Janet Leighton spends a third of her working week speaking to employees about their money worries.

Part of her mission at Timpson, the UK retailer best known for its shoe repair and key cutting services, is to make that stress disappear. “I’m not a qualified financial adviser,” she says, “but I know how to make budgets and I know my colleagues.”

Leighton is the company’s Director of Happiness — a seemingly frivolous title for a meaningful role she’s held since 2018. She says she recently helped one staff member source and purchase a car. Timpson paid the seller £1,990 and Leighton knocked up a manageable repayment plan for the employee spread over 12 months. “We don’t want them to struggle and go to a loan shark or a payday lender,” she explains.

“If people have got problems, we want to know,” says Leighton, adding that employees inevitably bring financial concerns into the workplace. “We want people to give excellent customer service, so we need to enable them to do that. Ultimately, we are a commercial business. If we help our colleagues, we know this will come back to us tenfold.”

In addition to the £450,000 in interest-free loans Timpson has collectively granted to its 5,000 staff — with the average individual loan somewhere between £500-£1,000 — it also gives away at least £50,000 in cash gifts a year. When one employee’s grandmother passed away, he was on the hook with his siblings to cover funeral costs. Timpson says it provided his share. The company also rewards staff financially for life milestones — from quitting smoking to getting married and learning how to drive — and pays the related tax bill.

Timpson, given its history as a family company and the relatively low wages of many of its workers (its average shop floor worker earns around £20,000-£23,000 a year), has a paternalistic culture. Its approach to the financial wellbeing of employees has, until now, been relatively unique.

But the number of employers in the UK getting more involved in the financial affairs of their staff is growing. Companies are not only stepping in to negotiate better rates on mobile phone tariffs and energy bills for the entire workforce, but also managing an individual’s personal money woes by issuing loans or coming up with plans to pay off credit card debt.

The same is happening in the US. According to a recent Bank of America report, 97 per cent of US employers surveyed feel responsible for employee financial wellness, up from 41 per cent in 2013.

In the past, if an employee was in trouble, it would land on the desk of the human resources team. Today, financial wellbeing is on the agenda in corporate boardrooms.

The pandemic accelerated this trend as managers were forced to confront the physical and mental health concerns of workers, paying closer attention to the personal lives of their employees than ever before. Providing access to online exercise classes and meditation apps, work-life balance coaching and workshops on how to make parenting easier were a few new perks on offer in many companies.

That blurring of private and professional boundaries has cemented a remarkable cultural shift. Workers are more comfortable discussing personal issues and political topics — from ill health and childcare troubles to climate change to racial injustice — with colleagues and bosses.

The importance of financial wellbeing — in some ways the most sensitive area in someone’s personal life — has only grown as the cost of living crisis bites. Inflation is rising more than wages. Everyday purchases including food and fuel are becoming more unaffordable. To make ends meet, even those in full-time employment are turning to salary advances, overdraft extensions, payday loans, friends and family and credit card debt.

A recent report from the Money and Pensions Service shows there are more than 11mn working-age people in the UK who are deemed “financially struggling” or “financially squeezed”. Around 14 per cent have no savings at all and 19 per cent have savings of less than £500.

“Many of these people are juggling the challenges of a busy working life, variable income and a young family,” says MaPS, a public body sponsored by the UK government’s Department of Work and Pensions. This is precarious as two-thirds of adults receive unexpected bills every year. “The breakdown of a car or domestic appliance could mean calling on costly, short-term credit. It could even tilt people into a debt crisis,” the report warns.

If employees are routinely struggling to make ends meet, an obvious fix might be to simply pay them more. Executives, however, are facing their own financial pressure and are finding ways to ease the economic pain felt by employees if they are unable, or unwilling, to offer widespread pay increases.

A new-look benefits package

Offering a more thoughtful benefits package is how Phil Bentley, chief executive of Mitie, a facilities management company that employs 68,000 largely lower-income workers in the UK, says it supports its staff.

“On low pay, people struggle to manage household budgets. We have always been pushing for higher pay for our people. But it is up to our clients [that contract our services] to agree to it. If we can’t [raise] pay, then we have to do it via the benefits package,” says Bentley. “We have to be smarter.”

Mitie has launched a £10mn “winter support” package to help the company’s lower paid colleagues. In addition, it says, it has given out retail gift vouchers and one-off cost of living payments.

Recommendations of pensions advisers, staff discounts for retailers, subsidised gym membership, bicycle loans and train season ticket loans used to be regular perks. Now companies are going further by providing access to third parties that can help restructure debt, provide sizeable loans or access to earnings in quicker time, rather than leaving employees beholden to standard payment cycles.

