The race to buy Chelsea is down to three candidates after the consortium led by the Ricketts family withdrew their takeover bid, citing “certain issues” and “unusual dynamics” around the sales process.

Raine Group, the US merchant bank, finalised their shortlist of preferred bidders for the club last month but the Chicago Cubs owners and their partners in the consortium opted not to submit a final bid, confirming that they had withdrawn from the race on Friday.

Roman Abramovich announced that Chelsea was being put up for sale on 2 March amid Russia’s invasion of Ukraine. The oligarch billionaire was then sanctioned by the UK government on 10 March after Downing Street claimed to have proven his ties to Vladimir Putin, with Chelsea only allowed to continue operating under a strict government licence.

The government will have oversight on the takeover to ensure Abramovich does not benefit from Chelsea’s sale, which is expected to be worth around £3bn, while the winning bid will also need to pass the Premier League’s Owners’ and Directors’ Test.

Two consortiums are reportedly seen as the most likely candidates to take over the west London club. The first is led by Todd Boehly, the billionaire part-owner of the LA Dodgers, while the second is headed by British businessmen Sir Martin Broughton. Boston Celtics co-owner Stephen Pagliuca has also made the final shortlist to buy Chelsea.

In

Boehly consortium

Todd Boehly

Boehly, the billionaire part-owner of the LA Dodgers, is thought to be at the head of one of the major bids to buy Chelsea. The American has courted Chelsea before - in 2019, he had a $3 billion (£2.24 billion) offer turned down by Abramovich as he looked to add the Premier League club to a sporting portfolio already including part-ownership of the Los Angeles Dodgers baseball team and Los Angeles Sparks basketball franchise.

Boehly added a stake in the LA Lakers last year and is an owner of fantasy sports behemoth DraftKings. He is the founder of private investment firm Eldridge Partners, which is involved in a broad range of industries.

“Football’s the biggest sport in the world, the passion the fans have for the sport and the teams is unparalleled,” Boehly told Bloomberg in 2019 of his interest in buying Chelsea.

“So what you are trying to build with these teams, you are really trying to a) win and b) be part of the community.

“The opportunity we had with the Dodgers was really about part-ownership with Los Angeles, how are we going to win, how are we going to drive championships and how are we going to build passion. If you look at what the Premier League offers, it’s all of those things.

“It’s the highest quality play, it’s the best players, and you also have a media market that’s just really developing.”

Swiss billionaire Hansjorg Wyss and is believed to be a key figure in Boehly’s consortium.

Broughton consortium

Sir Martin Broughton

Broughton, the former British Airways chairman and a lifelong Chelsea fan, is at the head of another consortium attempting to purchase Chelsea.

Broughton spent a short stint as Liverpool chairman in 2010 in order to broker the Reds’ eventual sale to Tom Werner’s Fenway Sports Group.

The business magnate won a court battle to push on Liverpool’s sale to FSG, who have helped drive the Anfield club back to Premier League and European summit.

Broughton remains the only person to have carried out a change of ownership at a top football club under UK government supervision.

Lord Sebastian Coe has thrown his weight behind Broughton’s attempt to take control of the Blues.

“I am certain that Sir Martin is the right man to lead Chelsea Football Club into its next chapter,” Coe said in a statement confirming he was also part of the consortium.

It has also been reported that American tycoons Josh Harris and David Blitzer, who own the Philadelphia 76ers and a minority stake in Crystal Palace, are involved in Broughton’s consortium.

Boston Celtics co-owner Stephen Pagliuca was the final bidder to make the shortlist compiled by New York merchant bank the Raine Group and remains in the running.

The 67-year-old billionaire co-chairman of Bain Capital outlined his bid this week, stating that his investment would allow the club to continue competing for trophies while promising to protect the traditions of the club and remain at Stamford Bridge.

“Not only are we committed to remaining at the home of Chelsea, Stamford Bridge, but we are inspired to renovate or redevelop the stadium. Chelsea is a world-class team, in a world-class city, with world-class fans: it deserves a world-class stadium,” Pagliuca said in a statement.

Pagliuca also has a 55 per cent shareholding in Italian club Atalanta, which he could have to divest should his bid for Chelsea prove successful.

