As the curtain opens on the 2025 stock market, it's fair to say that it will be among the most anticipated encores in financial history – if only because 2024 is a very tough act to follow.

The broad U.S. market, measured by the S&P 500 Index, notched 47 new highs over the course of the calendar year through October, to the surprise of many investors who watched from the sidelines with huge cash positions, and to the chagrin of many Wall Street experts, who had to boost their year-end forecasts for the benchmark throughout the year – some, multiple times.

"We got stampeded by the market. There are hoof marks on our backs," says strategist Ed Yardeni, of Yardeni Research, who began 2024 with one of the highest targets on Wall Street, then raised it in June. The index closed at 5,705 on October 31, the date for prices, returns and other data in this story. That's a price gain of 36% over the 12 months since our last outlook.

The powerful rally has pushed stock valuations close to red-flag territory for many market watchers, with the S&P 500 trading at nearly 22 times expected earnings for the coming 12 months – above its five-year average of 19.6 and 10-year average of 18.1. "There's no way to sugarcoat it: The S&P 500 is statistically expensive," writes BofA Securities strategist Savita Subramanian in a recent research note.

But it's not as if this high-altitude market is headed off a cliff, with nowhere to go but down. Solid supports include a robust economy, with recent reports coming in strong and some earlier ones revised upward. The base case on Wall Street is now for a soft landing – an economic cooling without a recession – or even no landing. Couple that with interest rate cuts from the Federal Reserve, and you've got what some of the most optimistic bulls are calling a "Softilocks" situation: the soft-landing version of a "just right" macroeconomic scenario.

Make no mistake, however, 2025 will be a test for the market and investors. Those high valuations are a hurdle. And those rosy economic reports have come with a back-up in bond yields at the longer, inflation-sensitive end of the spectrum. So-called bond vigilantes have pushed yields higher on worries that inflation will continue to smolder, hence rate cuts won't be as deep or as frequent as hoped while the Fed walks a tightrope between keeping a lid on prices and supporting job growth.

Geopolitics is a huge wildcard for stocks, with an ongoing war in Ukraine and escalating conflict in the Middle East. And the U.S. must navigate a new political regime after a hard-fought election.

Moreover, history cautions against too much bullishness now, given the typically measured gains in the third year of a bull market (this one just turned two in October). The 11 bull markets since 1947 that celebrated a second birthday went on to produce an average return of just 2.0% in the 12 months after, according to Sam Stovall, chief investment strategist at CFRA, an investment research firm. All third-years saw a pullback of at least 5%; three succumbed to a new bear market and three posted double-digit gains.

We have a rosy outlook for stocks in 2025

We see another positive year for stocks in 2025, especially in the U.S., with the S&P landing somewhere between 6,300 and 6,600. That represents a 10% to 16% price gain from the benchmark's close on October 31, and dividends could add another 1 to 1.5 percentage points.

The U.S. should continue to lead global markets, with corporate earnings continuing to grow and, better yet, broaden, supporting a rally that spreads beyond the so-called Magnificent Seven tech giants to the other 493 stocks in the S&P 500 and to other overlooked corners of the market.

Acknowledging the many risks, however, and the likelihood of a market correction at some point along the way, we caution investors to be selective and to keep portfolios diversified, rebalancing periodically to ensure they stay that way.

A note on the recent U.S. election: Don't overhaul your portfolio based on the results. At the margins, financial and energy stocks, for example, could enjoy a more favorable regulatory regime under a Trump administration, says Solita Marcelli, Chief Investment Officer Americas, UBS Global Wealth Management. But "we always remind clients that our sector views are primarily driven by macroeconomic factors and corporate earnings, not so much by politics."

The Benjamin Button economy

Think of a soft- or no-landing economy as one moving backward in time, says Jared Franz, an economist with Capital Group. Instead of moving through the four stages of the business cycle in order, ending in recession, we're moving from a late-stage economy (characterized by rising cost pressures, central bank tightening and contracting corporate profit margins) back to a mid-stage one (characterized by peak profit margins, a pickup in credit demand and improving employment).

Going back to 1973, Capital Group research shows that mid-cycle economies have tended to produce annualized stock returns in the mid-teen percentages. "If the economy continues to grow at a healthy rate, it should provide a nice tailwind for stocks," says Franz.

Recent indicators have been promising. In late October, the government reported that gross domestic product (GDP) grew at an annual rate of 2.8% in the third quarter, on top of 3.0% in the second quarter. Strong consumer spending on both goods and services powered much of the gain. The Fed's preferred inflation gauge inched closer to the central bank's 2% target. And although the most recent report showed a stagnation in job growth, poor weather and labor strikes got much of the blame, and the unemployment rate remained low, at 4.1%.

