What you need to know

- WhatsApp users in Brazil can now make in-chat payments to local businesses.

- The feature is initially available to a limited number of businesses before being made more widely available in the coming months.

- WhatsApp promises that the service will be expanded to more countries in the future.

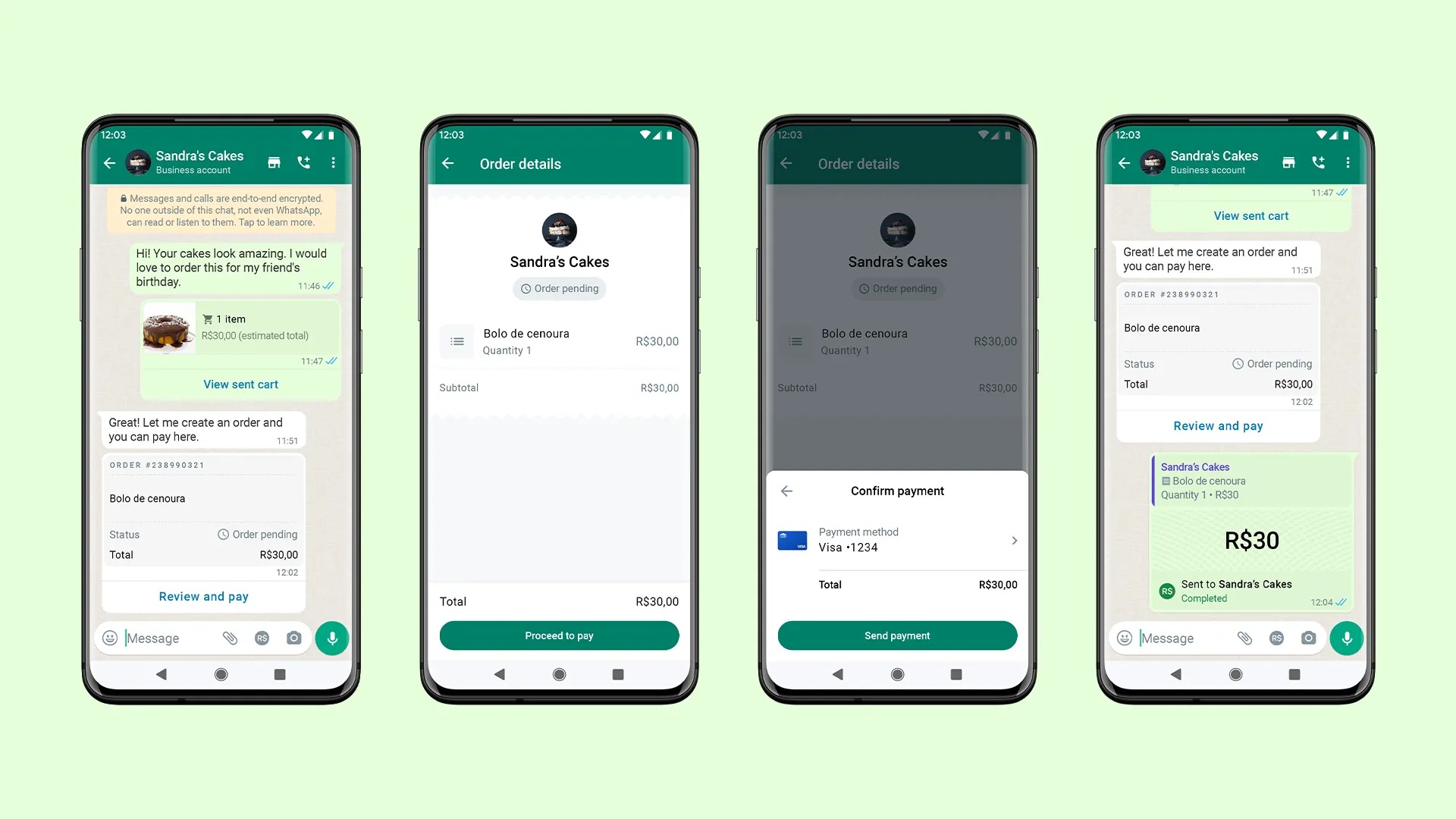

WhatsApp's payment solution, which launched in Brazil in 2020, originally allowed for person-to-person payments through the app, but the service now supports payments to local businesses in the country.

The Meta-owned platform announced in a blog post that users in Brazil can now shop online and send payments to merchants directly from within the messaging service. This feature was originally limited to peer-to-peer transfers when it launched in 2020, though it was temporarily suspended before being restored in 2021.

The latest expansion allows users to make payments to a small number of businesses at the outset. That said, Mark Zuckerberg vowed to bring more businesses on board in the coming months. Anyone with a Mastercard or Visa debit card, as well as credit and pre-paid cards issued by participating banks in the country like Banco do Brasil and Banco Inter can pay for goods and services in-chat.

Previously, merchants could only accept payments through WhatsApp by generating a payment link with a third-party payment solution. These links must then be sent to customers via chat so that they can complete their transaction.

WhatsApp reiterates that extensive security is integrated into the payments service, with users having to enter a six-digit PIN each time they make a payment. The goal is to prevent unauthorized transactions. In addition, card numbers are encrypted.

The platform's payment system is powered by Facebook Pay, which launched in 2019. It's also implemented across Meta's other services, including Messenger and Instagram.

There's no word on when the payments-to-merchant feature will roll out to other markets, but given WhatsApp's huge user base around the world, we can count on the company expanding the feature to more markets in the future.