Valued at a market cap of $8.8 billion, Federal Realty Investment Trust (FRT) owns, operates and redevelops high-quality retail-based properties located primarily in major coastal markets and select underserved regions with strong economic and demographic fundamentals. The North Bethesda, Maryland-based company is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

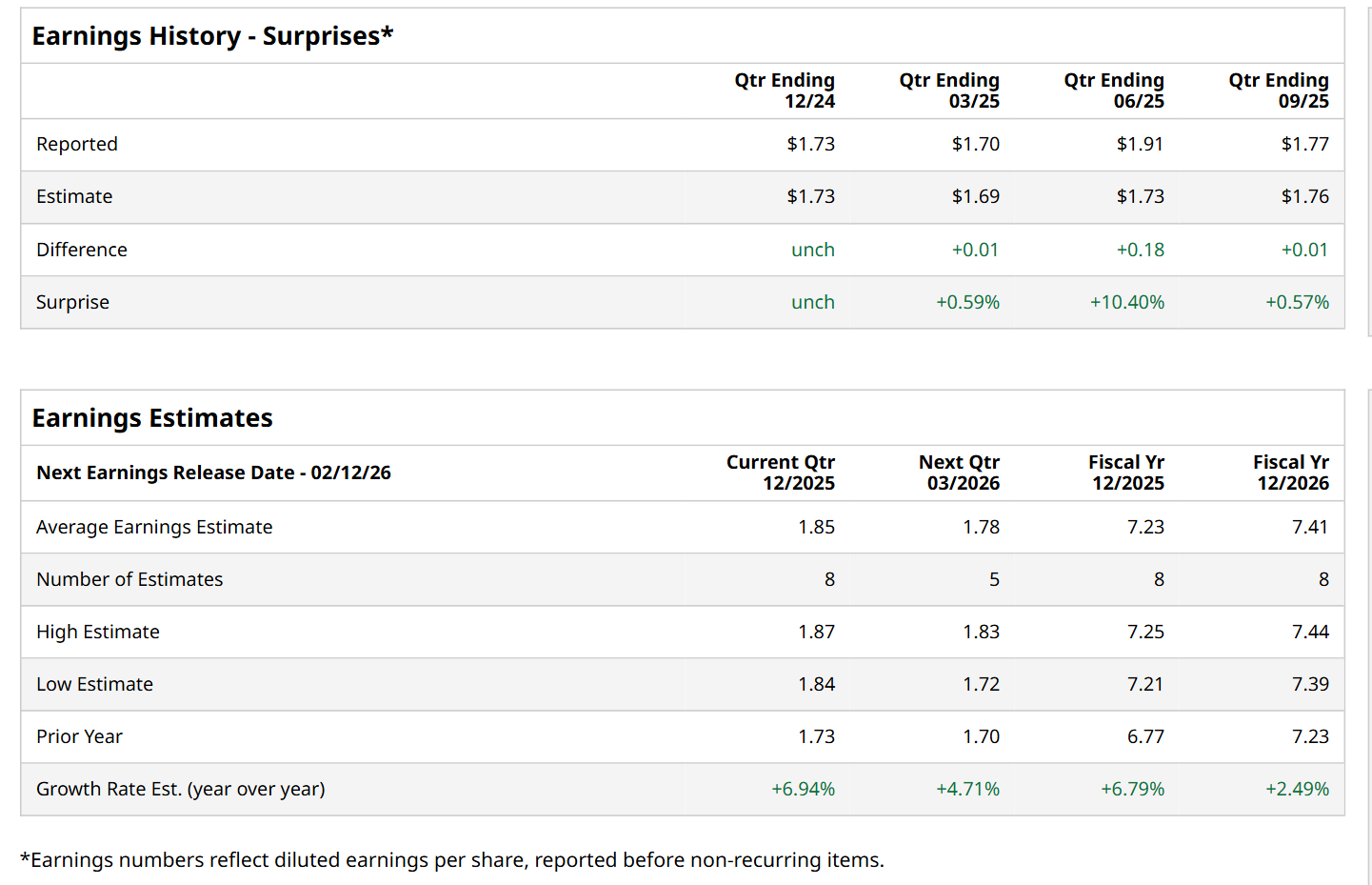

Ahead of this event, analysts expect this retail REIT to report a profit of $1.85 per share, up 6.9% from $1.73 per share in the year-ago quarter. The company has met or topped Wall Street’s bottom-line estimates in each of the last four quarters. In Q3, its FFO of $1.77 per share exceeded the consensus estimates by a slight margin.

