9 analysts have shared their evaluations of United Rentals (NYSE:URI) during the recent three months, expressing a mix of bullish and bearish perspectives.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 7 | 1 | 0 | 1 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 3 | 0 | 0 | 1 | 0 |

| 3M Ago | 2 | 1 | 0 | 0 | 0 |

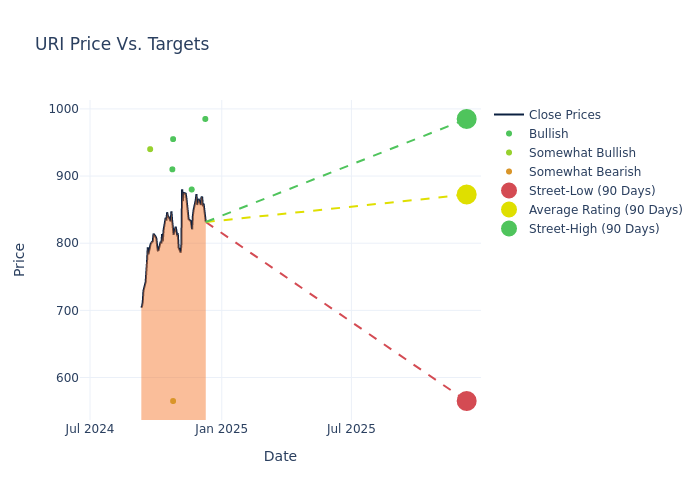

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $897.11, a high estimate of $985.00, and a low estimate of $565.00. Witnessing a positive shift, the current average has risen by 9.23% from the previous average price target of $821.33.

Decoding Analyst Ratings: A Detailed Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive United Rentals. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Kyle Menges | Citigroup | Raises | Buy | $985.00 | $955.00 |

| John Eade | Argus Research | Raises | Buy | $880.00 | $840.00 |

| Kyle Menges | Citigroup | Raises | Buy | $955.00 | $930.00 |

| Adam Seiden | Barclays | Raises | Underweight | $565.00 | $400.00 |

| Jamie Cook | Truist Securities | Raises | Buy | $955.00 | $954.00 |

| Ross Gilardi | B of A Securities | Raises | Buy | $910.00 | $800.00 |

| Kyle Menges | Citigroup | Raises | Buy | $930.00 | $860.00 |

| Jamie Cook | Truist Securities | Raises | Buy | $954.00 | $873.00 |

| Tami Zakaria | JP Morgan | Raises | Overweight | $940.00 | $780.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to United Rentals. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of United Rentals compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of United Rentals's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of United Rentals's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on United Rentals analyst ratings.

Unveiling the Story Behind United Rentals

United Rentals is the world's largest equipment rental company. It principally operates in the United States and Canada, where it commands approximately 15% share in a highly fragmented market. It serves three end markets: general industrial, commercial construction, and residential construction. Like its peers, United Rentals historically has provided its customers with equipment that was intermittently used, such as aerial equipment and portable generators. As the company has grown organically and through hundreds of acquisitions since it went public in 1997, its catalog (fleet size of $22 billion) now includes a range of specialty equipment and other items that can be rented for indefinite periods.

United Rentals: Financial Performance Dissected

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Over the 3 months period, United Rentals showcased positive performance, achieving a revenue growth rate of 6.03% as of 30 September, 2024. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 17.74%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): United Rentals's ROE stands out, surpassing industry averages. With an impressive ROE of 8.4%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 2.53%, the company showcases effective utilization of assets.

Debt Management: United Rentals's debt-to-equity ratio is below the industry average. With a ratio of 1.68, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

What Are Analyst Ratings?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.