With a market cap of $53.1 billion, Vistra Corp. (VST) is a Fortune 500 integrated retail electricity and power generation company based in Irving, Texas, United States. It operates across the U.S. through Retail, Texas, East, West and Asset Closure segments, serving approximately 5 million residential, commercial and industrial customers. Vistra’s energy mix spans natural gas, nuclear, coal, solar and battery storage facilities, and the company is involved in both retail energy sales and wholesale electricity markets, and fuel production, commodity risk management, and logistics.

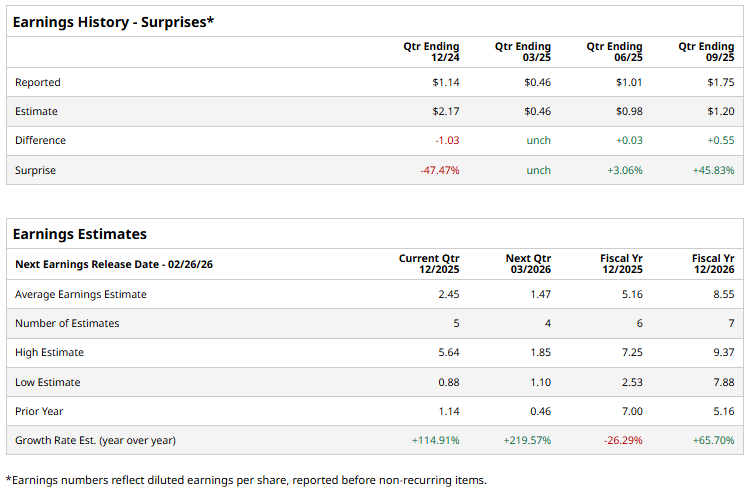

The utility company is expected to unveil its fiscal Q4 2025 results soon. Before the event, analysts anticipate Vistra to report an EPS of $2.45, up 114.9% from $1.14 in the year-ago quarter. It has surpassed or met Wall Street's bottom-line estimates in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts expect the company to report EPS of $5.16, a 26.3% decline from $7 in fiscal 2024. However, EPS is anticipated to grow 65.7% year over year to $8.55 in fiscal 2026.

VST stock has declined 13.7% over the past 52 weeks, underperforming the S&P 500 Index's ($SPX) 13.7% gain and the Utilities Select Sector SPDR Fund's (XLU) 7.5% increase over the same period.

On Jan. 16, shares of Vistra fell more than 7% as power sector stocks came under pressure following President Trump’s push for an emergency wholesale electricity auction and proposals to shift rising power costs to major technology companies. Investors reacted negatively to the potential regulatory and pricing disruptions, raising concerns about margin pressure and earnings uncertainty for power producers such as Vistra.

Analysts' consensus rating on VST stock is bullish, with an overall "Strong Buy" rating. Out of 19 analysts covering the stock, opinions include 16 "Strong Buys" and three "Holds." The average analyst price target for Vistra is $240.50, indicating a potential upside of 50.3% from the current levels.