/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

Broadcom Inc. (AVGO) is a leading technology company that designs, develops and supplies a wide array of semiconductor devices and infrastructure software solutions for markets including data centers, networking, broadband, wireless, storage and industrial applications. Headquartered in Palo Alto, California, the company serves global markets through its extensive product portfolio and distribution network. Broadcom boasts a market cap of $1.8 trillion. The company is slated to announce its fiscal Q4 2025 earnings results soon.

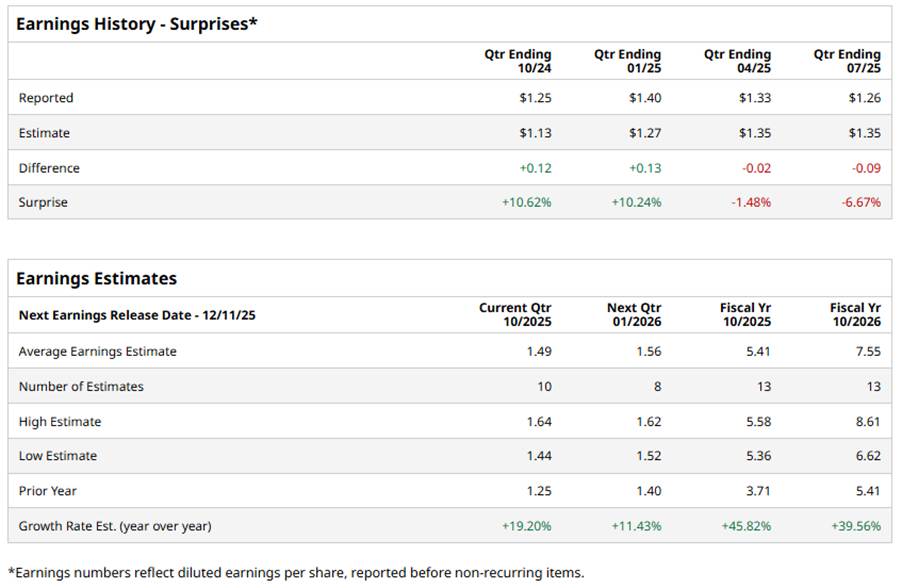

Ahead of this event, analysts expect Broadcom to report an EPS of $1.49, a 19.2% growth from $1.25 in the year-ago quarter. It has exceeded Wall Street’s earnings expectations in two of the past four quarters while missing on the other two occasions.

For the current year, analysts anticipate Broadcom’s EPS to be $5.41, up 45.8% from $3.71 in fiscal 2024. Moreover, its EPS is expected to rise 39.6% year over year (YoY) to $7.55 in fiscal 2026.

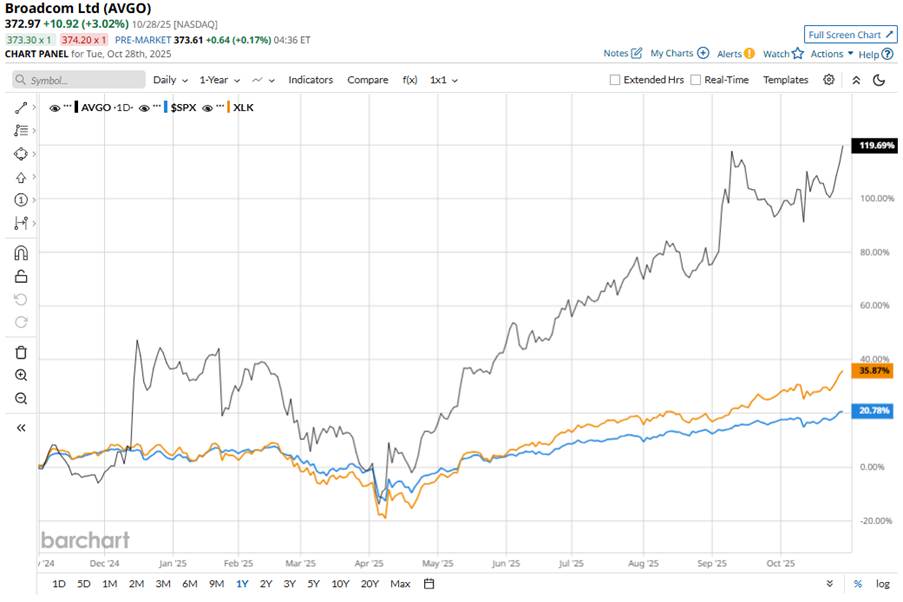

Shares of Broadcom have surged 116.8% over the past 52 weeks, outpacing the broader S&P 500 Index’s ($SPX) 18.3% return and the Technology Select Sector SPDR Fund’s (XLK) 31.2% rise over the same period.

Broadcom’s shares have been climbing largely because the company has successfully pivoted into being a key beneficiary of the artificial intelligence (AI) infrastructure boom. Additionally, Broadcom’s new AI deal wins signal that its offerings are resonating in the hyperscale market. Broadcom is not just a traditional chip‐maker anymore but a strategic AI-infrastructure partner, which supports its continued momentum.

Analysts’ consensus view on Broadcom stock remains bullish, with a “Strong Buy” rating overall. Out of 40 analysts covering the stock, 35 recommend a “Strong Buy,” two have a “Moderate Buy,” and three analysts suggest a “Hold.” Its average analyst price target of $397.92 suggests a 6.7% upside ahead.