Employee retention credits have been in the news lately. The Department of Justice recently arrested a New Jersey tax preparer for allegedly seeking more than $124 million from the IRS. The multi-millions came from filings of over 1,000 false tax forms claiming the pandemic-related employee retention credit, also referred to as the ERTC or ERC.

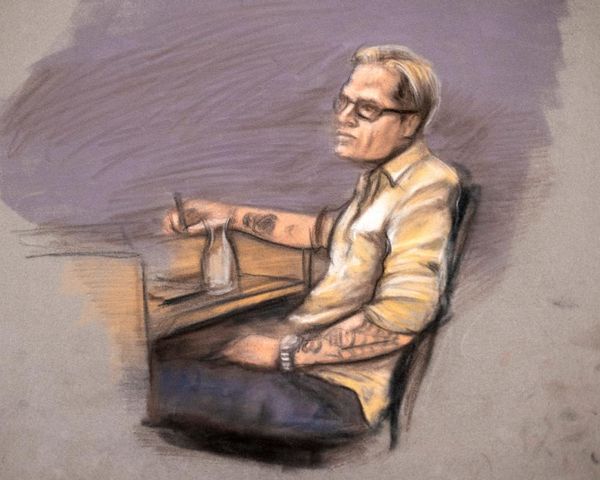

Tax preparer arrested in ERC fraud case

According to a release from the U.S. Attorney's Office from the District of New Jersey:

- A tax preparer in New Jersey, Leon Haynes, received over $1 million in fraudulent tax refund checks from the U.S. Treasury Department.

- The Treasury also disbursed at least $31.6 million in tax refunds to Haynes’ clients based on false tax form filings.

- The preparer charged clients up to a 15% fee based on the tax refunds they received. Many of those clients reportedly paid in cash.

“While our country was fighting the spread of the virus and its profound economic impact, Haynes allegedly scammed the system in a massive scheme to line his own pockets,” U.S. Attorney Philip R. Sellinger stated in a release about the arrest.

Haynes could face up to three years in prison and a $250,000 fine for each count of aiding and assisting in the preparation of false tax returns. But the arrest highlights a growing concern at the IRS over the Employee Retention Credit and related ERC scams that exploit the program for personal gain.

What is the employee retention credit (ERC)?

To better understand the problems surrounding dubious ERC claims, it helps to know what the employee retention credit is and how it works.

The ERC is a refundable tax credit for businesses that had employees and were affected by the COVID-19 pandemic. The credit isn’t available to individuals. The requirements for claiming the ERC vary based on the period for which you are claiming the credit. But to qualify, your business must have paid qualified wages to some or all employees after March 12, 2020, and before January 1, 2022.

The employee retention credit program was designed to provide relief to businesses and tax-exempt organizations that were shut down during the pandemic due to government orders, experienced a decline in gross receipts during that time, or were recovering start-up businesses for the third and fourth quarters of 2021.

- The ERC can be up to $5,000 per employee (for 2020) and up to $21,000 per employee in 2021 so long as an eligible business paid qualifying wages.

- Overall, the credit is 50% of up to $10,000 in wages, but other limitations may apply.

- The IRS has received more than 2.5 million employee retention credit claims since the program was enacted.

Why is the ERC a target of scam promoters? The deadlines for claiming the ERC for 2020 and 2021 are coming in April of 2024 and 2025 respectively. So promoters are able to take advantage of “There’s still time” and See if you qualify” promotions to lure people into filing employee retention claims. Also, the “up to $26,000 per employee” tease can, unfortunately, be an effective marketing tactic.

While many businesses might legitimately be eligible for the credit, some promoters are filing false claims and benefiting from charging unsuspecting taxpayers large sums.

ERC refund scams a concern for the IRS

IRS Commissioner Danny Werfel has repeatedly pointed out that the IRS is being “flooded” with employee retention credit claims and has warned taxpayers about ERC and other IRS-related scams.

The agency is devoting additional resources to the problem, including hiring specially trained auditors to process ERC claims and ensure the claims are legitimate. Increased scrutiny will include audits and support from the Criminal Investigations division to identify fraudulent claims, and prosecute when warranted.

If you think you might be eligible to claim the ERC, consult with a trusted tax professional or financial advisor. But if you receive an email or other unsolicited communication about the employee retention credit, be wary.

Report any suspicious scam emails to the IRS and keep in mind that if you receive funds from the IRS from a falsely filed ERC claim you will have to pay the money back. You might also incur penalties and interest. And in some cases, like the one involving the New Jersey tax preparer, serious criminal charges could come into play.