In the UK, companies are achieving this by partnering with fintechs such as Salary Finance or Wagestream. In the US, financial wellness tools and apps including DailyPay and PayActiv have been around for longer.

Mitie launched a loans programme through Salary Finance in December 2017. Since then, 10,000 loans have been taken out, with a total value of £25mn. Colleagues have saved around £3mn in interest by using the scheme, the company says.

“The cost of living crisis . . . is not new,” says Asesh Sarkar, chief executive of Salary Finance. The company enables savings plans and facilitates personal loans, backed by Virgin Money in the UK, repayments for which are automatically taken out of an employee’s pay packet. Supermarket chain Tesco, one of the UK’s biggest private sector employers, has announced it is partnering with the company.

“People don’t save,” continues Sarkar. “They accumulate huge levels of debt and millennials are far worse off than their parents. It’s more acute now, but it’s not new. It’s become normalised. So employers are now looking to do something about it.”

“Most UK adults are not financially literate,” Sarkar adds. “Before, you would say you should always have three months’ salary saved. It’s now a free for all. No one knows what to aim for.”

But while some individuals are spending carelessly, a bigger issue is that the odds are stacked against those who do not. Sarkar has particular concerns about buy now, pay later agreements, which “create habitual levels of debt”. He sees this as an example of how the economy perpetuates a system that works against the lowest earners who are seen as the riskiest borrowers by banks and are charged hundreds of pounds more per year for basic services.

“In finance, it is normalised that the poorest in society pay more for products,” Sarkar says, adding this would be considered unthinkable in other sectors such as retail. Salary Finance is soon hoping to launch mortgage products, using its lobbying power to secure better rates for those most likely to get the worst deals from traditional banks.

But these direct and indirect transactions are complicating the nature of relationships between employers and their staff. Workers are often giving away far more information about themselves to their bosses. It may also be an uncomfortable situation to owe money to your employer.

Caroline Siarkiewicz, chief executive of the Money and Pensions Service, says while it was good that employees were more vocal about money concerns and that employers were keen to help, the dynamic carries some risk. As a worker, she says, “you would be admitting you need support”.

“Employers also see that you might have made some bad decisions and there is a fear of being judged,” says Siarkiewicz, adding there might be a perception that it may influence promotions, pay rises and broader workplace advancement.

But it is also a grey area for employers, with executives increasingly asking where the limit is for corporate involvement in the lives of individual workers.

There are risks too. Companies could take on liabilities they never envisioned, for example if an employee defaults on a loan. There may also be adverse effects of choosing to help one employee financially over another, risking accusations of favouritism. There are also tax implications for handing out cash benefits above a certain amount.

Establishing boundaries

One solution seems to be establishing a partnership with an outside organisation. Employees can seek help without revealing details to their employer. Yet, this too can become ethically murky.

By passing on contact details about a third party service, employers are also unwittingly advocating for a company that may not be regulated by the Financial Conduct Authority, like a bank would be. They are also indirectly funnelling business to the financial institutions that support these third party companies.

“If, as the employer, you bring in an independent broker, they are not terribly independent. The job of a company is to provide easy access to information, but without endorsing it”, says Octavius Black, chief executive of workplace training provider MindGym.

He sees these efforts as an untested area with possible downsides should a company be blamed for something going wrong in the financial affairs of a member of staff, or the entities providing the services. “Psychologically, an employee might feel their employer is liable even if, legally, they are not,” he adds.

While their intentions may be good, companies are opening themselves up to accusations of profiting from their own employees. Timpson, for example, charges an administration fee of 5 per cent per loan transaction. While this is far less than the average annual percentage interest rate of up to 1,500 per cent charged by payday lenders, or more than 20 per cent APR for a typical credit card, it is still a means through which an employer stands to gain.

But there is another school of thought that argues doing nothing is no longer an option. Workers today face a world where they have less job stability and more individual risk around unemployment, sickness and longer retirements as people live longer.

Economist Minouche Shafik argues in a paper, based on her book What We Owe Each Other: A New Social Contract, that the rise of temporary contracts, part-time arrangements and the so-called gig economy means “workers increasingly carry the risk of how many hours they will work, keeping their skills relevant, supporting themselves if they get sick, and securing their income for when they are old.”