Out

The owners of the Chicago Cubs made the final shortlist to buy the club but their interest was met with fierce protests from fan groups after it emerged that the family patriarch, Joe Ricketts, allegedly referred to Muslims as “my enemy”.

The Ricketts-led consortium confirmed they had withdrawn their bid on Friday, although it is understood the opposition they faced from Chelsea supporters was not a reason behind their decision.

Cubs owners Tom and Laura Ricketts had partnered with US billionaires Ken Griffin and Dan Gilbert, the owner of the Cleveland Cavaliers, on a cash-only bid to buy the Blues.

But a Ricketts family statement read: “The Ricketts-Griffin-Gilbert group has decided, after careful consideration, not to submit a final bid for Chelsea FC.

“In the process of finalising the proposal, it became increasingly clear that certain issues could not be addressed given the unusual dynamics around the sales process.

“We have great admiration for Chelsea and its fans and we wish the new owners well.”

Property developer Nick Candy initially assembled a bid worth £2.5bn to buy Chelsea and later submitted an improved offer with a large Korean financial institution joining his consortium.

“Nick Candy is actively exploring a number of options for a potential bid for Chelsea Football Club,” a spokesperson for Candy said in a statement to Sportsmail. “Any bid would be made in conjunction with another party (or consortium) and we have serious interest from several international partners.”

“Mr Candy has a huge affinity with Chelsea. His father was asked to play for the club and he has been watching matches at Stamford Bridge since the age of four. The club deserves a world class stadium and infrastructure and Mr Candy’s unique expertise and background in real estate would be a hugely valuable asset to delivering this vision.”

However, Candy is believed to have been informed by Raine Group that his bid has not made the shortlist.

Centricus

Global investment firm Centricus was keen to take over the club and “maintain and support existing management”.

The firm, which has £29bn in assets and included several Chelsea season-ticket holders as part of the group, including Centricus co-founder Nizar Al-Bassam and chief executive Garth Ritchie, had said it was “committed to supporting [Chelsea] and its key stakeholders to ensure its continued success”.

However, their bid is also thought to have been ruled out by Raine Group.

Empowerment IP

Empowerment IP, a rights monetisation firm headed by the sports financier Stephen Duval, were said to have tabled an improved £3.1bn bid for Chelsea to Raine over the last few days.

Of that total amount, Sky claimed £1bn was to acquire Chelsea’s share capital, while £2.1b would be ring-fenced for investment in the club’s Stamford Bridge stadium, players and academy.

Their bid is also thought to have been ruled out by Raine Group.

