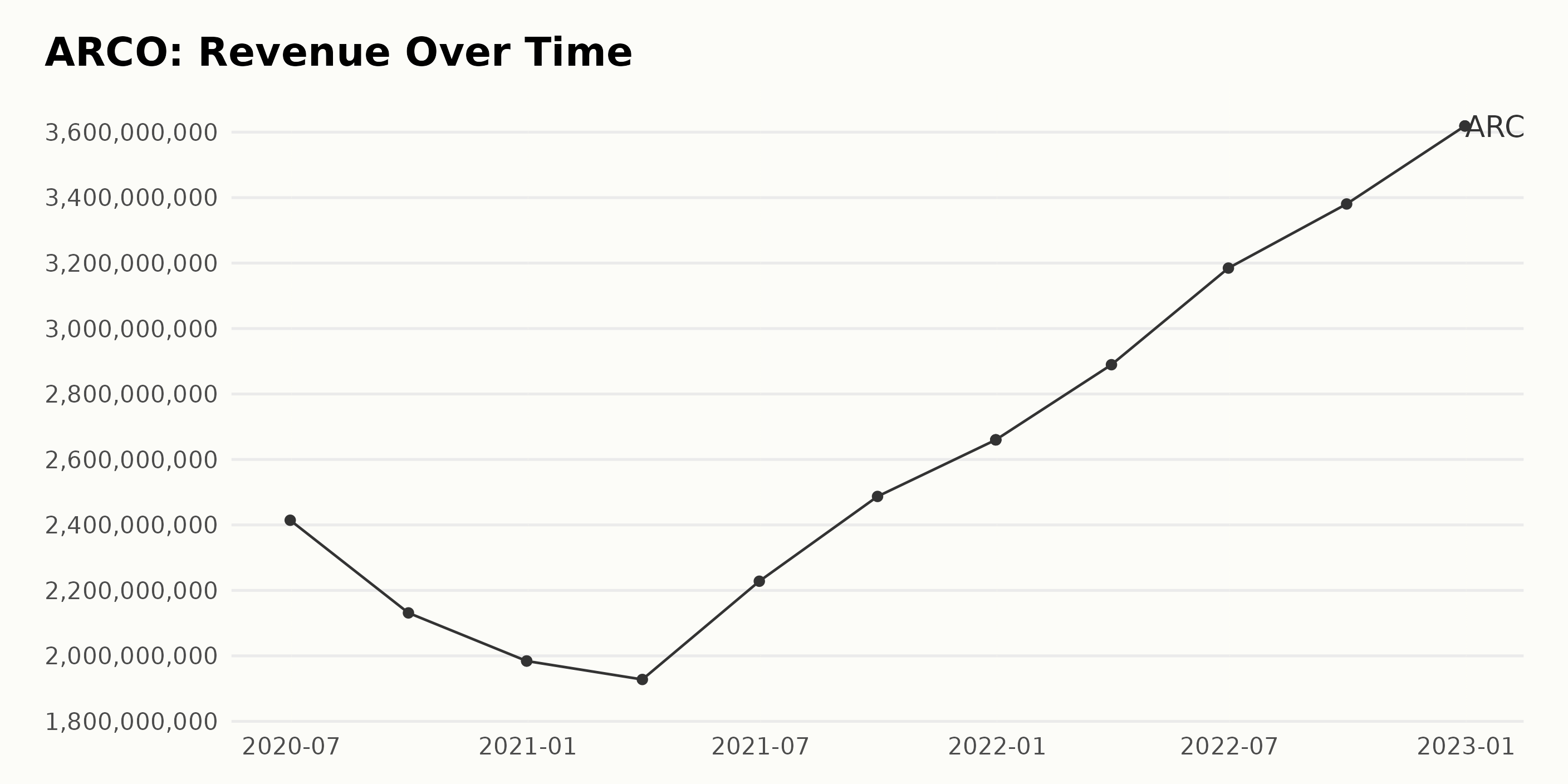

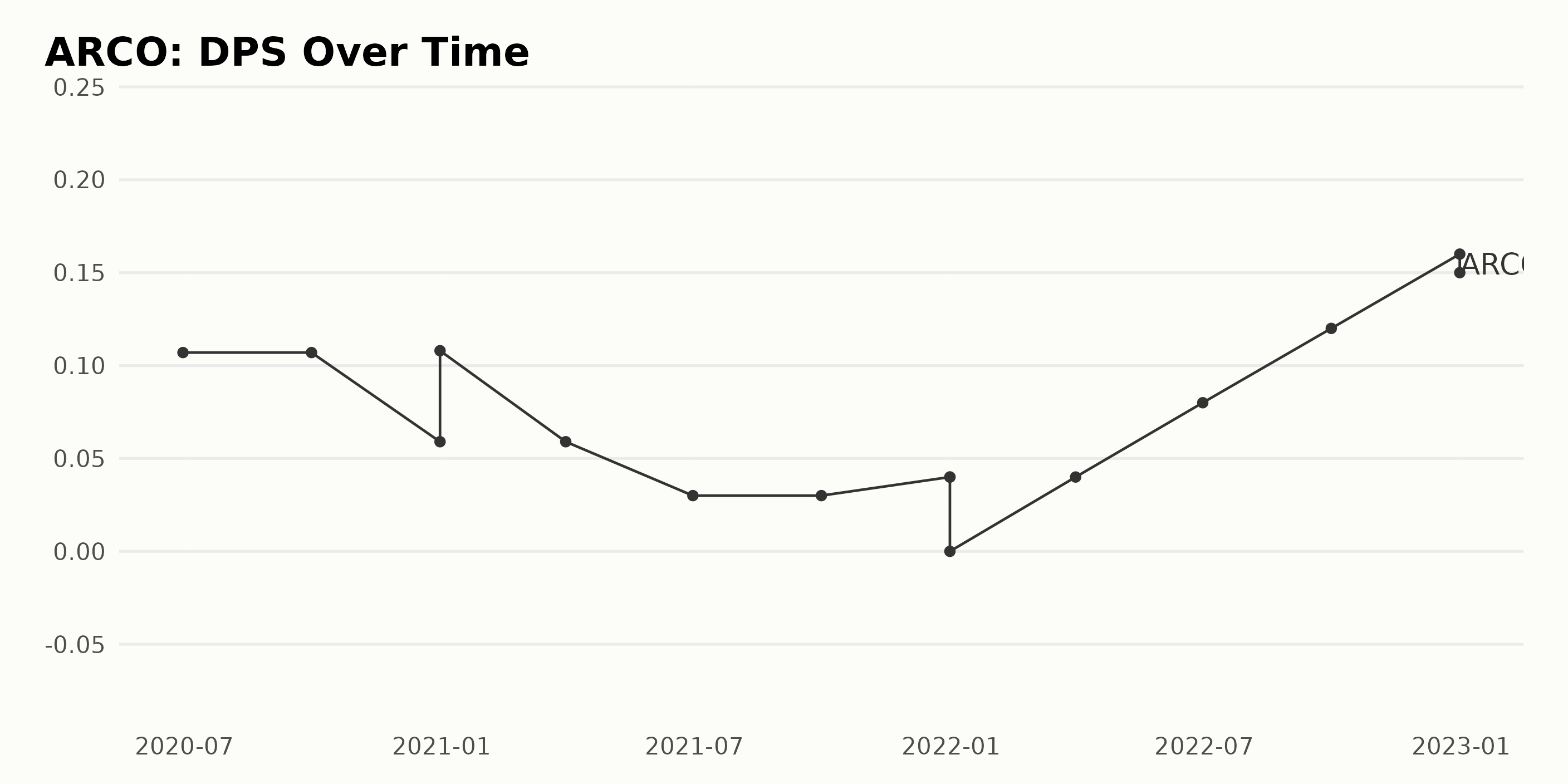

Arcos Dorados Holdings: Net Income, Revenue, and DPS Trends

ARCO’s net income has seen significant fluctuations over the past two years. From June 2020 to March 2021, the net income decreased (negative $845.65 million to negative $1.27 billion). However, from then to December 2022, the net income increased significantly (negative $323.55 million to $450.86 million). The overall growth rate of the series is 28.2%.

The company’s revenue steadily grew from $2.41 billion on June 30, 2020, to $3.62 billion on December 31, 2022. There were some fluctuations, with a decrease in revenue of $300.18 million between September 30, 2020, and December 31, 2020, and an increase of $638.05 million between March 31, 2021 and June 30, 2021. In the last period, there was a growth rate of 23.54%.

ARCO’s dividend per share (DPS) experienced fluctuations, with the DPS in June 2020 at $0.11, and its most recent value of December 2022 is $0.15, representing a 36% growth rate. Between December 2020 and September 2021, DPS decreased from $0.11 to $0.03 before bouncing back to its current level. This indicates that the company remains financially stable despite fluctuating trends.

