The second earnings season of the year is due to start next week once the US banks report how they performed in the first three months of 2022.

Earnings Surprises Dominated The Last Earnings Season

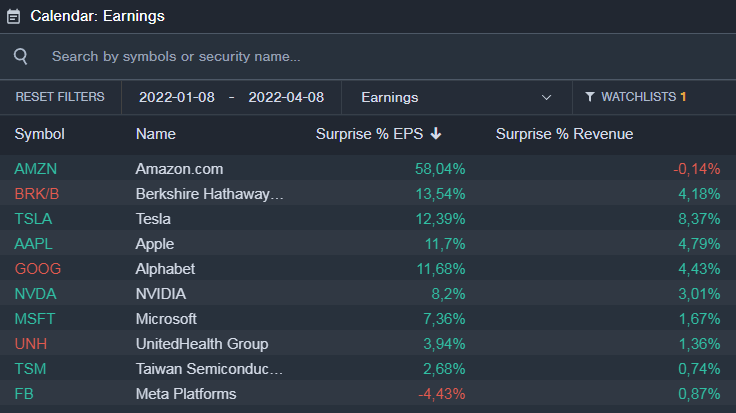

In Q1/2022, the 10 companies with the highest market cap came out with EPS earnings surprises ranging from +2.68% for Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) to +58.04% for Amazon.com Inc. (NASDAQ:AMZN). Only Meta Platforms Inc. (NASDAQ:FB) struggled with a negative earnings surprise of -4.43%. Also, 9 out of 10 companies reported higher than expected revenues.

Source: Earnings Calendar Benzinga Pro (14-day free trial)

What Analysts Expect for The Earnings Season Q2/2022

According to FactSet, the expected earnings growth rate for the S&P 500 is 4.7%. If met, it will be the lowest earnings growth rate S&P 500 had recorded since the fourth quarter of 2020, when it reported an earnings growth rate of 3.8%.

New estimates are lowered from the previous Q1 2022 earnings growth rate forecast of 5.7%, published on December 31. Because of the revision, seven sectors are now estimated to report weaker earnings than the December 31 estimates.

FactSet reports that 67 S&P 500 companies have released downward EPS outlooks for Q1 2022, while 29 S&P 500 companies have issued upbeat EPS forecasts.

Currently, the forward 12-month P/E ratio for the index stands at 19.5, compared to the 5-year average P/E ratio of 18.6 and 10-year average of 16.8.

12 S&P 500 have reported better-than-expected Q1 2022 earnings results, while 14 S&P 500 companies have generated better-than-expected revenue in the quarter.

In a year-ago period, the earnings growth of S&P 500 components was fueled mainly by the financial companies. These firms represented just 11% of the S&P 500 index. However, analysts believed they could contribute as much as 25% of the earnings growth for the benchmark index.

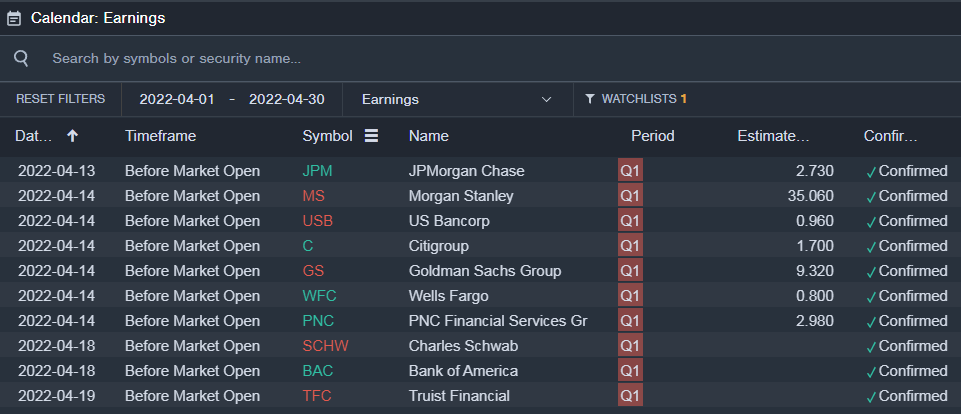

Source: Earnings Calendar Benzinga Pro (14-day free trial)

Banks to Pave the Way

On a positive note, data for Q1 2022 earnings season looks promising, while inflation and supply chain-related challenges continue to worsen following Russia’s invasion of Ukraine and the consequent surge in oil prices.

These issues are likely to make a worse-than-expected short-term impact on the market, though analysts are optimistic about the earnings growth in the second half of the year.

While analysts are still expecting to see growth for the S&P 500 companies in Q1 2022, there is not much more positive to say in terms of earnings estimates. The earnings growth for the first quarter this year will be primarily driven by the energy industry, with seven other sectors suggesting negative earnings outlooks.

The energy sector is expected to see earnings growth of as much as 165% in the period. Some analysts expect continued strength in the energy sector, with investors unlikely to want to exit commodities amid decades-high inflation figures.

Furthermore, the consensus estimates for the second quarter and full-year earnings growth are also expected to be fueled by the energy sector, with estimates for the calendar 2022 year edging higher following a 4000 basis point surge in the sector outlook.

As far as tech stocks are concerned, analysts focus on high-quality companies with high pricing power and can pass on higher input costs. In this market environment, with the Fed acting in a highly hawkish manner, any miss on both the top and bottom line, or guidance, is likely to be punished heavily.

Conclusion

The S&P 500 earnings reporting season for the first quarter this year begins in a few days when Wall Street banks disclose their earnings. The expected earnings growth rate for the S&P 500 is 4.7%, which means the bar is not as high as it used to be earlier.

Investors are likely to focus on energy stocks given their massive outperformance YTD and tech stocks, with some indicators showing this sector trades at the most oversold levels since 2015.

Alexander Voigt is the Chief Executive Officer and founder of daytradingz.com. He does not hold any positions in the mentioned stocks.