/Brown%20%26%20Brown%2C%20Inc_%20HQ%20photo-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Valued at a market cap of $27.3 billion, Brown & Brown, Inc. (BRO) is an insurance brokerage and risk management firm headquartered in Daytona Beach, Florida. It offers a wide range of services, including property and casualty, employee benefits, specialty insurance products, risk management solutions, and third-party services. It is expected to announce its fiscal Q4 earnings for 2025 in the near future.

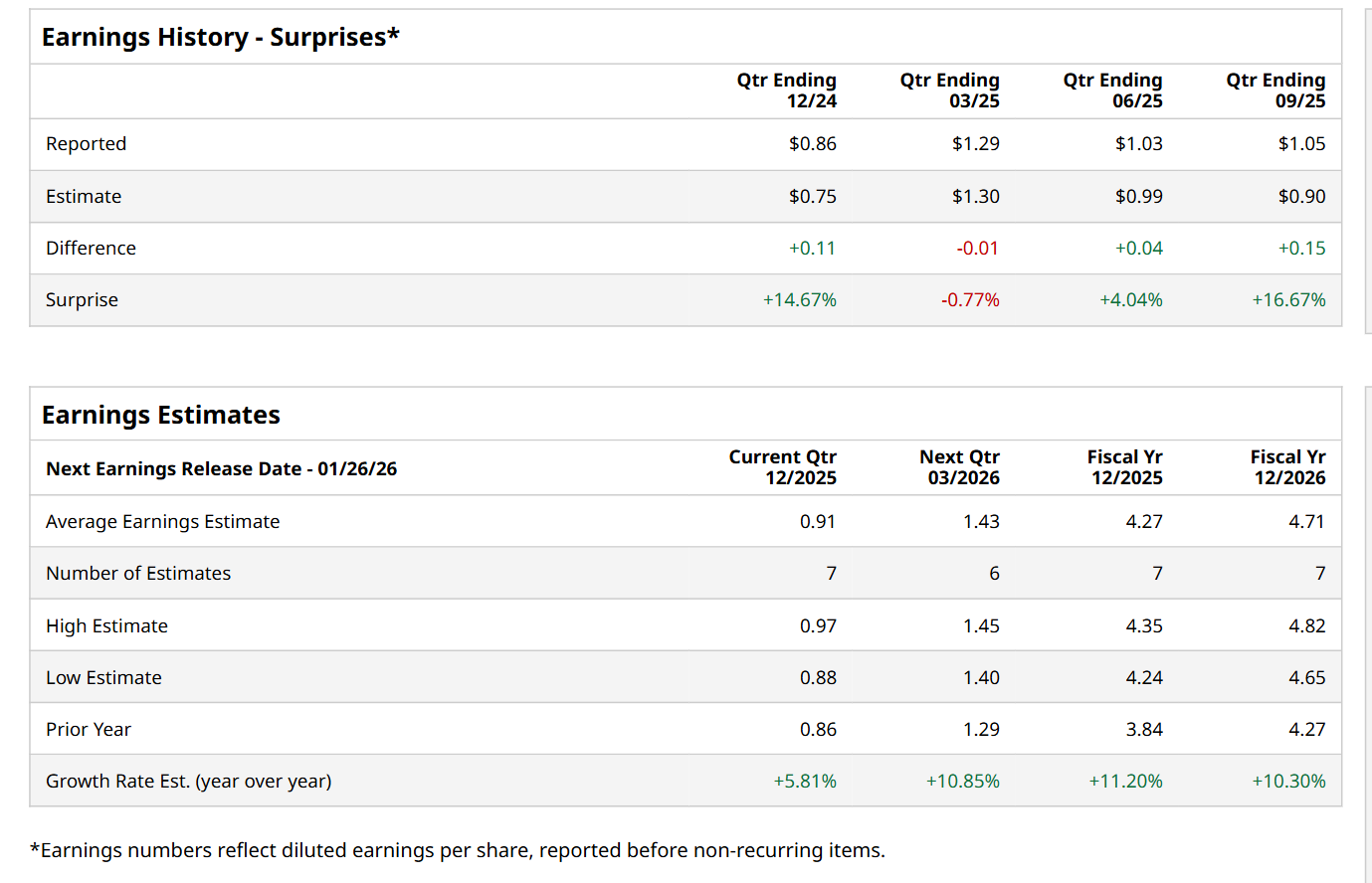

Ahead of this event, analysts expect this insurance company to report a profit of $0.91 per share, up 5.8% from $0.86 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. In Q3, BRO’s EPS of $1.05 exceeded the forecasted figure by a notable margin of 16.7%.

For the current fiscal year, ending in December, analysts expect BRO to report a profit of $4.27 per share, up 11.2% from $3.84 per share in fiscal 2024. Furthermore, its EPS is expected to grow 10.3% year-over-year to $4.71 in fiscal 2026.

Shares of BRO have declined 22.4% over the past 52 weeks, considerably underperforming both the S&P 500 Index's ($SPX) 15.7% return and the State Street Financial Select Sector SPDR ETF’s (XLF) 13.2% uptick over the same time period.

On Oct. 27, BRO reported better-than-expected Q3 results, yet its shares plunged 6.1% in the following trading session. The company’s total revenue increased 35.4% year-over-year to $1.6 billion, surpassing consensus estimates by 6.6%. Meanwhile, its adjusted EPS of $1.05 improved 15.4% from the year-ago quarter, handily topping analyst expectations of $0.90. However, its income before income taxes margin decreased by a notable 630 basis points from the same period last year to 19.4%, which might have weighed on investor sentiment.

Wall Street analysts are cautious about BRO’s stock, with a "Hold" rating overall. Among 20 analysts covering the stock, two recommend "Strong Buy," one indicates a "Moderate Buy,” 16 suggest "Hold,” and one advises a "Moderate Sell” rating. The mean price target for BRO is $96.25, indicating a 19.4% potential upside from the current levels.