/Alphabet%20(Google)%20Image%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Alphabet Inc (GOOGL) announced on Feb. 4 that it would almost double its capex spending in 2026, and GOOGL stock fell. But its free cash flow (FCF) could survive and stay strongly positive, as I will show. Moreover, this provides a great buying opportunity for value investors, as well as cash-secured short-put investors.

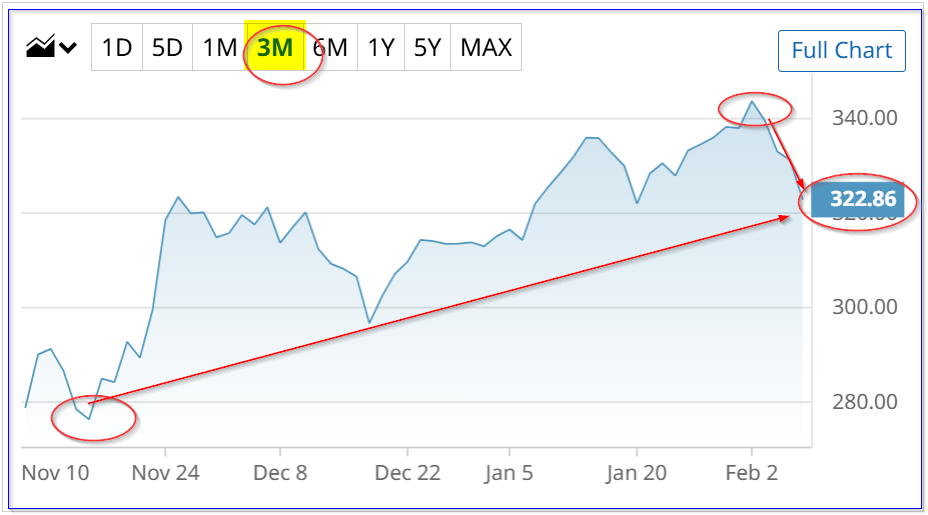

GOOGL closed at $322.86, down over 6% from its pre-earnings release peak of $343.69 on Feb. 2. However, it's still up 16.9% from a three-month low of $276.14 on Nov. 14, 2025.

A closer look at its results shows why it could be worth more. This article will show why.

Strong Operating and Free Cash Flow (FCF)

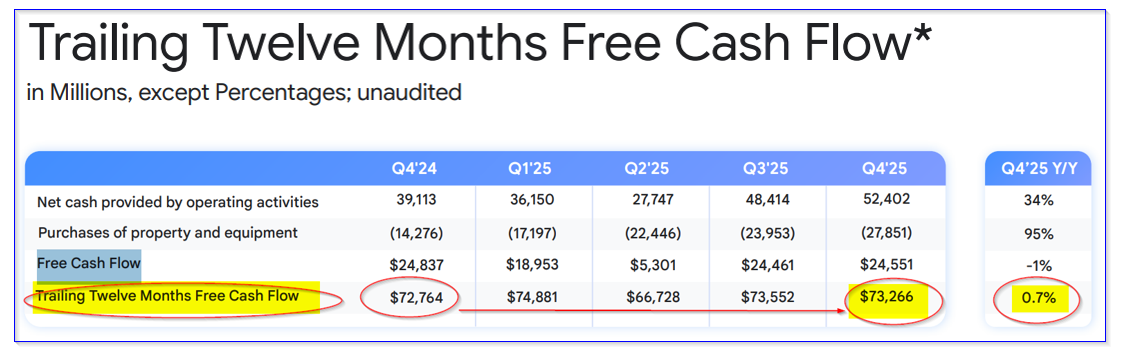

Alphabet is making massive investments in AI. Its capex almost doubled over the last year (+95%) from $14.3 billion in Q4 2024 to $27.9 billion in Q4 2025. For the full-year 2025, capex rose 74% to $91.4 billion.

