In the preceding three months, 7 analysts have released ratings for Abercrombie & Fitch (NYSE:ANF), presenting a wide array of perspectives from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 4 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 3 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 2 | 0 | 0 | 0 |

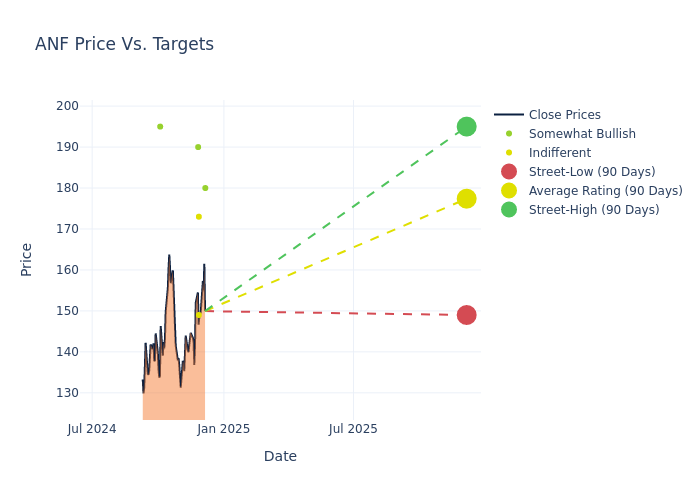

Insights from analysts' 12-month price targets are revealed, presenting an average target of $178.14, a high estimate of $195.00, and a low estimate of $149.00. This current average has increased by 1.22% from the previous average price target of $176.00.

Diving into Analyst Ratings: An In-Depth Exploration

A comprehensive examination of how financial experts perceive Abercrombie & Fitch is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Rick Patel | Raymond James | Announces | Outperform | $180.00 | - |

| Mauricio Serna | UBS | Raises | Neutral | $173.00 | $170.00 |

| Alexandra Steiger | Morgan Stanley | Raises | Equal-Weight | $149.00 | $147.00 |

| Dana Telsey | Telsey Advisory Group | Maintains | Outperform | $190.00 | $190.00 |

| Mauricio Serna | UBS | Raises | Neutral | $170.00 | $165.00 |

| Matthew Boss | JP Morgan | Raises | Overweight | $195.00 | $194.00 |

| Dana Telsey | Telsey Advisory Group | Maintains | Outperform | $190.00 | $190.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Abercrombie & Fitch. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Abercrombie & Fitch compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Abercrombie & Fitch's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Abercrombie & Fitch's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Abercrombie & Fitch analyst ratings.

Get to Know Abercrombie & Fitch Better

Abercrombie & Fitch Co is a specialty retailer that sells casual clothing, personal-care products, and accessories for men, women, and children. It sells direct to consumers through its stores and websites, which include the Abercrombie & Fitch, Abercrombie kids, and Hollister brands. Most stores are in the United States, but the company does have many stores in Canada, Europe, and Asia. All stores are leased. Abercrombie ships to well over 100 countries via its websites. The company sources its merchandise from dozens of vendors that are primarily located in Asia and Central America. Abercrombie has two distribution centers in Ohio to support its North American operations. It uses third-party distributors for sales in Europe and Asia.

Abercrombie & Fitch: A Financial Overview

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Abercrombie & Fitch's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 6.61% as of 31 October, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Abercrombie & Fitch's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 10.92%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Abercrombie & Fitch's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 10.76%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Abercrombie & Fitch's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.18% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a below-average debt-to-equity ratio of 0.76, Abercrombie & Fitch adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: Simplified

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.