/Honeywell%20International%20Inc%20thermostat-by%20Joni%20Hanebutt%20via%20Shutterstock.jpg)

Charlotte, North Carolina-based Honeywell International Inc. (HON) engages in the aerospace technologies, industrial automation, building automation, and energy and sustainable solutions businesses. Valued at $131.7 billion by market cap, its business is aligned with three powerful megatrends - automation, the future of aviation and energy transition, underpinned by its Honeywell Accelerator operating system and Honeywell Forge IoT platform. The diversified industrial conglomerate is expected to announce its fiscal fourth-quarter earnings for 2025 before the market opens on Thursday, Jan. 29.

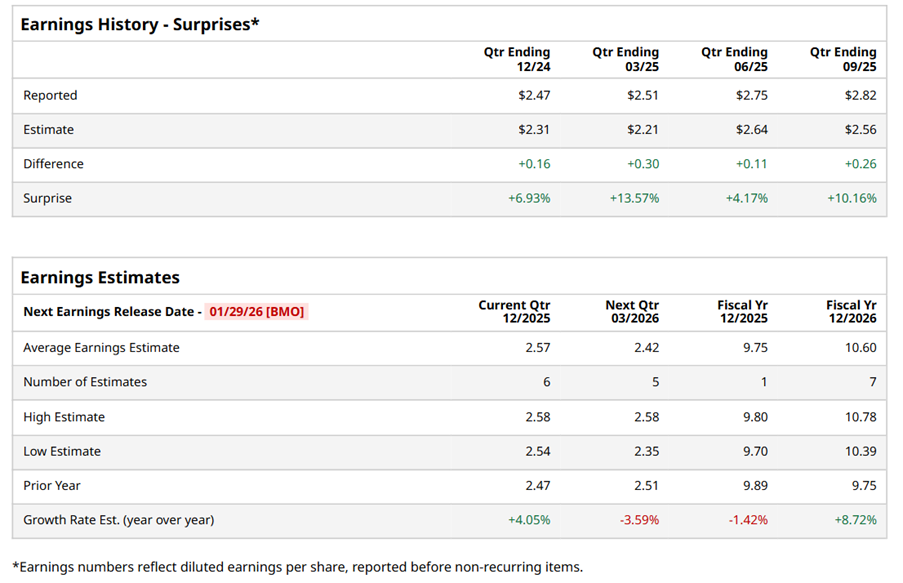

Ahead of the event, analysts expect HON to report a profit of $2.57 per share on a diluted basis, up 4.1% from $2.47 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect HON to report EPS of $9.75, down 1.4% from $9.89 in fiscal 2024. However, its EPS is expected to rise 8.7% year over year to $10.60 in fiscal 2026.

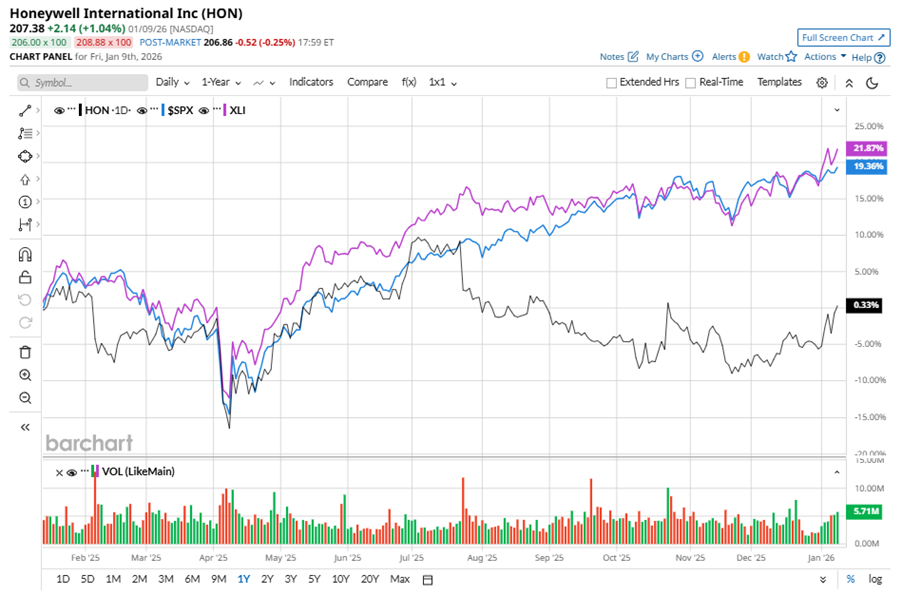

HON stock has underperformed the S&P 500 Index’s ($SPX) 17.7% gains over the past 52 weeks, with shares down marginally during this period. Similarly, it underperformed the Industrial Select Sector SPDR Fund’s (XLI) 21.9% gains over the same time frame.

HON's underperformance was driven by margin decline due to cost inflation, tariffs, and acquisition-related headwinds in Aerospace and Industrial Automation segment.

On Oct. 23, 2025, HON shares closed up by 6.8% after reporting its Q3 results. Its revenue was $10.4 billion, exceeding analyst estimates by 2.6%. The company’s adjusted EPS of $2.82 surpassed analyst estimates of $2.57.

Analysts’ consensus opinion on HON stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 24 analysts covering the stock, 10 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” 12 give a “Hold,” and one recommends a “Moderate Sell.” HON’s average analyst price target is $235.04, indicating a potential upside of 13.3% from the current levels.