But, despite that huge increase, its free cash flow (FCF) stayed strong, actually rising almost 1% to $73.266 billion. This is because its operating cash flow (OCF) rose 31.5% in 2025 and 34% in Q4 on a YoY basis.

This can be seen on page 11 of its earnings slide deck.

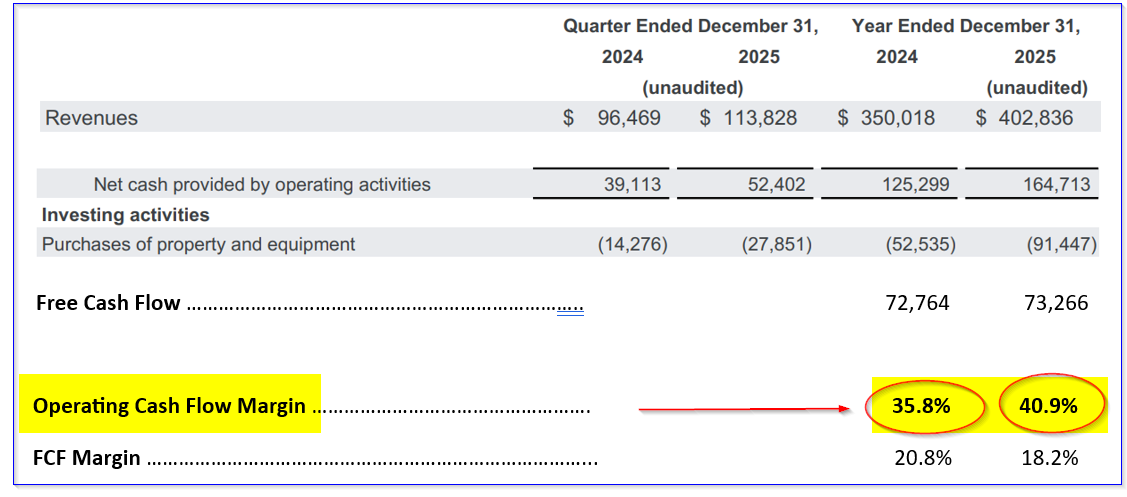

However, what is more important here is that the OCF margin rose dramatically. That's the secret to why, despite management's guidance that it will raise its capex spending to between $175 billion and $185 billion in 2026, its free cash flow could stay strong.

Let's look at this more carefully.

For example, the cash flow statement on page 6 of the earnings release shows that in 2024, operating cash flow was $164.7 billion, representing 40.9% of its $402.8 billion in revenue in 2025.

But, as the table above shows, the OCF margin was higher than the 35.8% OCF margin in 2024. In other words, cash flow, as a percent of revenue, rose 14.2%, based on its large capex AI-related spending (almost double).

So, that implies there could be another large gain in operating cash flow as capex doubles this year, measured as a margin on revenue. The point is that Alphabet's capex investments are paying off.

Projecting Operating and Free Cash Flow

For example, analysts are projecting revenue will rise 16% this year to $467.22 billion, and by 33% in 2027 to $536.27 billion.

So, over the next 12 months (NTM), revenue could average $501.7 billion.

However, we might be able to expect that operating cash flow (OCF), as a percent of revenue, could rise 14.5% or so to 46.8%, just like it did in 2025. So, here is what that means:

$501.7b x 0.468 OCF margin = $234.8 billion operating cash flow

As a result, even if its capex spending rises to $180 billion (the midpoint of guidance), free cash flow (FCF) could be:

$235b - $180b = $55 billion FCF

And by 2027, assuming a 47% OCF margin:

$536.27 x 0.47 = $252 billion OCF

$252b - $180b capex = $72 billion FCF

Granted, these FCF forecasts are lower than the $73.266 billion in FCF made in 2025. But, it still shows that Alphabet's FCF could stay strong, depending on how its OCF margin improves (as a result of higher capex investments).

