Thimoty Sebastian from Pexels; Canva

What Was the Great Depression? When Did It Happen?

The longest recession in American history took place between 1929 and 1939. Known as the Great Depression, this economic crisis was noteworthy in terms of both its length and its severity. There had never been anything like it before, and hopefully, there never will be again.

Stretching on for more than a decade, the Great Depression began with a stock market crash. On Black Tuesday—October 29, 1929—over 16 million shares were sold in a wave of mass capitulation over the course of a single trading session, bankrupting thousands of investors and decimating the assets of hundreds of American businesses.

Panicked and suddenly penniless, some Wall Street stockbrokers plunged to their deaths from skyscraper windows—later, downtown hotel clerks would ask arriving guests if their rooms were intended for sleeping or jumping.

How Did the Great Depression Affect Americans?

Banks experienced runs as customers withdrew their deposits—but without reserve requirements or other financial regulations, they soon discovered there was no money left. Factories were shuttered, industrial output plummeted, and GDP nosedived, only adding to mounting losses around the globe. In this deflationary environment, home prices fell; people could not afford to pay their bills, yet they could not sell their homes, either.

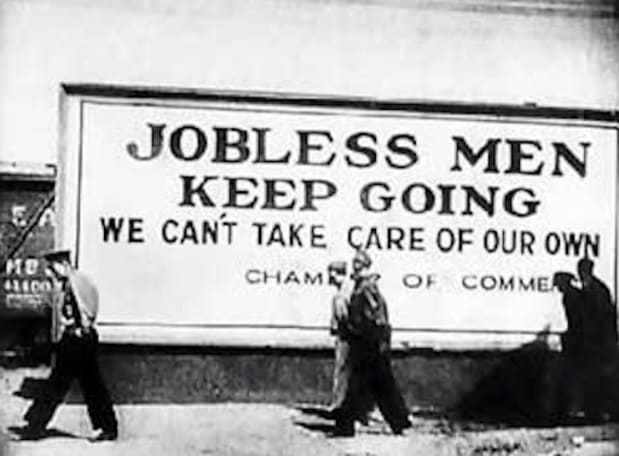

In cities, men and women waited in bread lines stretching around blocks, while in rural areas, many homeless folks lived out of shanty towns known as Hoovervilles (named in derision to then-President Herbert Hoover) assembled from little more than scraps of wood, cardboard, and tin.

Frugality was the means to survive, and hardship eroded social norms and traditional values. Some people stowed away on freight trains, crisscrossing the country in search of work, but a years-long drought would transform the Great Plains into a Dustbowl, intensifying the suffering of those who sought work there.

The Great Depression vs. the Great Recession

For a perspective on just how extreme the losses of the Great Depression were, compare it to the second-worst financial crisis in the United States, the Great Recession of 2007–2009. Stemming from the implosion of U.S. subprime mortgages, the Great Recession was painful, but the Great Depression was nearly 5 times longer and more than doubly catastrophic:

What Caused the Great Depression? How Did the Fed React?

The Stock Market Crash may have sparked the Great Depression, but it wasn’t the sole cause.In fact, in a 2002 speech, former Fed Chairman Ben Bernanke actually apologized for the Federal Reserve’s actions during the Great Depression, placing much of the blame on the Fed itself.

Around the time of the Great Depression, the Fed was young and pretty inexperienced, having only been founded the previous decade in 1913. The Fed had yet to set significant reserve requirements, known as federal funds, for banks and other financial institutions. Without such measures, the entire banking system was vulnerable: Deposits may have swelled during the Roaring 20s, but when post-crash banking panics occurred, these institutions quickly became insolvent.

The Federal Open Market Committee had yet to be created. The purpose of the FOMC is to manage the Fed funds rate and ensure market liquidity. Without the FOMC, there was little internal structure to the Federal Reserve system, and Fed governors often contradicted each other.

The Fed had inadvertently implemented policies that did more harm than good. For example, it increased interest rates in 1928 and again in 1929 while attempting to curb speculation in currency markets. Unfortunately, these efforts had an unintended consequence: recession. To make matters worse, the Fed could not stimulate markets by increasing the monetary supply because the U.S. was still on the gold standard; thus, the economy entered a tailspin.

Still not comprehending the magnitude of its decisions, after the 1929 stock market crash, the Fed actually voted to further reduce the monetary supply in the 1930s, which strangled liquidity and effectively prolonged the depression.

What Ended the Great Depression?

In 1933, President Franklin Delano Roosevelt launched a campaign called The New Deal, which provided sweeping financial reforms as well as re-established consumer trust with the federal government. He introduced monetary stimulus programs designed to ease the Great Depression, including Social Security. Workers received unemployment benefits, farmers were given assistance for failed (or excess) crops, child labor was outlawed, and a minimum wage was instituted.

Roosevelt took the country off the gold standard and created jobs through new federal public works programs such as the Works Progress Administration (WPA). He declared a four-day “bank holiday” in March 1933, shutting down the banking system and thus preventing further banking panics. When banks reopened on Monday, March 13, 1933, amazingly, lines of customers appeared, willing to return their hoarded deposits.

Notable legislative reforms in this period included the Banking Acts of 1933 and 1935, which created the Federal Reserve’s Federal Open Market Committee (FOMC), and the Glass-Steagall Act of 1933, which founded the Federal Deposit Insurance Corporation.

Unemployment decreased by 12 million between 1933 and 1937, and GDP grew an average of 9% over the same period. The New Deal was a tremendous success, but it would take the attack on Pearl Harbor on December 7, 1941 for the Great Depression to completely end—America’s official entrance into World War II would spur even further productivity gains and job creation, including work for all sexes, as women joined the workforce in droves to support both civil and military efforts on the home front.

Could the Great Depression Have Been Prevented?

There’s an old saying about hindsight always being 20/20, and Ben Bernanke implied that if the Federal Reserve knew back then what it knows today, it might not have acted the way it did. But while it’s impossible to rewrite history, it’s heartening to know that the reforms that took place as a result of the Great Depression established the modern central banking system as we know it today—they may have already prevented other catastrophes from happening.