SilverBow Resources Inc (NYSE:SBOW) is a small cap oil and gas company operating out of Texas that is leveraging its core footprint in the Eagle Ford Shale, while also employing disciplined M&A parameters to scale its South Texas footprint.

The Keybanc Analysts: Tim Rezvan initiated an Overweight rating on SilverBow Resources with a price target of $58.

Also Read: Chevron Mulls Divesting Minority Stakes In Three Alaska-Based Oilfields: Report

Key Takeaways: Rezan mentioned there is a mandate for growth from current shareholders, causing acquisitions to remain very active, as he expects a renaissance in the Eagle Ford Shale.

On Sept. 15, SilverBow announced the addition of a new acreage block in the Dorado play of Webb County, Texas.

According to Rezvan, the necessary supply response from large upstream companies to balance supply and demand is simply not there, which is why their models reflect $84 to $91 per barrel for the second half of the year into 2023, above the WTI strip.

Also, U.S. shale gas is needed for geopolitical reasons, validating demand for incremental liquified natural gas export projects and putting a higher floor in place for long-term prices.

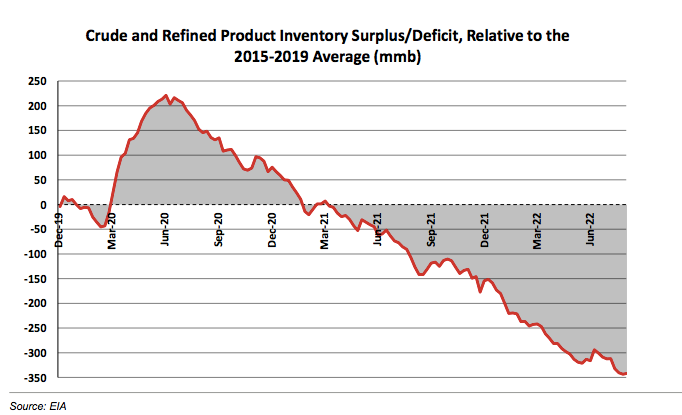

As the U.S. is the largest oil-consuming nation, it is finding itself with an inventory shortfall as oil, gasoline, and distillate are 341 MM barrels, 15% below the 2015-2019 level.

The Bull Case: In the energy and power industry, SilverBow shares are the most inexpensive trading at 2.1x 2023E EBITDA, as the average for the group is trading at 3.3x. Although this signals some concern, Rezvan commented that in the past five acquisitions since mid-2021, there has been no dilutive growth.

Additionally, SilverBow is focused on deleveraging its balance sheet as leverage has declined below 1.5x, and a decline below 1x by the second quarter of 2023 is expected, according to the Keybanc analysts.

Rezvan also forecasted 54% EBITDA growth in 2023 to $652 million, which will contribute to creating value for its shareholders.

The analyst commented that his bullish thesis assumes zero capital return, adding that the firm should forgo shareholder distributions and focus on growth through the drill bit.

The Bear Case: On the other hand, Rezan reported that a new large shareholder with 14% ownership and a history of activist investing could prevent what has been a successful growth effort by management.

Furthermore, since the company is small in size and has lower levels of liquidity it may prevent long-term investors from buying, adding that its growth strategy is reliant on finding accretive deals, which may be tough to come across.