/Mckesson%20Corporation%20logo%20on%20phone-by%20IgorGolovniov%20via%20Shutterstock.jpg)

Valued at a market cap of $101.7 billion, McKesson Corporation (MCK) is a healthcare services and information technology company based in Irving, Texas. It primarily distributes pharmaceuticals, medical supplies, and healthcare products, while also offering advanced healthcare IT solutions, practice management services, and data analytics solutions. The company is ready to announce its fiscal Q3 earnings for 2026 after the market closes on Wednesday, Feb. 4.

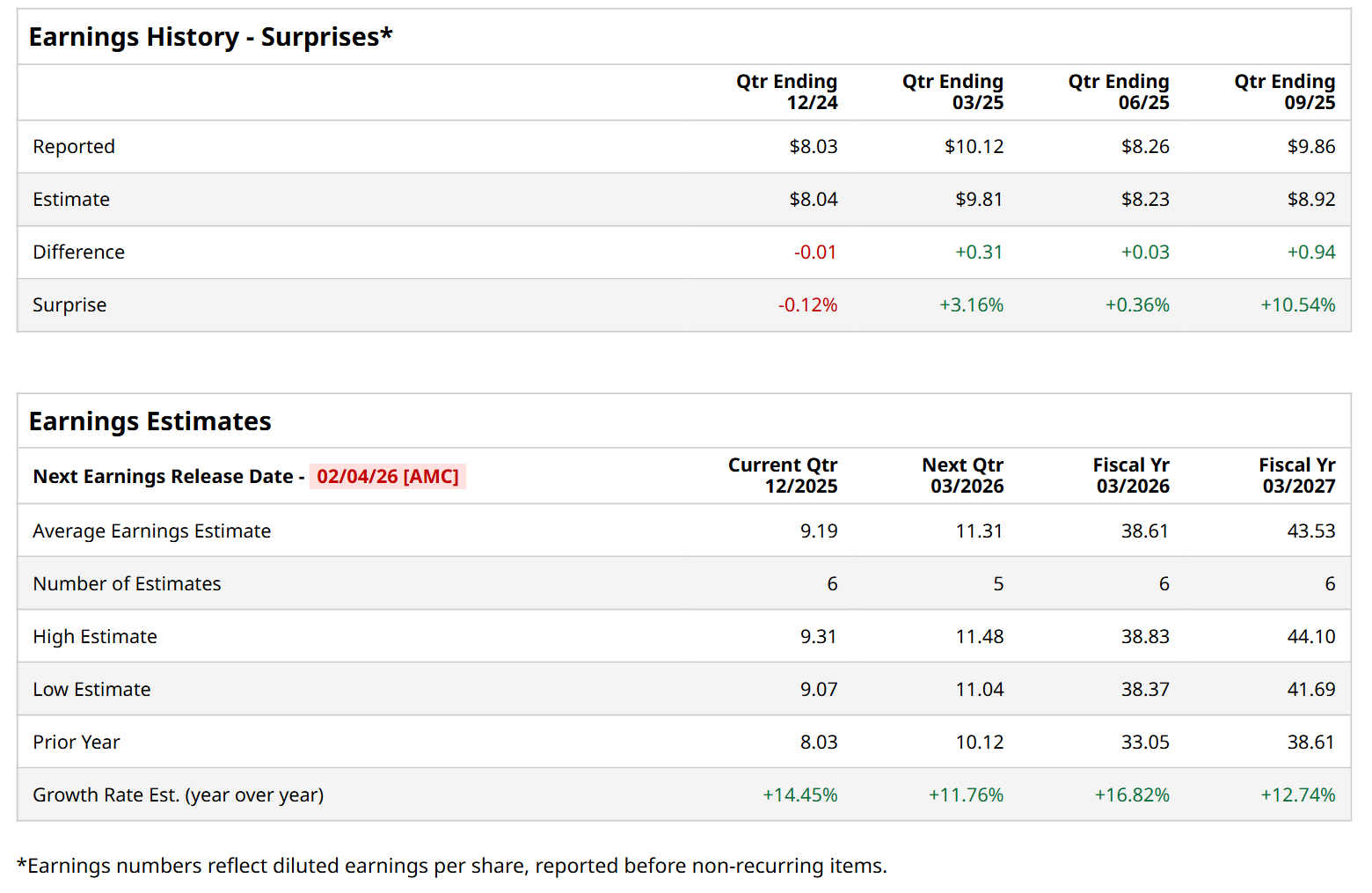

Before this event, analysts expect this healthcare company to report a profit of $9.19 per share, up 14.5% from $8.03 per share in the year-ago quarter. The company has topped Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. In Q2, its EPS of $9.86 exceeded the consensus estimates by 10.5%.

For fiscal 2026, ending in March, analysts expect MCK to report a profit of $38.61 per share, up 16.8% from $33.05 per share in fiscal 2025. Furthermore, its EPS is expected to grow 12.7% year-over-year to $43.53 in fiscal 2027.

Shares of MCK have soared 38% over the past 52 weeks, considerably outperforming both the S&P 500 Index's ($SPX) 17% return and the State Street Health Care Select Sector SPDR ETF’s (XLV) 12.6% uptick over the same time period.

On Nov. 5, MCK delivered impressive Q2 results, prompting its shares to surge 1.7% in the following trading session. Due to higher prescription volumes and increased distribution of oncology and multispecialty drugs, the company’s overall revenue improved 10.1% year over year to $103.2 billion. Moreover, its adjusted EPS of $9.86 increased 39.5% from the year-ago quarter, topping analyst expectations by 10.5%.

Wall Street analysts are highly optimistic about MCK’s stock, with a "Strong Buy" rating overall. Among 17 analysts covering the stock, 13 recommend "Strong Buy," and four suggest "Hold.” The mean price target for MCK is $940.94, indicating a 15.5% potential upside from the current levels.