Kiplinger's forecast calls for the economy to grow at an average rate of 2.3% in 2025, following 2.7% in 2024, with inflation averaging 2.4% in 2025, down from an average rate of 2.9% expected for 2024. To put that in a global context, the International Monetary Fund in October raised its forecast for U.S. economic growth to 2.8% for 2024 and 2.2% in 2025, up from its July outlook, making the U.S. the only developed economy to see upward revisions for both years.

Against this backdrop, betting on healthy consumer spending makes sense. CFRA analysts recommend both Airbnb (ABNB) and Six Flags Entertainment (FUN).

A low-rate playbook

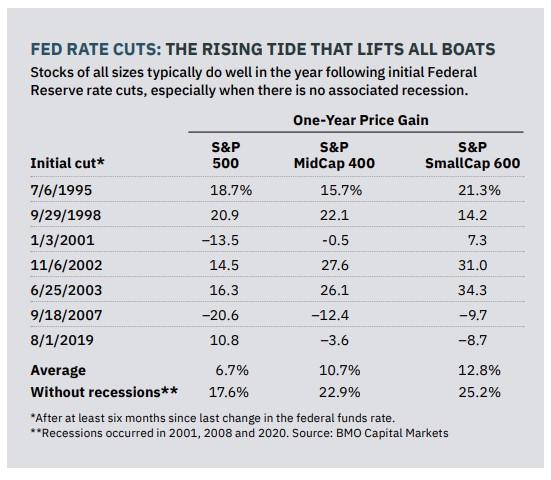

A central bank rate-cutting cycle, even a modest one, that unfolds without an associated recession is a rarity – and a boon to the stock market (see the table below). Since 1984, according to Capital Group, when that lucky combination has occurred, from the first rate cut to the last, nearly every stock sector has logged double-digit-percentage gains.

Following the Fed's half-point cut in September, Kiplinger expects seven more cuts by the second quarter of 2026, amounting to an additional 1.75 percentage points, or 2.25 percentage points total. Look for the benchmark federal funds rate to settle at 3.0% to 3.25%.

That means investors who've been content to earn generous cash yields, which are now shrinking, will have to put money to work elsewhere. Don't ignore dividend stocks, says David Polak, an investment director who leads the stock team at Capital Group. "Over the past 97 years, typically, 37% of the return for the S&P 500 has come from dividend stocks," he notes, although over the past 14 years, the contribution has been just 15%. Any reversion toward the long-term average would boost the impact of dividends in portfolios, he says, and current valuations for dividend-paying stocks are inexpensive.

Investors can find a number of attractive dividend payers in the Kiplinger Dividend 15, the list of our favorites, including retail giant Walmart (WMT) and chipmaker Broadcom (AVGO). Among our favorite mutual and exchange-traded funds are T. Rowe Price Dividend Growth (PRDGX) and Schwab U.S. Dividend Equity (SCHD).

Many low-rate beneficiaries have seen a bounce already, but they have room left to run. That includes financial stocks such as big banks and insurers, utilities, and real estate investment trusts (REITs), many of which have less exposure to moribund commercial office space than investors think. Welltower (WELL), a REIT specializing in healthcare facilities, is a top pick of Mizuho Securities.

Saira Malik, chief investment officer at financial firm Nuveen, recommends preferred shares, which have characteristics of both stocks and bonds, and combine higher yields with a bet on financials. "They're heavily geared toward banks, which have very strong balance sheets and are passing regulatory requirements handily," she says. Consider Fidelity Preferred Securities & Income (FPFD) or iShares Preferred and Income Securities (PFF), two preferred stock ETFs.

The changing interest rate landscape has been tougher for fixed-income investors to navigate, with rates not moving down across the board. (Bond prices and yields move in opposite directions.) Yields on the 10-year Treasury note have jumped from 3.6% just before the first rate cut in September to nearly 4.3% at the end of October, as better-than-expected economic reports have rattled bond investors. Worries about a ballooning federal deficit as a new administration seeks to implement its campaign promises haven't helped. Kiplinger sees the 10-year yield averaging 4.4% in 2025, up a bit from an average 4.2% in 2024.

Investors moving cash off the sidelines in search of higher yields in 2025 can start with a bond-laddering strategy, say strategists at Wells Fargo Investment Institute, investing first in intermediate- and longer-term maturities to capture higher yields.

In October, the firm upgraded its outlook for investment-grade bonds, including corporate IOUs, which they expect to benefit over the coming 12 months from increased demand for attractive yields without much credit risk. Among our favorite core bond funds, Baird Aggregate Bond (BAGSX) is a medium-duration, investment-grade standout, with a 36% stake in corporate bonds. It yields 3.7% at last report.

AI and beyond

Many of the market's most dominant tech giants continue to exceed earnings expectations, and there's little reason to give up on the winners that have brought us this far. However, "you need breadth to create a more durable run in the stock market," says Capital Group's Polak.

Now is a good time to make sure your portfolio is balanced, diversified beyond the technology and communications services stocks that dominate large-company indexes and funds.

