frender from GettyImages Signature; Canva

What Was the COVID-19 Recession?

According to the National Bureau of Economic Research (NBER), the official arbiter of recession, a sharp economic downturn coincided with the onset of the COVID-19 pandemic. It officially categorized the COVID-19 recession as a two-month contraction between February and April of 2020, after which stay-at-home orders and lockdown restrictions were lifted in many parts of the world.

A stock market crash had ushered in the Covid-19 recession—not just one, in fact, but several:

- Over the span of three days in March 2020, the New York Stock Exchange implemented emergency stops during its trading sessions to avoid a complete meltdown. The Dow Jones Industrial Average lost 37% of its value, while the S&P 500 declined 34%. These days would come to be known as Black Monday I (March 9, 2020), Black Thursday (March 12, 2020) and Black Monday II (March 16, 2020).

- Like the virus itself, the capitulation knew no boundaries, and stock market indexes around the globe also experienced staggering declines: The Nikkei in Tokyo, FTSE 100 in London, and IBOVESPA in Brazil all posted double-digit losses, marking their worst performance since the Financial Crisis of 2007–2008.

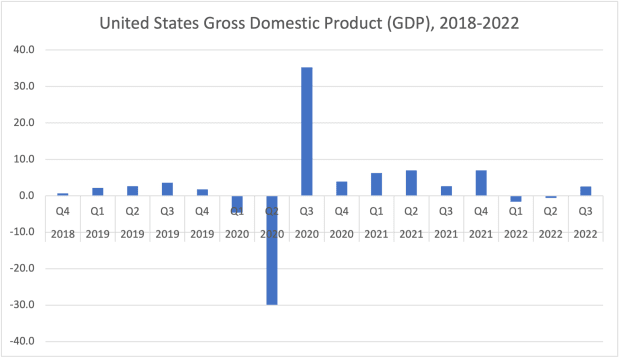

Source: BEA.gov

What Caused the Covid-19 Recession?

Back in the 1970s, an economist named Julius Shiskin popularly defined a recession as two quarters of negative GDP growth. While stock market pundits commonly point to that classification, the NBER looks at a host of other indicators to paint a more complete picture on the economy—and when all is said and done, the economy’s continued poor performance just might as well cause the NBER to revise and extend its timeframe for the COVID-19 recession.

The COVID-19 Recession Was So Much More Than GDP Contraction

What’s interesting about the COVID-19 crisis is that it not only fits within Shiskin’s definition, since GDP contracted by an astounding 34.5% in the first two quarters of 2020, and again at the onset of theDelta and Omicron variants but other economic indicators had also pointed to a looming contraction—one not just due to a health crisis. This may explain why the stock market went on to experience turbulence and anxiety well after the lockdowns ended.

The Covid-19 Recession Was Also an Inflation-Triggered Recession

One of the reasons why the Federal Reserve scrutinizes monthly data releases is that it knows that inflation is notoriously hard to control. Inflation alone can trigger a recession because the policy procedures used to rein it in—namely, by raising interest rates—are considered to be a “blunt instrument.” That means that it takes a while for their effects to be felt, and that they leave widespread, instead of targeted, fallout.

When interest rates rise, for example, it’s more difficult for consumers to obtain a car loan or a mortgage from a bank, and thus, the housing and retail sectors suffer. Credit card and student loan repayments also increase, and so consumer confidence weakens. Businesses can’t afford to expand—and often, many are forced to reduce their workforces, which causes unemployment to rise.

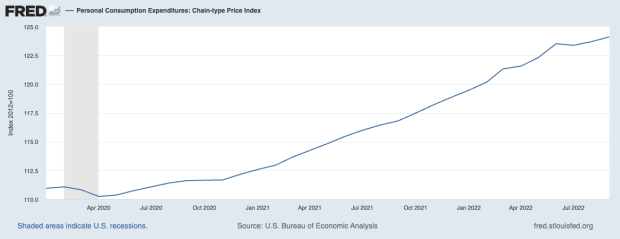

U.S. Bureau of Economic Analysis, Personal Consumption Expenditures: Chain-type Price Index [PCEPI], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PCEPI, November 14, 2022.

One of the Federal Reserve’s preferred inflation gauges is the Personal Consumption Expenditures index (PCE), which measures the change in prices for the everyday items that make our lives possible. During March and April of 2020, the Core PCE actually declined before it began a steep, two-year ascent that has yet to level off—prices skyrocketed more than 10% in little more than two years! This trend would not be sustainable for any economy.

Remembering how Fed Chair Paul Volcker had to raise the Fed funds rate to an all-time high of 20.0% in order to tame inflation back in the 1980s may explain why its current Chair, Jerome Powell, quickly reacted to inflation’s surge by implementing a series of 0.75% rate hikes throughout much of 2022.

Unfortunately, the effects of these actions will be felt for some time to come.

The COVID-19 Recession Ignited a Series of Economic Shocks

What happens when people are scared for their lives, huddled at home, or even worse—trapped in the grips of a deadly disease with no treatment in sight? Production stops, manufacturing output plummets, businesses fail, and unemployment soars.

The COVID-19 pandemic introduced a series of supply shocks that strangled the economy and left supply chains hopelessly snarled. Borders closed, leaving shipments of raw materials and other items stalled for months. When lockdowns eased, demand for products surged, but manufacturing would take months to come back online, and inventories simply could not keep up fast enough.

COVID-related famines swept the globe, while oil-producing nations declared war on each other. To make matters worse, China reinstituted mandatory lockdowns between February and June of 2022, causing the entire cycle to repeat itself. It’s no wonder global economies continue to feel the malaise.

The COVID-19 Pandemic Popped Wall Street’s Bubble

Stretching from 2009 through February, 2020 the longest bull market in history had to end at some point. It could be argued that an asset bubble had engulfed the entire stock market, and a correction was needed to return stock prices closer to their intrinsic values.

And as anyone who blows a bubble knows, when it finally bursts, the results aren’t pretty. The warnings grew more ominous: The yield curve on US Treasuries inverted between May and October of 2019, which is often thought to be a reliable indicator of recession.

Is There an End to the COVID-19 Recession in Sight?

Controlling the virus itself will finally extinguish the COVID-19 recession, but so long as it has hosts to infect and variants that mutate, a cure remains elusive. Along with each surge, the economy falters, preventing a true recovery from taking form. Until then, investors would be wise to buckle up and follow sound approaches to keep their money as safe as possible—such as this bear market superpower from TheStreet’s Todd Campbell.