A day after chip stocks received a big boost, Micron (MU) is weighing on the space on Wednesday and is down 5.5% on the day.

Chip stocks like Nvidia (NVDA) and Advanced Micro Devices (AMD) have been on fire lately, roaring higher off the October and November lows.

After it was disclosed on Tuesday that Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) bought 60 million shares of Taiwan Semiconductor (TSM), chip stocks enjoyed even more gains.

Now there’s some pause on Wednesday. That’s after Micron announced a disappointing outlook for 2023.

The company is “reducing DRAM and NAND wafer starts by approximately 20% versus fiscal fourth quarter 2022.”

The news also comes just hours ahead of Nvidia’s third-quarter earnings report (here’s a preview of the quarter). That has the potential to make or break the short-term trade in semiconductor stocks, but until then, let’s look at the setup with Micron.

Trading Micron Stock

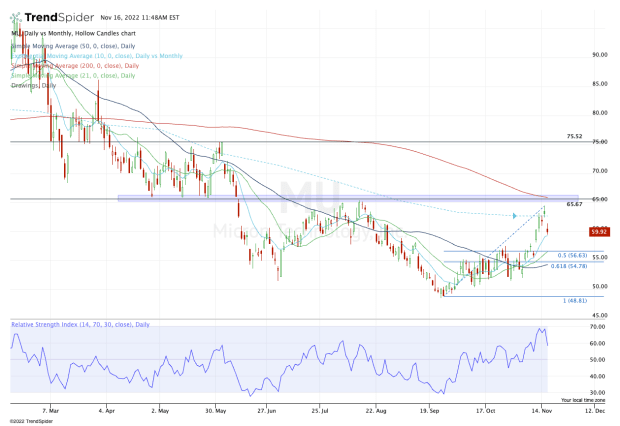

Chart courtesy of TrendSpider.com

Yesterday, Micron hit its highest level since August and had rallied 33% from its 2022 low. From this month’s low, shares were up 24%.

I mention the rally because it gave Micron stock its first close above the 10-month moving average since June. However, Wednesday’s decline has Micron in retreat, now trading just above its 10-day moving average.

If bulls are to maintain active control, then the 10-day moving average will hold as support.

If this level holds, traders can look for a gap-fill back up to $62.42. Above that puts $65 to $66 in play, which is the declining 200-day moving average and a key pivot so far in 2022.

For instance, a positive reaction to Nvidia’s report could fuel such a move. At the same time, a bearish reaction could force Micron and other chip stocks lower.

In that case, investors ought to pay close attention to the $54.50 to $56.50 area. There we have the 21-day and 50-day moving averages, as well as the 50% and 61.8% retracements from the recent high down to the 2022 low.

If Micron stock trades into this zone, it’s vital that the stock finds support. If it doesn’t, it likely means other chip stocks are struggling too. More specifically though, it would open the door down to the $50 to $51 area and then potentially lower.