As the new year begins, many retirees age 73 or older will need to start thinking about when to take annual required minimum distributions (RMDs) from their pre-tax 401(k) accounts and traditional IRAs. And because the market ended the year on a very positive note, your 2025 RMD obligation could be higher than it was last year — which could increase your tax bill.

Higher returns equal higher RMDs

If a large portion of these accounts was invested in stocks, chances are that the value of your retirement portfolio ended 2024 significantly higher than it was at the end of 2023. That's largely because the S&P 500 closed 2024 with a total gain (including reinvestment of dividends) of 23.3%.

While most retirees will be happy with these results, they may also be hit with a higher total RMD amount this year. Why? Because the RMDs they’ll pay in 2025 are calculated based on the value of their accounts on December 31, 2024, the last day of trading.

RMDs are taxable income. However, since the IRS has raised the standard deduction amount and adjusted income tax brackets for inflation, the amount you owe in taxes may not be as much as you may think, even if your RMD is higher.

If a good portion of your retirement nest egg is invested in a Roth IRA or Roth 401(k) account, there’s more good news: Not only are distributions from these accounts totally tax-free, but you’ll never have to take annual RMDs.

The process for calculating RMDs

While the process of calculating RMDs may seem mysterious, the methodology is rather simple.

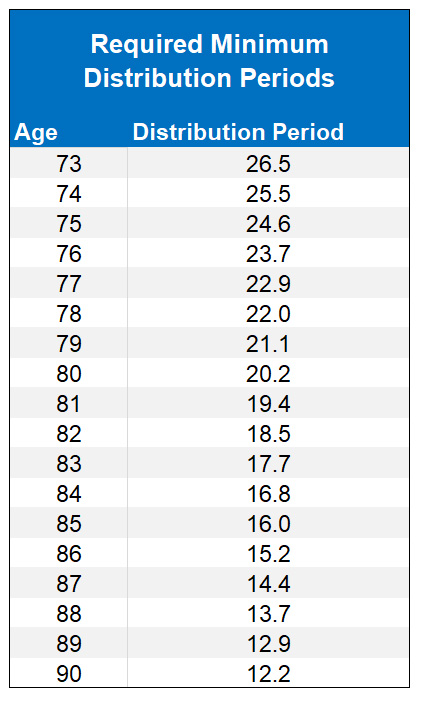

Your yearly RMD is calculated using a formula based on the IRS’ Uniform Lifetime Table. The table and its associated distribution periods are based on complicated actuarial calculations of projected life expectancies. But basically, this table estimates the maximum number of years (also known as distribution periods) your retirement account may need to make RMDs to you and your surviving spouse (please see the note at the bottom of this article).

Your distribution period gets shorter every year, based on your age. For example, if you take your first RMD in 2025 at age 73, your distribution period is 26.5 years. When you turn 74, it will be 25.5 years. When you turn 90, it will be 12.2 years.

Will you or your surviving spouse need your retirement assets to last this long? Maybe, if longevity runs in your family. In any case, the distribution period is designed to gradually increase the percentage of RMDs from your retirement accounts over time without prematurely draining your nest egg should you live to a ripe old age.

Calculating your own RMDs

So how do you calculate your RMD for a given year? By dividing the value of each retirement account at the end of the previous year by the distribution period based on what your age will be in the year you take the RMD.

Here are two hypothetical examples using the table above. Say your IRA was worth $500,000 at the end of 2024, and you were taking your first RMD at age 73 this year. Your distribution amount would be $18,868 ($500,000 divided by 26.5). Likewise, if you were turning 85 in 2025, your RMD would be $31,250 ($500,000 divided by 16).

Making smart RMD decisions

Calculating RMDs is relatively simple. Where it can get complicated is figuring out which accounts you should take them from.

With 401(k) plan accounts, it’s pretty much a no-brainer. If you’re no longer actively participating in the plan (i.e., you’ve left the company or retired), most plan providers will calculate your annual RMD. However, it's generally your responsibility to make these withdrawals from your accounts in a timely fashion.

With other accounts, you have more flexibility and thus more options to consider. For example, if you have several traditional or rollover IRAs, you first need to calculate the RMD for each individual account. Many IRA custodians will do this for you. The challenge comes when you decide how much to withdraw from each account.

- You can take separate RMDs from each IRA

- You can take the total combined RMD from one IRA

- Or you can withdraw different amounts from several IRAs that, when combined, add up to the total RMD amount

Keep in mind that RMDs from 401(k) accounts don’t offset RMDs from IRAs or vice versa. You’ll need to take those as separate distributions.

Alternative RMD strategies

You may also want to consider other strategies for simplifying RMDs or reducing their taxable impact.

For example, you may be able to offset the taxable impact of RMDs from your IRA by donating some or all of the RMD amount as qualified charitable distributions (QCDs) to eligible nonprofit organizations. QCDs can lower or eliminate your taxable RMD amount, up to an aggregated maximum amount per year withdrawn from one or more IRAs. In 2025, this maximum is $108,000, and it will be adjusted for inflation every year. Keep in mind that QCDs are not eligible as charitable deductions.

Or, you might want to consolidate all of your various IRA and 401(k) accounts into a single rollover IRA with a custodian that calculates one aggregated RMD amount for you every year and automatically takes the distribution from the account on a date you specify.

All of these scenarios have retirement and tax planning consequences that aren’t always easy to figure out on your own. Working with an accountant and a financial adviser can help you figure out which distribution strategies make sense.

Note that the IRS Uniform Lifetime Table and the various RMD calculations discussed in this article apply only to unmarried retirement account owners; retirement account owners whose spouse is not their sole beneficiary; or retirement account owners whose spouse is their sole beneficiary and is not more than 10 years younger than the account owner. Different calculations are required if your spouse is your sole beneficiary and is more than 10 years younger than you. Learn more at the IRS website.