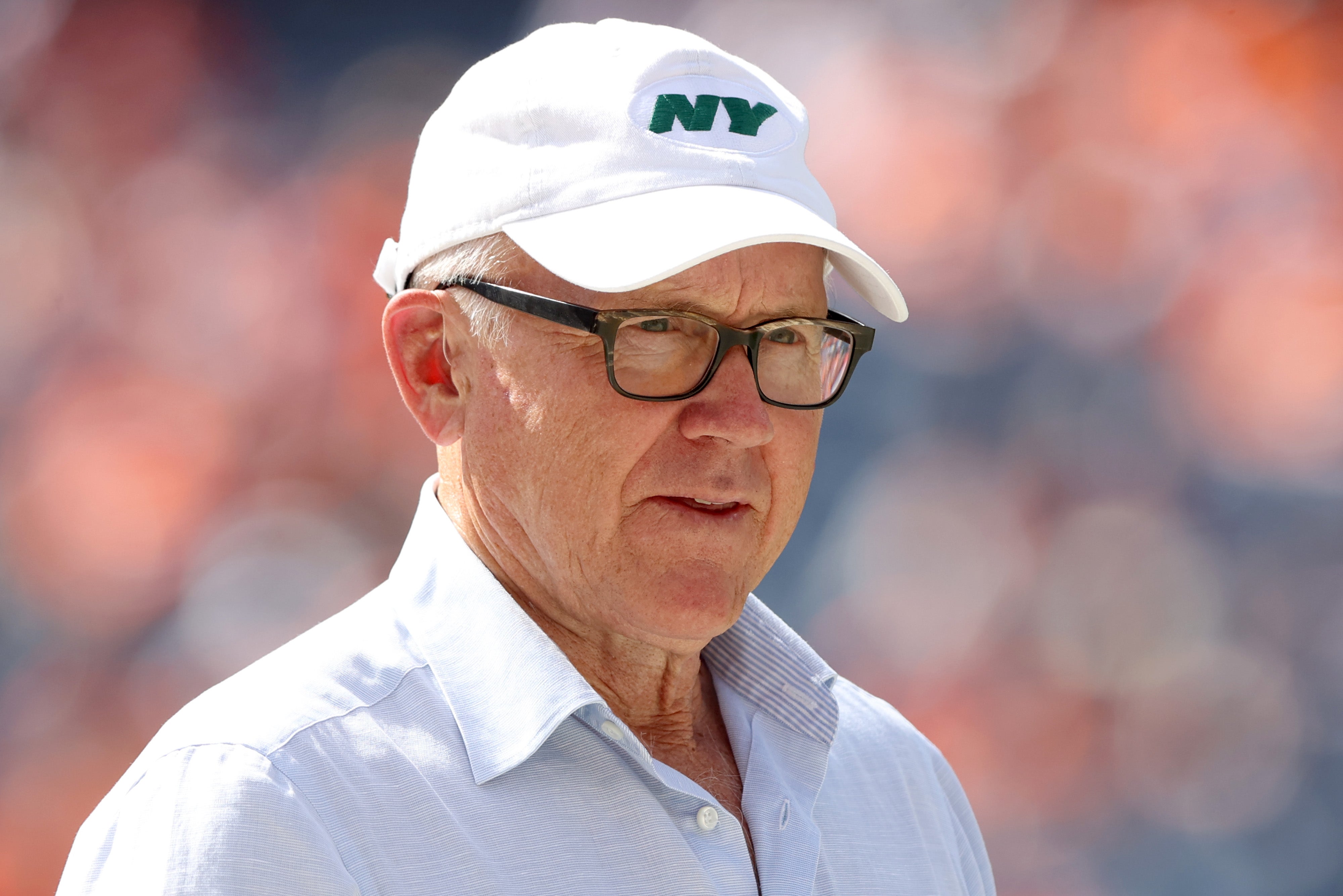

Woody Johnson

US billionaire Woody Johnson’s bid for Chelsea has also been ruled out.

The owner of the New York Jets and heir to the Johnson & Johnson pharmaceuticals empire had claimed he was ready to offer £2bn for the club.

“What Chelsea need right now is longevity and stability when it comes to a new owner. Woody and his team think they can provide that,” a source had told The Sun.

“He’s run the Jets successfully and knows a huge amount about the sports industry. And he’s spent the last four years in London and knows it well.”

Saudi Media

The biggest media company in the Middle East, the Saudi Media group, have also seen their proposal knocked back. Reports had suggested they had lodged a £2.7bn bid to win the auction for the club.

Aethel Partners

Investment firm Aethel Partners were also said to have bid for Chelsea before last Friday’s deadline, according to BBC Sport.

Headed by Portuguese entrepreneur Ricardo Silva, the London firm had declared their intention to pay in the region of £2bn for the European champions and were pledging to put in £50m immediately. However, their proposal also appears to have been overlooked.

Muhsin Bayrak

The Turkish billionaire had publicly registered his interest, telling Turkish media: “We are discussing the terms of Chelsea’s purchase with Roman Abramovich’s lawyers. We’re negotiating signatures. We will soon fly the Turkish flag in London.”

His bid was not officially confirmed and he has not been included on the shortlist.

Loutfy Mansour

Loutfy Mansour, 39, is the Egyptian chief executive of Man Capital, which operates as the investment arm to his family’s conglomerate, which has revenues in the region of $6b (£4.4b).

Mansour, who is a season ticket holder at Stamford Bridge and has the McDonald’s Egyptian franchise as part of his portfolio, was initially rumoured to be interested in buying the club.

But a spokesperson told The i that he would not pursue a bid: “In light of the recent media speculation, we want to make it clear that we are not pursuing a bid for Chelsea Football Club at this time.”