/Bristol-Myers%20Squibb%20Co_%20logo%20on%20building-by%20tatu%20Campelo%20via%20iStock.jpg)

With a market cap of $113.7 billion, Bristol-Myers Squibb Company (BMY) is a global biopharmaceutical company that discovers, develops, manufactures, and markets innovative medicines for oncology, hematology, immunology, cardiovascular, and neuroscience diseases. It serves patients worldwide with leading therapies such as Eliquis, Opdivo, Revlimid, Orencia, and Yervoy.

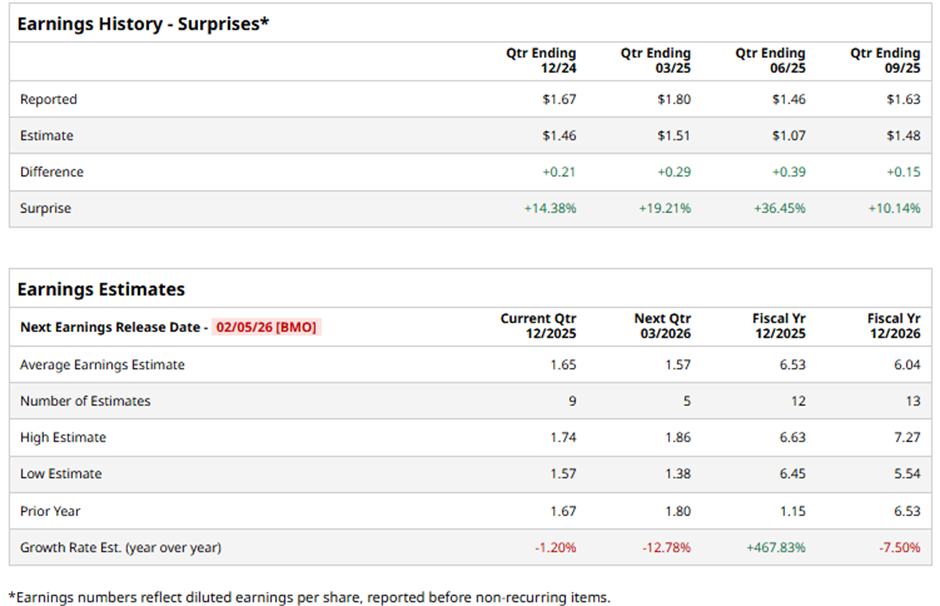

BMY is set to unveil its fiscal Q4 2025 results before the market opens on Thursday, Feb. 5. Ahead of this event, analysts expect the Princeton, New Jersey-based company to report an adjusted EPS of $1.65, down 1.2% from $1.67 in the year-ago quarter. However, it has surpassed Wall Street's bottom-line estimates in the past four quarters.

For fiscal 2025, analysts project the biopharmaceutical giant to report adjusted EPS of $6.53, a surge of 467.8% from $1.15 in fiscal 2024.

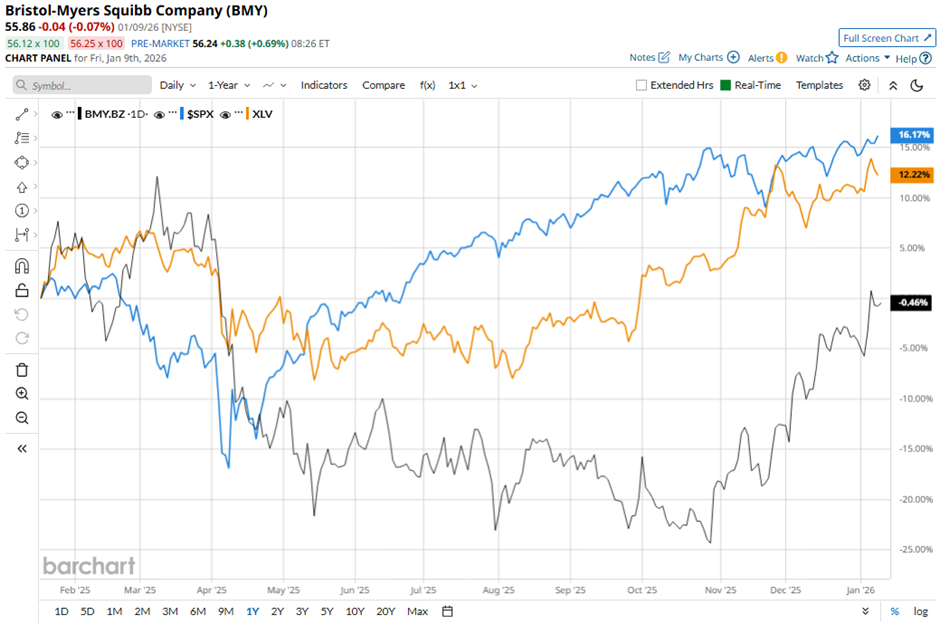

BMY stock has declined 1.7% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 17.7% gain and the State Street Health Care Select Sector SPDR ETF's (XLV) 12% rise over the same period.

Shares of Bristol Myers Squibb climbed 7.1% on Oct. 30 after the company reported stronger-than-expected Q3 2025 adjusted EPS of $1.63 and revenue rising 3% to $12.2 billion. Investor sentiment was further boosted by 18% Growth Portfolio revenue growth to $6.9 billion, driven by strong performance from its immuno-oncology portfolio, Reblozyl, Camzyos, and Breyanzi. The company also raised its full-year 2025 revenue guidance to $47.5 billion - $48 billion and updated adjusted EPS guidance to $6.40 - $6.60.

Analysts' consensus rating on BMY stock is moderately optimistic, with a "Moderate Buy" rating overall. Out of 29 analysts covering the stock, opinions include nine "Strong Buys,” one "Moderate Buy," 18 "Holds," and one "Strong Sell.” As of writing, it is trading above the average analyst price target of $56.17.