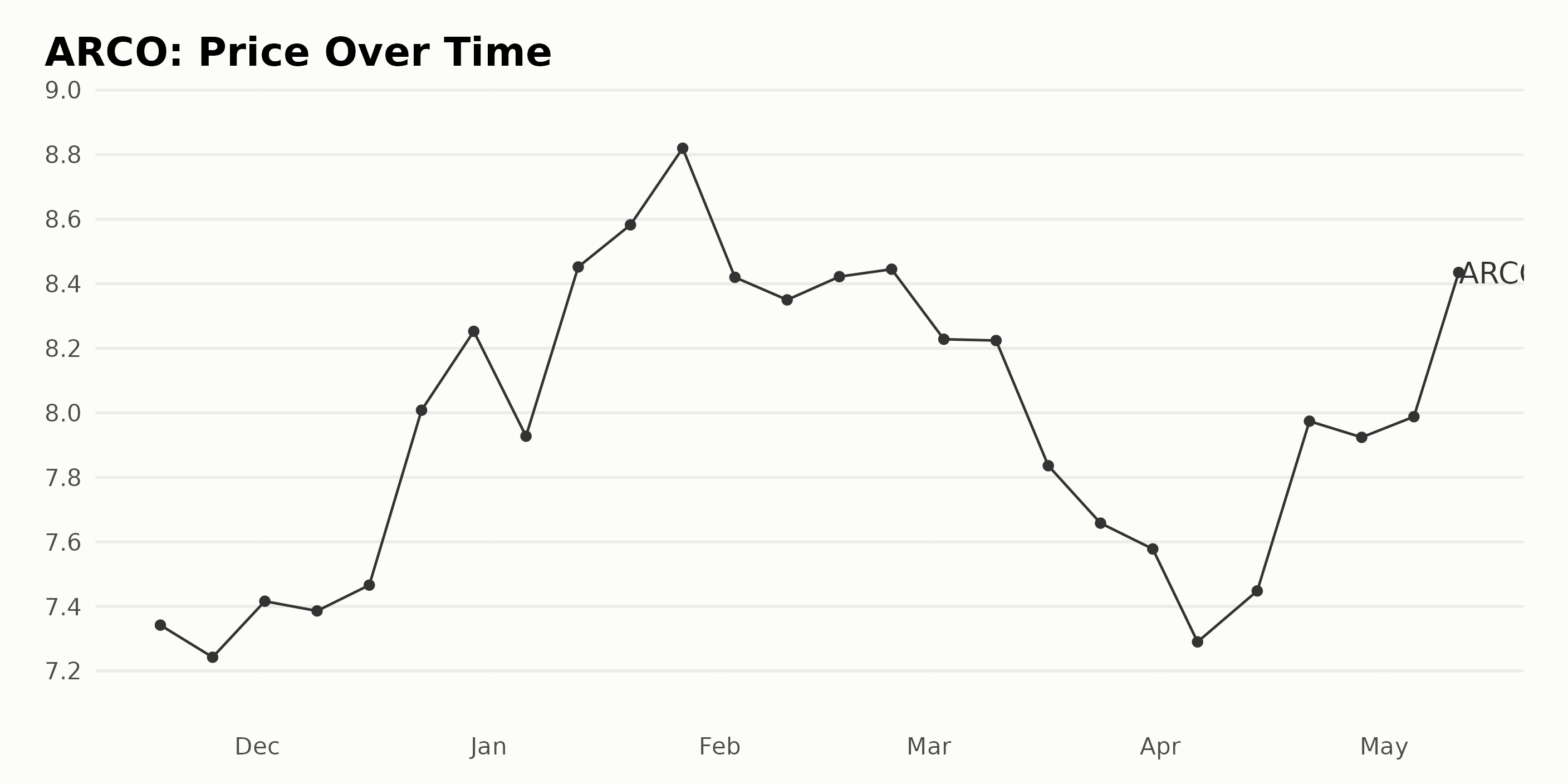

ARCO’s Steady Price Increase — November 2022-May 2023

The stock has had a steady upward trend beginning in November 2022 with a price of $7.34 and increasing with gradual fluctuations to $8.42 in February 2023 before briefly slowing down and then hopping back to its current price of $8.42 in May 2023. The growth rate over this period has been around .14 or 14%. Here is a chart of ARCO’s price over the past 180 days.