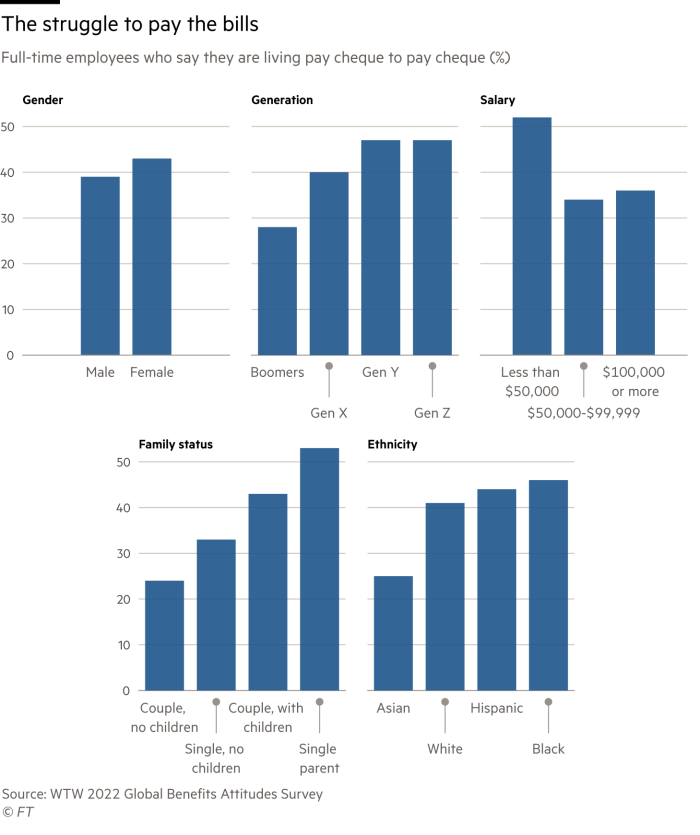

In order to achieve a reasonable standard of living, many workers end up taking on debt, but then have no hope of earning enough to pay it off. Even those who are relatively well off are in a precarious situation. Nearly 40 per cent of US workers earning over $100,000, surveyed by consulting firm Willis Towers Watson, are living pay cheque to pay cheque. This is twice as many as the number in 2019.

With governments tightening their belts and banks increasingly risk averse — declining two out of every three loan applications, particularly those from lower earners and shift workers with unpredictable incomes — employers are in the line of sight.

“They are the most significant financial institution in your life. They are giving you money when everyone else is taking your money,” says Peter Briffett, chief executive of Wagestream, a charity-backed fintech.

Wagestream does not issue loans. Instead, armed with employer data on work schedules and pay per shift taken, its app allows full-time staff and casual workers to have real time visibility on earnings rather than waiting until the end of the month to see if the numbers add up.

It charges a £1.75 flat fee per transaction, like an ATM charge, should employees opt to fast-track up to 30 per cent of their monthly pay. They also charge a platform fee to employers, such as NHS Trusts and retailers. “We see more and more employers paying. It’s taken a while for us to prove that people do more work and they are easier to retain [once they have this access to their data] . . . the propensity for employers to pay is now higher.”

Diana, who asked to withhold her last name, works at retailer The White Company and uses the Wagestream app to access her next month’s earnings if she is falling short. She hopes to avoid the financial turmoil she faced when her previous marriage collapsed. Back then, she was forced to go to payday lenders, increase her credit card limit and make high interest rate payments. “It caused great stress, depression and sleepless nights because I was worried about the money. I don’t want to be in that position again,” she says.

Those like Diana are not saving and might spend more frequently, according to academics. But they are staying in the black; avoiding late bill payments, bank overdraft fees and other charges that can trigger a debt spiral.

For corporations, there are commercial interests to protect. Financial stress costs companies hugely in the form of absenteeism and lost productivity as employees deal with personal money issues while on the clock. Those who are financially stressed are also more likely to look for jobs elsewhere, costing companies more in recruitment and training at a time of chronic skills shortage.

“Every industry seems to be short of people,” says Rupal Kantaria at management consultancy Oliver Wyman. “If a company is desperate to keep talent and you can help an employee from descending into some negative financial spiral, that is good for everyone.”

“The employee will also have a greater sense of belonging to an organisation and loyalty . . . This is a moment of necessity, but it’s also a moment of opportunity for employers.”

Photographs by Anna Gordon and Jon Super for the FT; Jason Alden/Bloomberg and Mitie

The Financial Literacy and Inclusion Campaign charity, backed by the Financial Times, lobbies for greater promotion of financial literacy and produces educational content for schools, organisations and individuals. For more articles about the subject, go to ft.com/ftflic. To donate to FLIC, email neal.fuller@ftflic.com