Ratings for SiteOne Landscape Supply (NYSE:SITE) were provided by 4 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 1 | 1 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 1 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

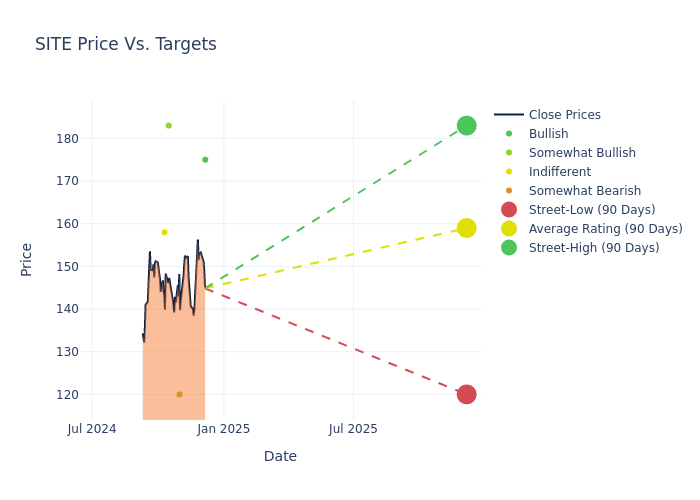

Analysts have recently evaluated SiteOne Landscape Supply and provided 12-month price targets. The average target is $159.0, accompanied by a high estimate of $183.00 and a low estimate of $120.00. Marking an increase of 11.71%, the current average surpasses the previous average price target of $142.33.

Analyzing Analyst Ratings: A Detailed Breakdown

In examining recent analyst actions, we gain insights into how financial experts perceive SiteOne Landscape Supply. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Stephen Volkmann | Jefferies | Raises | Buy | $175.00 | $145.00 |

| Matthew Bouley | Barclays | Raises | Underweight | $120.00 | $114.00 |

| David Manthey | Baird | Raises | Outperform | $183.00 | $168.00 |

| Charles Perron-Piche | Goldman Sachs | Announces | Neutral | $158.00 | - |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to SiteOne Landscape Supply. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of SiteOne Landscape Supply compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for SiteOne Landscape Supply's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of SiteOne Landscape Supply's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on SiteOne Landscape Supply analyst ratings.

Discovering SiteOne Landscape Supply: A Closer Look

SiteOne Landscape Supply Inc is a supplier of tools and equipment. The company serves various businesses which include wholesale irrigation, outdoor lighting, nursery, landscape supplies, grass seeds, and fertilizers, turf protection products, turf care equipment, and golf course accessories for green industry professionals mainly in the United States and Canada. Its product portfolio includes irrigation supplies, fertilizer and herbicides, landscape accessories, nursery goods, natural stones and blocks, outdoor lighting and ice melt products and other products.

SiteOne Landscape Supply's Financial Performance

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining SiteOne Landscape Supply's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 5.56% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 3.67%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): SiteOne Landscape Supply's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 2.77%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): SiteOne Landscape Supply's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 1.4%, the company may face hurdles in achieving optimal financial performance.

Debt Management: SiteOne Landscape Supply's debt-to-equity ratio is below the industry average. With a ratio of 0.59, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Basics of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.