For example, let's say OCF margins rise to 50% and capex stays at $180 billion:

$536b x 0.50 = $268b OCF - $180b capex = $88 billion FCF

The bottom line is that the market fears over its huge increase in capex investments need not lead to fears of a huge decline in FCF.

How to Play GOOGL

One way to conservatively GOOGL stock is to sell short out-of-the-money (OTM) put options. I discussed this in my last Barchart article three weeks ago on Jan. 13 ("Alphabet Stock Is Still Undervalued According to Analysts - 1 Month GOOGL Puts Yield 2.50%").

For example, look at the one-month forward puts expiring on March 13. It shows that the $305.00 put option contract has a midpoint premium of $5.93.

In other words, if a short-seller of this put contract secures $30,500 with their brokerage firm, they can immediately receive $593 after entering an order to “Sell to Open” this contract.

That works out to an immediate yield of 1.944% (i.e., $593/$30,500). Moreover, even if GOOGL falls to $305.00, or 5.5% lower than Friday's close, the investor's net cost is:

$305.00 - $5.93 = $299.07 breakeven (B/E)

In other words, value investors can set a much lower potential buy-in point (i.e., 7.36% lower than $322.86 on Friday) and collect 1.944% while waiting.

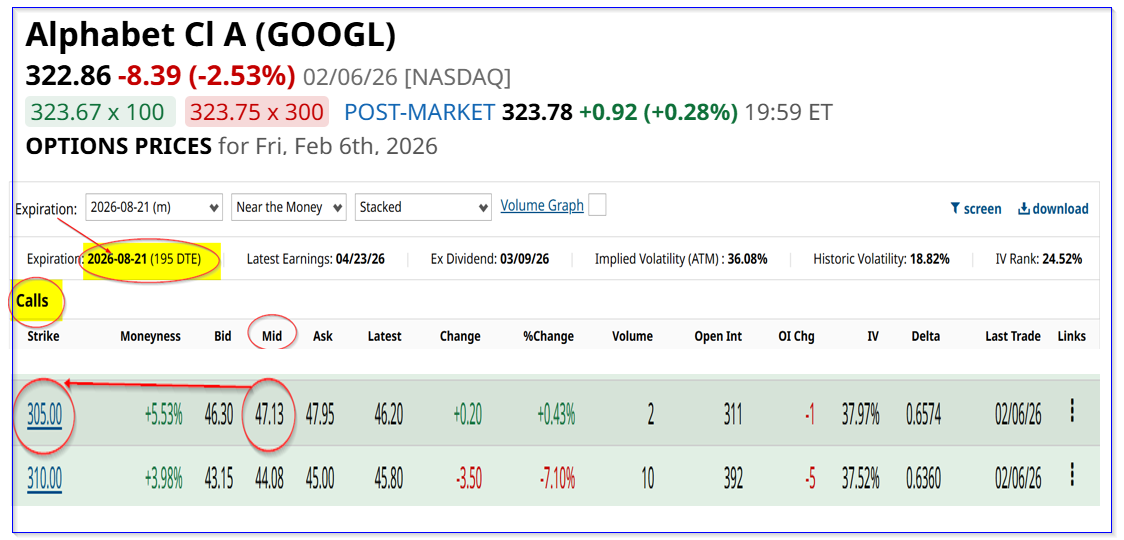

Some investors could use this capital to buy in-the-money (ITM) call options with much longer expiry periods. I have discussed this kind of play in other Barchart articles.

For example, the $305.00 call option expiring on Aug. 21, has a midpoint premium of $47.13.

So, an investor could potentially collect $5.93 for seven months (or $35.58) to help pay for most of this $305 call, leaving a net buy-in cost of $313.55 (i.e., $47.13-$35.58, or $11.55 +$305.00 = $313.55). (Keep in mind there is no guarantee that the one-month put premiums will stay at this level for the same 5.5% OTM distance.)

That means the investor could still make a profit, even if GOOGL stays flat at $322.86 today.

The bottom line is, there are ways to play GOOGL using OTM puts and ITM calls, for value investors.