The Federal Open Market Committee (FOMC) has met six times this year, in January, March, May, June, July and September.

As it meets on Nov. 2, a daily stock trading trend that has occurred every time interest rates have been raised in 2022 will be tested again.

When the FOMC met in January, it took no action on the federal funds rate (FFR), maintaining its target goal at a range of 0% to 0.25%. It had held there since March 2020, when the Fed convened an emergency meeting to lower the rate in response to the coronavirus pandemic.

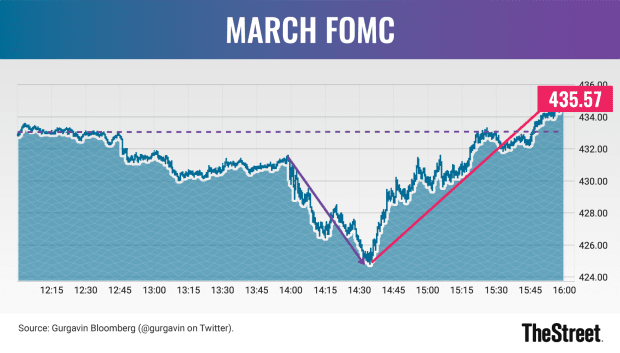

On March 16, the FOMC raised its federal funds benchmark rate by 25 basis points, to the range of 0.25% to 0.50%. It was the first time the Fed had increased rates since 2018. It stated a goal of returning inflation to 2%.

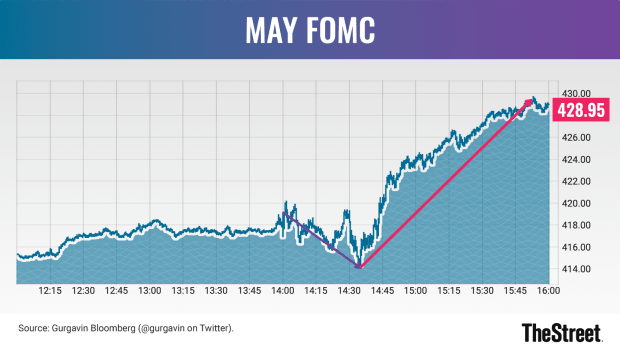

During the FOMC meeting on May 4, the rate was raised 50 basis points, making its target for the FFR 0.75% to 1.00%.

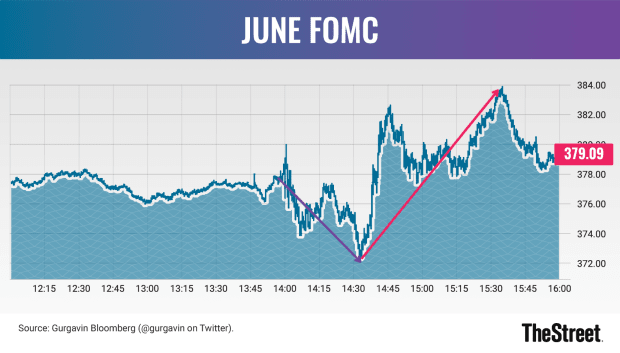

The June 15 meeting was the committee's most significant interest rate action in years as it raised its rate by 75 basis points, moving its target rate for the FFR to 1.50% to 1.75%. The FOMC restated its goal of lowering inflation to to 2%.

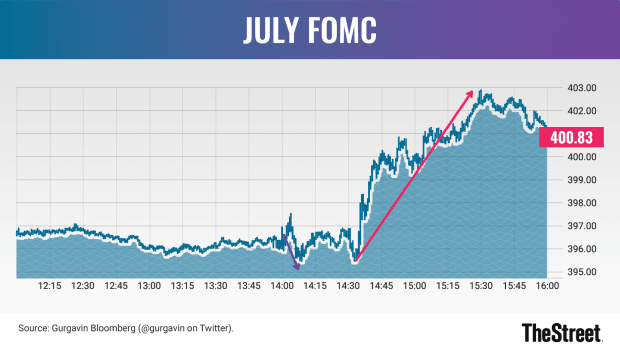

On July 17, the FOMC again raised its rate 75 basis points, moving its target to 2.25% to 2.50%. The committee indicated that further increases to the target range, it felt, would be appropriate.

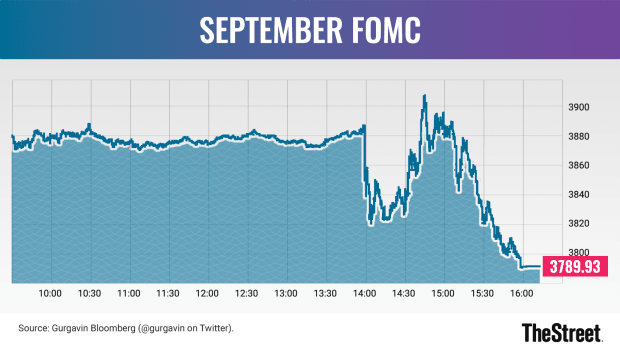

At the Fed meeting on Sept. 21, the FOMC raised its rate again by 75 basis points, increasing the target range to 3.00% to 3.25%, again saying it was strongly committed to the 2 percent inflation objective.

Most analysts expect another 75 basis point increase from the Nov. 2 meeting, the sixth time the Fed will have raised rates during the calendar year. But the number one question on Wall Street seems to be whether or not the Fed will indicate an end to the rate hikes sometime soon.

Similarities in Market Activity During Fed Meetings

During each FOMC meeting in 2022 where the committee has announced interest rate hikes, remarkably similar investor behavior has been observed.

Charting of the SPDR S&P 500 ETF Trust (SPY) shows that each committee meeting involving increased rates precipitates a stock sell-off during the meeting when the announcement is made, followed by a rally in each instance when Federal Reserve Chairman Jerome Powell delivers remarks after the news.

The trend is easily observable in the following images. These charts follow the aforementioned SPDR S&P 500 ETF during daily trading on FOMC days. Note that, in each instance, the value drops when the meeting starts at 2 p.m. Eastern. When Powell speaks at 2:30 p.m. it rises again.

Gurgavin Bloomberg (@gurgavin on Twitter)

Gurgavin Bloomberg (@gurgavin on Twitter)

Gurgavin Bloomberg (@gurgavin on Twitter)

Gurgavin Bloomberg (@gurgavin on Twitter)

Gurgavin Bloomberg (@gurgavin on Twitter)

In September, note that the trend holds, but it's the only one of these charts that shows a second sell-off during the day, occurring after Powell's remarks that follow the meeting.

The SPDR S&P 500 ETF Trust, also called the SPY ETF, tracks the Standard & Poor’s 500 Index, a primary indicator of the strength of the U.S. economy.