"Our call is that the dramatic outperformance of the Mag Seven names is unsustainable and that the rally should broaden out," says Philip Orlando, chief equity market strategist at Federated Hermes. "That trend has legs." He sees improving prospects for large-company value-oriented names, U.S. small caps generally, and international stocks with a focus on emerging markets. "Sectors we like include financials, healthcare – biotech jumps off the page – industrials and utilities," he says.

There are signs that the bull is starting to roam further afield already. In the second half of 2024 (through October), for example, utilities were the top-performing sector, with a total return of more than 18%, compared with just 3.7% for communications services and just 0.6% for technology stocks. Financials and real estate gained more than 13%; industrials were up 10%. Profit expectations are broader, too. Tech and communications are slated to be the top earners in 2024, while energy, materials and industrials companies are forecast to show profit declines. But all 11 S&P sectors are expected to show growth in 2025, led by healthcare and industrials.

Investors worried about sky-high valuations in general and who want to make sure their holdings aren't concentrated in the tech behemoths with the biggest market values can consider an index fund that weights each stock equally, such as Invesco S&P 500 Equal Weight (RSP). The equal-weight S&P 500 trades at historic lows relative to the market-value-weighted benchmark, with the differential so significant that, according to analysts at BofA, it implies total returns over the next decade of just 1% to 2% annualized for the traditional S&P 500 but 8%-plus for the average S&P 500 stock, represented by the equal-weight index.

Revenge of the small fry?

Not everyone is convinced the market rally will broaden consistently "down cap" to small- and mid-capitalization stocks, at least for now. But small-cap bull Shannon Saccocia, at Neuberger Berman Private Wealth, notes three trends in their favor: More dependent on debt financing, small caps benefit from lower interest rates; less tech-heavy, they should gain from a pick-up in industrial spending; and they trade at historically low valuations.

Small caps have been pulling ahead lately, with the Russell 2000 benchmark returning 7.7% in the second half through October, compared with 4.9% for the large-cap S&P 500. Investors willing to bet on small caps will get a wide swath of companies in iShares Core S&P Small-Cap (IJR), an ETF tracking an index that includes only profitable companies.

Midsize-company stocks are a good compromise for investors who want to diversify away from highly concentrated, artificial-intelligence-laden large-cap positions, but are wary of the inherent risk in the smallest companies. Mid-cap portfolio manager Brian Demain at Janus Henderson Enterprise (JAENX) holds a healthy slug of tech stocks, but he sees plenty of opportunity elsewhere.

Property-casualty insurers are in the middle of a long up-cycle, he says, boosted by the impacts of climate change, bigger jury awards in litigation claims, and growing demand for protection against intellectual property and cyber threats.

Within healthcare, Demain likes medical-device and life-science companies serving today's innovative biotech labs. And utilities are on a 15- to 20-year growth path thanks to burgeoning demand from AI data centers, electric vehicles and even increasing use of heat pumps. Even after recent gains, the sector still trades at levels close to its historical average relative to the broad market, "despite having better prospective fundamentals than they used to have," says Demain. Stocks in the Enterprise fund's portfolio that reflect these themes include Intact Financial (IFC), Boston Scientific (BSX) and Alliant Energy (LNT).

Value-oriented stocks have fared badly against the growth-stock juggernaut in recent years. But the S&P 500 Value Index outperformed its growth counterpart by 4.6 percentage points in the second half of 2024 through October, and broadening market gains could reward bargain hunters.

"The market has clearly had a good run, and growth stocks have earned it," says Ryan Hedrick, portfolio manager of T. Rowe Price Value fund. "That's ripe for a turn. It begs the question about whether there's opportunity elsewhere," he says. Hedrick believes a long-lasting cycle that favors commodities is under way, and that beleaguered energy stocks will prosper, including well-managed sector bellwether Conoco-Phillips (COP). The energy trade requires patience, Hedrick cautions.

He also sees value in consumer staples stock Keurig Dr Pepper (KDP) and Elevance Health (ELV), the nation's second-largest health-plan provider. Elevance (formerly Anthem) is nearing the trough in an underwriting cycle, says Hedrick, making now "an opportunistic time to buy."

Finally, although international stocks look like bargains, we're bigger boosters of U.S. companies for 2025. "International stocks have been frustrating investors for the last 35 years," says Jim Paulsen, longtime Wall Street strategist and author of the Paulsen Perspectives blog. That's because the U.S. has been the technology leader in recent decades, driving both the economy and the stock market. A strong dollar also favors a domestic trade. Still, some strategists see value in overseas shares, and a diversified portfolio should include some. Get broad exposure with Vanguard Total International Stock (VXUS).

Note: This item first appeared in Kiplinger's Personal Finance Magazine, a monthly, trustworthy source of advice and guidance. Subscribe to help you make more money and keep more of the money you make here.