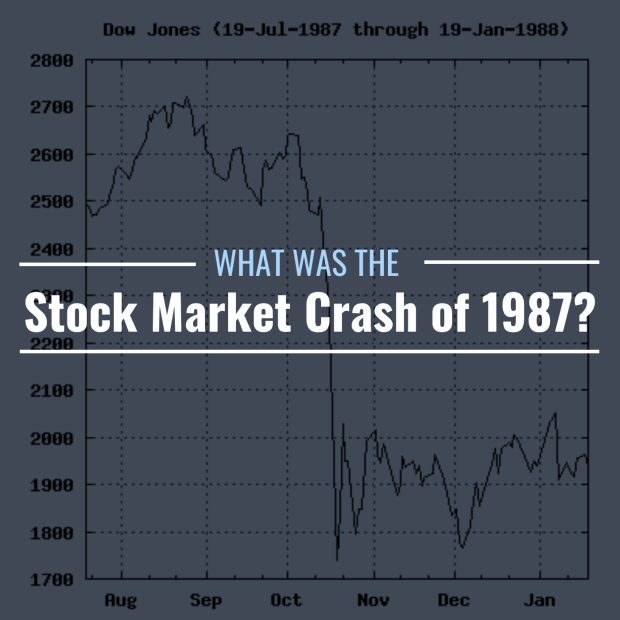

Edward - en:Image:Black_Monday_Dow_Jones.png, Public Domain, Wikimedia Commons

What Was the Stock Market Crash of 1987? Why Was It Important?

October 19, 1987, known as “Black Monday,” was a day of infamy on Wall Street, when steep and unexpected selloffs devastated global markets. These selloffs reached a frantic crescendo in a matter of hours, triggering a massive stock market crash. The Dow Jones Industrial Average lost 508 points, or 22.6% of its value, marking the largest single-day decline in its history: $500 billion was wiped out in one trading session.

The stock market crash of 1987 was the first financial crisis of global proportions, demonstrating how interconnected the financial markets had become through the advent of electronic trading. All twenty-three stock exchanges saw declines of more than 10% that day—nineteen dropped more than 20%—in total, the losses amounted to a staggering $1.7 trillion.

Fortunately, there were many lessons learned from this crash, and two changes in particular would help to prevent future capitulation:

- Regulators moved the options expiration phenomenon known as triple witching to the afternoon hours instead of the morning, so that the market wouldn’t open on accelerated selloffs from large, institutional investors.

- Trading floors added circuit breakers to electronic trading systems that would temporarily halt trading in the event of another steep and sudden decline. The circuit breakers would be divided into three thresholds:

- Level 1 and Level 2: If an index dropped by 7% or 13% and the decline occurred before 3:25 PM, trading stopped for 15 minutes.

- Level 3: If an index fell 20% at any time during the day, trading would be suspended for the rest of the day.

How Did the Federal Reserve Resolve the Stock Market Crash of 1987?

Astonishingly, there was no single factor that triggered the stock market crash of 1987. But thanks to quick thinking from central banks, specifically the U.S. Federal Reserve, a total financial meltdown was largely averted. Unlike the banking panic of 1907, bank runs did not occur, and the Dow regained its Black Monday losses within two trading sessions.

The Fed’s actions would set a precedent for future response. The morning after the crash, before the markets opened on October 20, 1987, it issued a statement promising to help, which went a long way in restoring investor confidence:

“The Federal Reserve, consistent with its responsibilities as the Nation’s central bank, affirmed today its readiness to serve as a source of liquidity to support the economic and financial system.” —Fed statement (October 20, 1987)

The Fed also immediately slashed interest rates by 50 basis points, and it injected billions of dollars back into the financial system through long-term Treasury buybacks. This practice would later come to be known as quantitative easing.

In addition, the Fed encouraged banks to continue to make loans on their usual terms, which went a long way in maintaining financial liquidity. Compared with the Stock Market Crash of 1929, which sparked the decade-long Great Depression, the markets recovered relatively quickly after the stock market crash of 1987, regaining their pre-crash heights within two years.

What Factors Contributed to the Stock Market Crash of 1987?

The 1980s were a time of massive change, witnessing the fall of Communism and the rise of multinational corporations. It was an era of Reaganomics, catchy pop songs on MTV, and the emergence of the home computer. After the crippling inflation of the 1970s, consumers believed that better times were truly ahead.

Wall Street’s Asset Bubble Finally Burst

On Wall Street, greed was glamorized, and financiers like Donald Trump and Michael Milken became household names. Investment banks came into prominence—and not only because of their ability to facilitate mergers and acquisitions.

Advances in computer technology made it possible to execute complex trades in under a second, allowing these banks to mint profits from tiny changes in stock prices. As a result, the markets appreciated rapidly in the 1980s—the Dow rose 250% from 1981 to 1987, and an asset bubble formed.

Risky Hedging Techniques Imploded

Another factor that played into the stock market’s sudden and rapid decline was the practice of “portfolio insurance,” an automated trading strategy that used stock index futures as a portfolio hedge. The problem was, most of the firms on Wall Street were using the same strategy: When prices fell, losses mounted exponentially because the trading algorithms written inside new computer programs automatically placed sell orders and halted buy orders at certain thresholds, which only compounded the problem.

Triple Witching Spooked the Markets

Another occurrence that added to the combustible mix in October 1987 was the quarterly phenomenon of triple witching, when three different types of options contracts expired. This happened on Friday, October 16th, just before the Black Monday crash. Growing market unease had caused the selloff of options and futures contracts to accelerate in after-hours trading, so that by Monday morning, stocks would open much, much lower.

News Events Rattled Investors

Add to this tinder the spark of investor anxieties from a series of grim economic reports about the widening U.S. trade deficit and then-Treasury Secretary Jim Baker’s threats to devalue the dollar, and traders began selling off in the days leading up to the October 19th crash.

And the rest, as they say, is history.

What Was Alan Greenspan’s Role in the Stock Market Crash of 1987?

Alan Greenspan began his job as the new Fed Chairman with a trial by fire. Just two months into his position, the stock market crash of 1987 occurred. But his decision to release a response to the crisis heralded a new era in Fed transparency—as the organization had been notoriously tight-lipped in the past.

By releasing a statement of support along with a promise to take whatever action was necessary, Greenspan helped to settle down distraught investors and rebuild confidence in the economy. This would set the tone for the way central banks and their chairs behaved going forward. Greenspan passed his trial with flying colors and would continue at the helm all the way until 2006.

Could Another Stock Market Crash Happen in 2022?

TheStreet's Daniel Kline believes that not all stock market crashes look the same. Some are short and steep, while others stagnate through bear market lows. Here’s why he believes investors are more worried about it than they should be.