ARCO’s Outstanding Ratings: A Positive Outlook

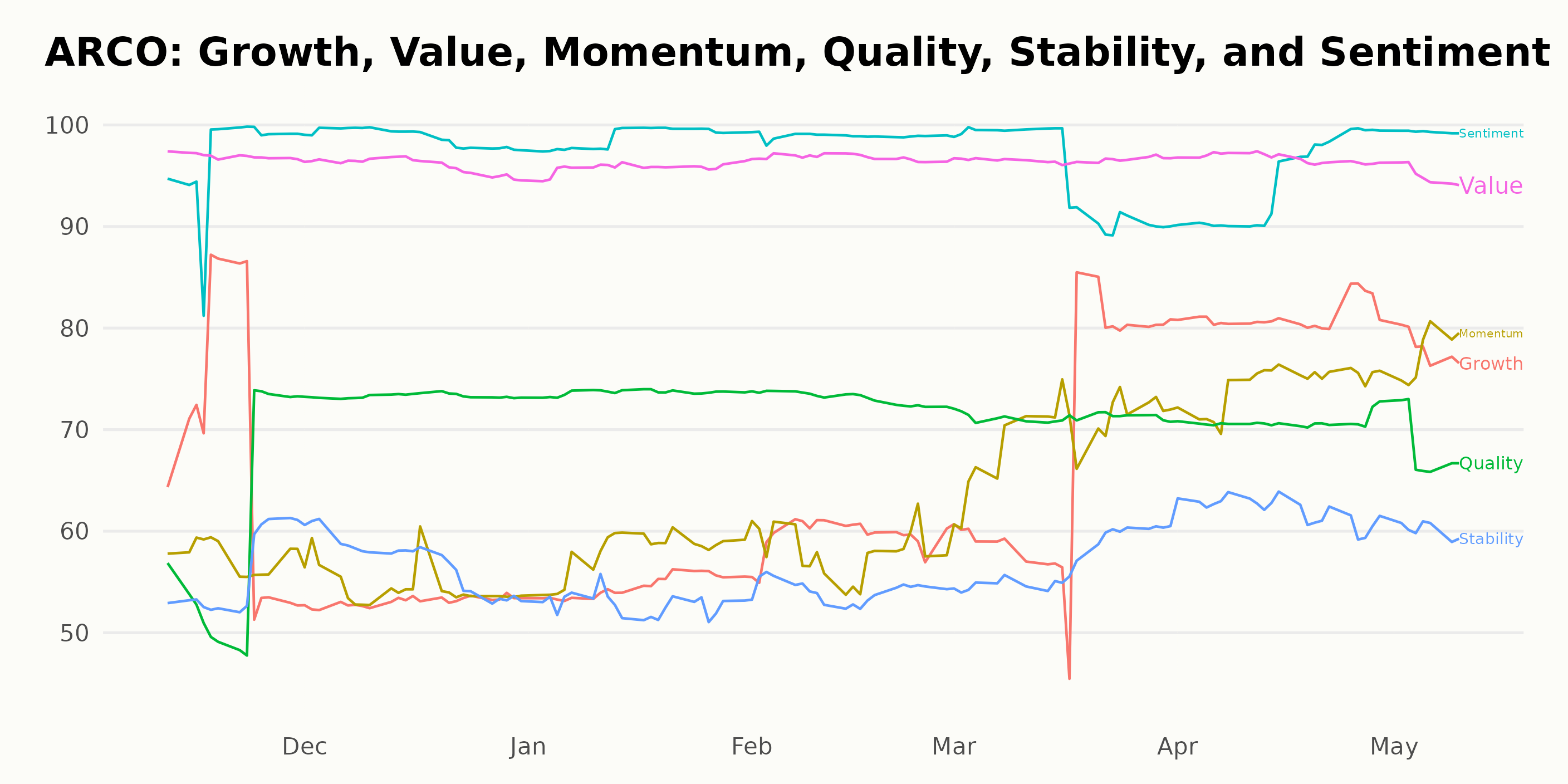

ARCO has an overall A rating, translating to a Strong Buy in our POWR Ratings system. ARCO has consistently held an A rating since November 2022. It is ranked first out of 46 stocks in the Restaurants industry.

The three most noteworthy dimensions in POWR Ratings for ARCO are Sentiment, Growth, and Value. Over the period from November 2022 to May 2023, the Sentiment rating consistently achieved a score of 97 or higher. The Growth rating also showed an upward trend, with scores increasing from 53 in December 2022 to 81 in April 2023. The Value rating also had scores above 96 in all five months. These highest ratings indicate a positive outlook for the stock.

How does Arcos Dorados Holdings Inc. (ARCO) Stack Up Against its Peers?

Other stocks in the Restaurants sector that may be worth considering are Nathan’s Famous Inc. (NATH), Biglari Holdings Inc. (BH), and Rave Restaurant Group, Inc. (RAVE). These stocks also have an overall A rating.

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

ARCO shares were trading at $8.37 per share on Thursday afternoon, down $0.22 (-2.56%). Year-to-date, ARCO has gained 0.79%, versus a 8.12% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

Why Are Investors Buying This Food Stock? StockNews.com