/Idexx%20Laboratories%2C%20Inc_%20phone%20and%20chart%20-by%20IgorGolovniov%20via%20Shutterstock.jpg)

IDEXX Laboratories, Inc. (IDXX) is a multinational healthcare company specializing in the development, manufacture, and distribution of diagnostics and related products for companion animal veterinary care, livestock and poultry health, dairy testing, and water quality analysis. The company’s market cap is approximately $53.6 billion, reflecting its large-cap status in the healthcare sector. IDEXX Laboratories is headquartered in Westbrook, Maine.

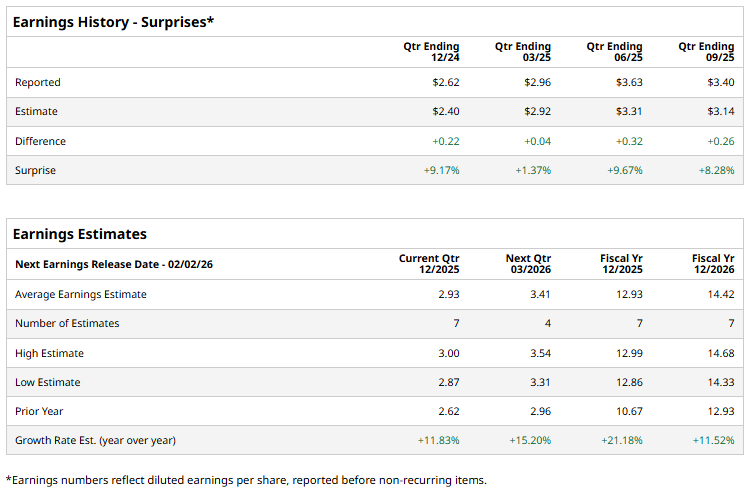

The veterinary giant is ready to announce its fiscal Q4 earnings for 2025 soon. Ahead of this event, analysts project the company to report a profit of $2.93 per share on a diluted basis, up 11.8% from $2.62 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in each of the last four quarters.

For the fiscal year, analysts expect IDXX to report EPS of $12.93, up 21.2% from $10.67 in fiscal 2024. Its EPS is expected to further grow 11.5% annually to $14.42 in fiscal 2026.

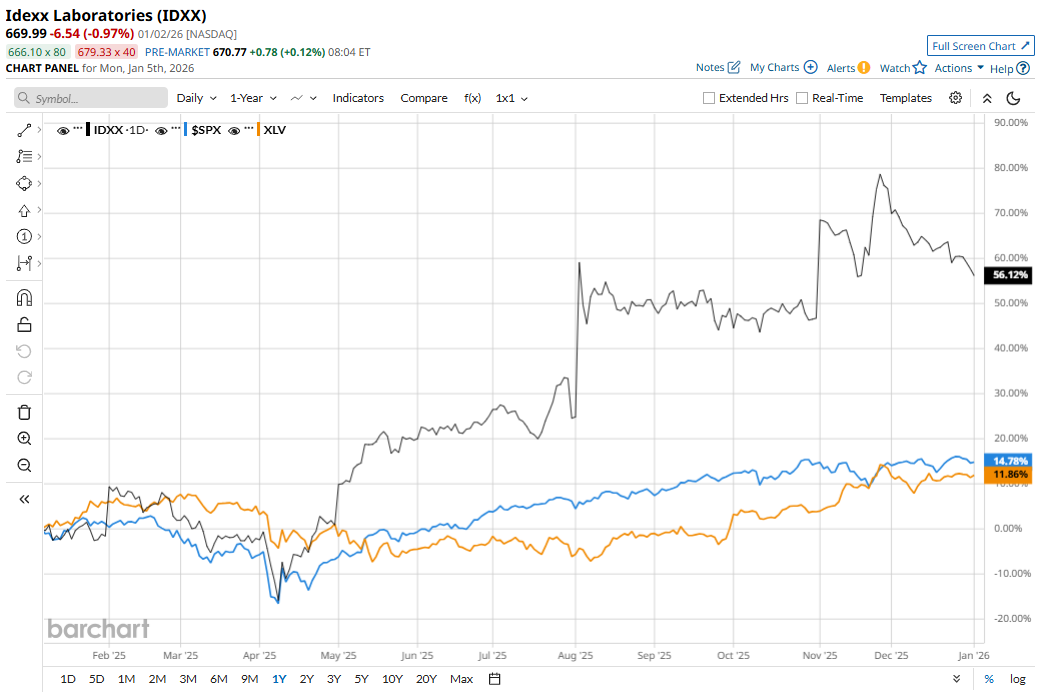

IDXX shares have climbed 61.4% over the past 52 weeks, surpassing the S&P 500 Index’s ($SPX) 16.9% return and the Health Care Select Sector SPDR Fund’s (XLV) 11.3% uptick over the same time frame.

IDEXX Laboratories’ shares rose sharply as the company reported strong financial results that beat analyst expectations, which increased investor confidence. Robust performance in its Companion Animal Group (CAG) Diagnostics segment and expanding global instrument installations were key drivers of the stock’s momentum. Plus, high demand for its cloud-based software solutions and diagnostic products, along with strategic execution, further supported the share price gains.

Wall Street analysts are moderately optimistic about IDXX’s stock, with a “Moderate Buy” rating overall. Among 14 analysts covering the stock, eight recommend “Strong Buy,” one suggests a “Moderate Buy,” and five advise “Hold.” The mean price target for IDXX is $790.67, indicating an 18% potential upside from the current levels.