Key Information:

- China’s Central Bank continues to loosen monetary policy against the backdrop of steep rate hikes in the West.

- On August 24th, China passed a $148B stimulus package to support economic growth.

- On August 26th the US and China reached a deal that would prevent the delisting of several US-listed Chinese stocks.

- The combination of these bullish factors has provided Chinese stocks with enough momentum to rally through an otherwise difficult week for the market.

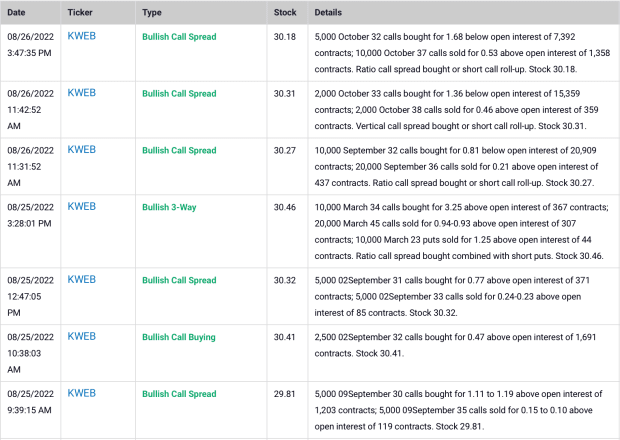

- From August 8th to August 26th, Market Rebellion identified unusual options activity in Chinese stocks in the form of over 100,000 call options purchased in the iShares China Large-Cap ETF (FXI) and the KraneShares China Internet ETF (KWEB).

The Backdrop: Blood on Wall Street

Last Friday, on the back of hawk-talk from central bankers at Jackson Hole, the stock market experienced its deepest single-day decline in months. Now it’s Monday, and there’s blood in the street yet again. Who’s to blame? While many were quick to point the finger at Fed Chair Jerome Powell for his nod toward the inflation-fighting successes of notorious hawk Paul Volcker, there’s a second piece to this puzzle that people seem to be missing: The European Central Bank.

The European Central Bank Steps on the Gas

On Saturday, European Central Bankers made the case for front-loading big rate hikes, with French Central Bank chief Villeroy arguing that the neutral rate should be reached by the end of the year. This is a notable change considering the ECB only just began hiking rates this past July — it’s first rate hike in 11 years. In the face of a plunging Euro (which currently faces a two-decade low) ECB members argue that the sudden acceleration is warranted. According to a recent survey, the European public has lost faith in the central bank as inflation rages on across the pond — especially the price of gas, which just set a new record in Europe last week. The problem: Though the price of energy plays a big part in the public perception of inflation, the remedy is completely out of the European Central Bank’s hands.

That’s because Central Bank tool kits are limited to blunt, hammer-like objects. Tools like rate hikes, meant to smash demand in areas like goods and services. Central Bank tool kits do not include things like time machines — which is what it would need in order to go back in time and become energy-independent before cutting off the “world’s gas station”, Russia. The European Central Bank will need to work extra hard with the tools it does have in order to compensate for its inability to combat rising energy costs. That means several big rate hikes before the end of the year, and likely (as Jerome Powell warned on Friday), economic pain for businesses, households, and yes — the stock market.

Coming up: More than 100,000 call options bought in the Chinese ETFs ahead of two massive bullish press releases. These stocks rallied despite the downtrend last week. Want access to institutional trades like these as soon as we spot them? Take the first step. Discover how WE follow the smart money.

Zooming Out: Hunting for Alpha in a Down Market

The macro reaction to economic tightening from Europe and America has been largely negative. The global heat map above depicts exactly that much. Europe, Canada, America, Mexico, South East Asia — it’s essentially all red. Except for two key areas.

The first obviously strong sector is energy. Look at the map above — what’s working? In Europe, it’s Shell (SHEL) and BP PLC (BP). In Canada it’s Canadian Natural Resources (CNQ), Cenovus Energy (CVE), and Suncor Energy (SU). In America, it’s almost the entire energy sector, led by Occidental Petroleum (OXY), Exxon (XOM) and Chevron (CVX).

Market Rebellion has seen consistent unusual options activity in the energy sector all year long. What does this tell us? That the market believes energy prices will remain higher despite the efforts of world governments to put a lid on them.

However, there’s one more spot on the map that clearly stands out, far outperforming everything else over the past week including energy: Chinese stocks.

Chinese Stocks Rally

While America and Europe look to raise rates and engage in quantitative tightening, China is moving in the opposite direction. In April of this year, China began putting a plan together to start its own version of quantitative easing — something it has never done before. The plan would seek to put government dollars behind national businesses in an attempt to support Chinese economic growth. China’s Central Bank is also preparing to spend $148B dollars to bail-out its struggling real-estate sector. The CCB has also loosened its banking regulations, allowing banks to keep smaller reserves of cash on hand than were previously required. As a result, China is a bright green square on an otherwise red heatmap.

China’s pledge to keep monetary policy accommodative runs counter to the rest of the world, but it also shows stark contrast to its own activities last year. In 2021, Chinese stocks fell dramatically as the government cracked down on many of the largest companies in the Chinese tech sector, issuing punishing antitrust fines and penalties to companies like Alibaba (BABA), Tencent (TCEHY) and more. These days, institutional investors are betting that those same Chinese tech stocks are about to continue higher.

Unusual Options Activity in KWEB and FXI

Before the news broke that the US and China had reached a deal on the US listing of Chinese stocks — and before names like Pinduoduo ((PDD)), KE Holdings (BEKE) and Baidu (BIDU) had notched double-digit percentage gains, the institutional “smart money” had already sized up their position. Leading up to the rally, Market Rebellion’s unusual options activity service identified 70,000 call options purchased in the iShares China Large-Cap ETF (FXI) and in the KraneShares CSI China Internet ETF (KWEB).

Following the surge, the “smart money” came back for more.

Between Thursday and Friday of last week, Market Rebellion identified 39,500 more call options purchased in the KWEB ETF — many of them short-dated. Those same buyers had also sold 10,000 put options, a bullish, one-million share-equivalent bet (requiring collateral of more than $20 million dollars) that the KWEB ETF will be trading at least above $23 by the option’s expiration.

The KWEB ETF currently trades around $30 per share. However, for a short time in 2021, the KWEB ETF traded above $100 — and that was before China had ever considered quantitative easing. This all paints a very bright outlook, but don’t be fooled — not all is well in China. Stricken with Covid lockdowns, mortgage-payment strikes, and a slowing economy, Chinese stocks have a series of tough hurdles to overcome if they ever want to return to their previous highs.

The bottom line: With aggressive Central Banks across the globe looking to rein in inflation at any cost, China’s accommodative monetary policy stands out as a stock market safe-haven — and some “smart money” traders are cashing in.