/Trimble%20Inc%20logo%20on%20building-by%20Tada%20Images%20via%20Shutterstock.jpg)

Valued at $17.6 billion by market cap, Trimble Inc. (TRMB) is a global technology company that provides hardware, software, and data solutions that connect physical operations with digital workflows across industries such as construction, geospatial, transportation, agriculture, and utilities. The Colorado-based company is built around advanced positioning, scanning, and analytics technologies, including GNSS, 3D surveying, machine control, and cloud-based platforms, that help professionals improve accuracy, productivity, and asset management.

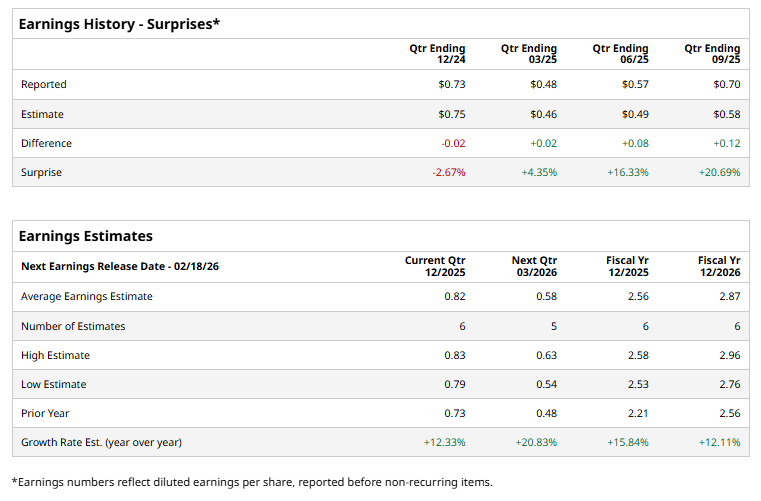

The leading industrial technology company is expected to announce its fiscal fourth-quarter earnings for 2025 in the near term. Ahead of the event, analysts expect TRMB to report a profit of $0.82 per share on a diluted basis, up 12.3% from the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For FY2025, analysts expect TRMB to report EPS of $2.56, up 15.8% from $2.21 in fiscal 2024. Its EPS is expected to rise 12.1% year over year to $2.87 in fiscal 2026.

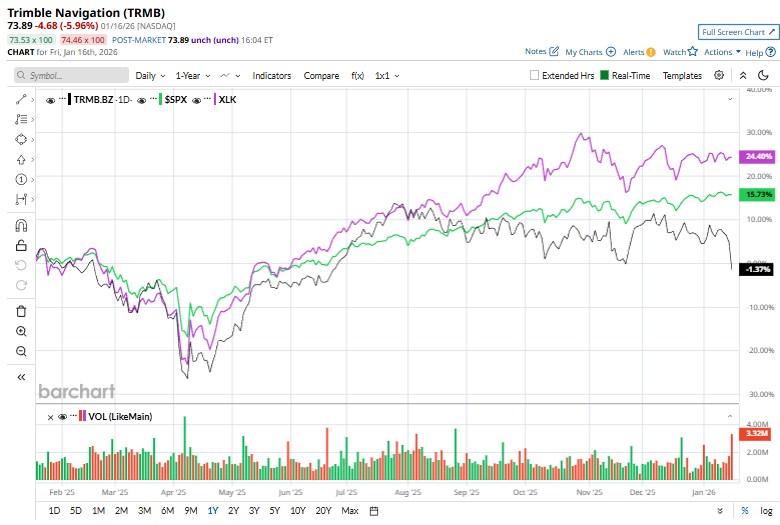

TRMB stock has declined marginally over the past year, underperforming the S&P 500 Index’s ($SPX) 15.1% gains and the Technology Select Sector SPDR Fund’s (XLK) 26.4% rise over the same time frame.

On Jan. 16, Trimble’s stock dropped about 5.7% after its CEO, Robert G. Painter, sold 7,500 shares worth roughly $606,600, which raised investor concern, and the decline was amplified when the stock fell below its 200-day moving average, triggering technical selling.

Analysts’ consensus opinion on TRMB stock is bullish, with a “Strong Buy” rating overall. Out of 13 analysts covering the stock, 11 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and one gives a “Hold.” TRMB’s average analyst price target is $97.91, indicating an ambitious potential upside of 32.5% from the current levels.