The SPDR S&P 500 ETF Trust (NYSE:SPY) opened lower on Wednesday ahead of the Federal Reserve’s monthly meeting, where the central bank is expected to implement a fourth consecutive 0.75% interest rate hike.

Consumer price index (CPI) data for September came in at 8.2%, exceeding economist estimates of 8.1%. The number indicates the Fed’s previous attempts to lower inflation haven’t been successful.

U.S. GDP grew 2.6% in the third quarter, ahead of the 2.3% estimate.

On Wednesday, ADP reported U.S. companies added 239,000 jobs in October, exceeding economist estimates of 195,000 positions, which suggests the labor market continues to run hot.

JPMorgan Chase & Co. (NYSE:JPM) analysts see the S&P 500 down 1% to up 0.5% if the Fed raises rates by 75 basis points and gives a hawkish press conference. If the Fed raises rates by 0.75% but provides dovish comments afterwards, analysts at the firm believe the ETF could rally between 2.5% and 3%.

According to CME Group, the bond market is pricing in a 90.2% chance of a 0.75% rate hike, up from an 88.7% chance on Monday.

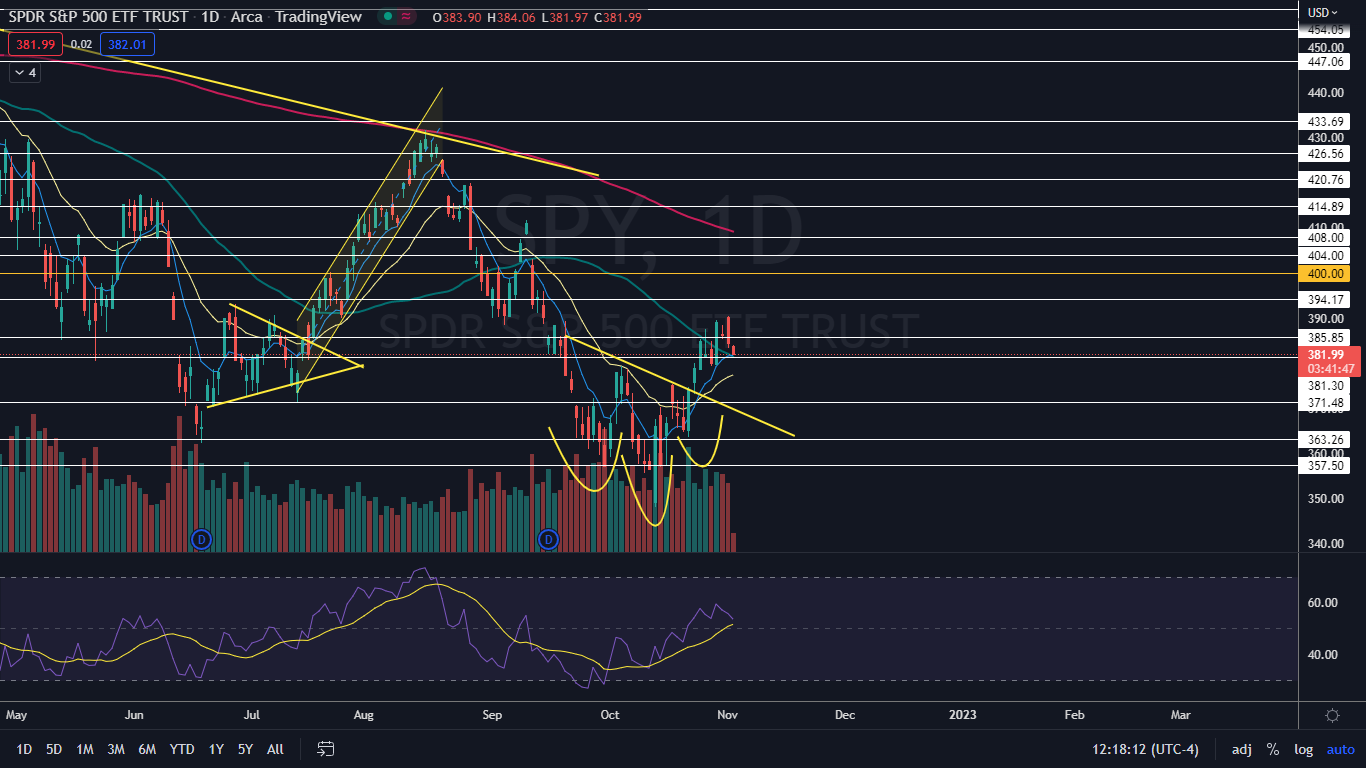

Despite Tuesday’s and Wednesday’s decline, the SPY didn’t negate the uptrend it’s been trading in since Oct. 13, and if the ETF can hold above the eight-day exponential moving average (EMA) after the meeting a bounce is the most likely scenario.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The SPY Chart: On Oct. 24, the SPY broke up from an inverted head-and-shoulders pattern, which according to the measured move indicated a 7% rally was on the horizon. So far, the SPY has completed about half of the suggested increase, rising a total of 3.5% to reach a high of $394.17 on Tuesday.

- The SPY’s most recent higher high within its uptrend was printed at that high-of-day Tuesday and the most recent confirmed higher low was formed on Oct. 27 at $379.33. If the SPY reacts positively to the Fed’s decision, the ETF may surge higher and print a hammer candlestick, which could indicate the uptrend will continue.

- If the SPY reacts negatively to the decision and falls under the eight-day EMA, a lower low could be on the horizon, which will negate the uptrend. If that happens, the SPY will also lose support at the 50-day simple moving average, which will indicate longer-term sentiment has turned bearish.

- The SPY has resistance above at $385.85 and $394.17 and support below at $381.30 and $371.48.