It has not been a smooth ride the past few weeks. Investors are still struggling with the buy-the-dip concept in a market where the rallies are being sold and the market is putting in lower highs rather than higher lows.

That’s true for investors’ favorite stocks, too, like Advanced Micro Devices (AMD).

On Monday, we outlined where Nvidia (NVDA) stock may find support. Now let's talk about AMD, which is down in five of the past six weeks.

I especially want to look at AMD given its relative strength vs. Nvidia.

Both stocks were hitting all-time highs in November 2021. Fast-forward a few quarters and Nvidia stock was recently down 64% last week as it was making new 52-week lows. AMD has not made new lows since July 5, when it was down 57%.

AMD stock has relative strength vs. Nvidia stock, but its business also seems to be holding up better.

Nvidia preannounced worse-than-expected results in early August, then followed up with disappointing guidance.

Conversely, AMD beat on earnings and revenue expectations and while guidance was slightly below consensus estimates, it was pretty solid given the environment.

While its business may be holding up — estimates for this year and next year are still near the highs and up considerably from the start of the year — AMD stock has been battered.

When to Buy AMD Stock

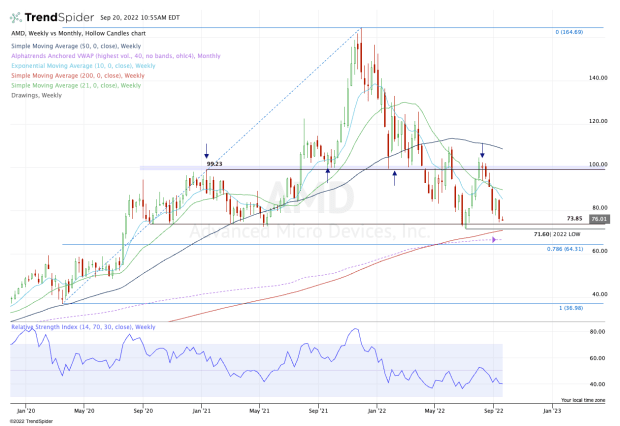

Chart courtesy of TrendSpider.com

In mid-2020, AMD clearly was taking dominant market share and eating Intel’s (INTC) lunch. That triggered an explosive breakout: The shares burst into a new trading range between $72 and $100.

About a year later, AMD broke out again, this time clearing the $100 level and surging to all-time highs. On the ensuing pullbacks, former resistance held as support. Once that level gave out ($100), former range support at $72 has reemerged as a significant area of interest.

The chart above lays out these levels pretty well, but as AMD stock starts to tip lower, you’ll notice more than just range support in the $70 to $72 area.

That level also includes the rising 200-week moving average and the 2022 low at $71.60. If we revisit this level, it may be advantageous for long-term bulls to accumulate a starter position.

If AMD tags this level and bounces, a push into the mid-$80s is not unreasonable and it’s where it will find its shorter-term moving average.

If the $71 level fails as support, it opens the door to a test of the mid-$60s. That's where AMD stock finds its 78.6% retracement from the all-time high down to the covid low, as well as the monthly VWAP measure. This area could also act as support.

Lastly — and for the bulls’ sake, we hope we don't see it — the $58 to $60 breakout zone could be in play if all the above support levels fail.