For the current fiscal year, ending in December, analysts expect FRT to report an FFO of $7.23 per share, up 6.8% from $6.77 per share in fiscal 2024. Furthermore, its FFO is expected to grow 2.5% year-over-year to $7.41 in fiscal 2026.

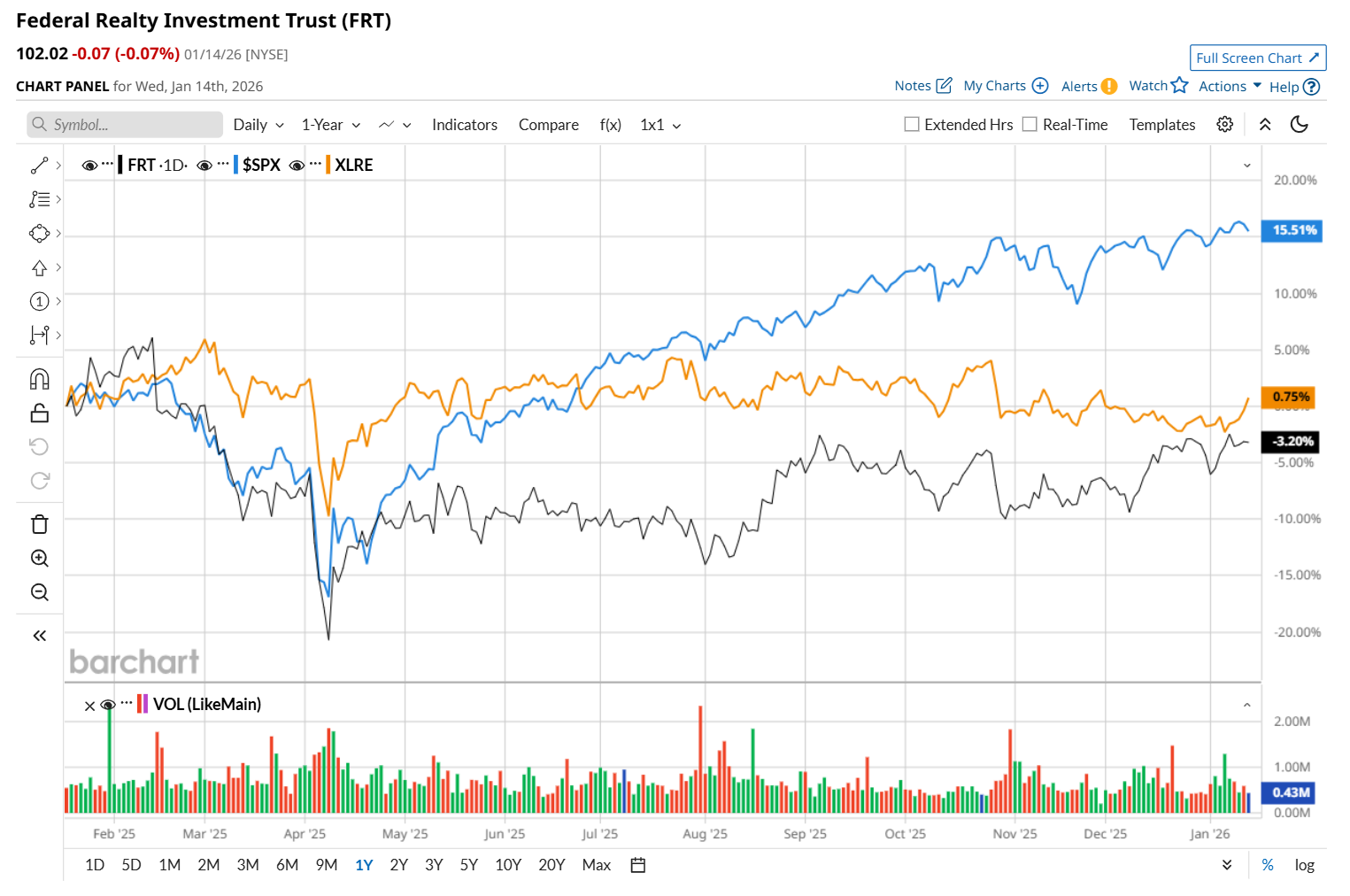

FRT has declined 1.9% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 18.6% return and the State Street Real Estate Select Sector SPDR ETF’s (XLRE) 3.4% uptick over the same time period.

On Oct. 31, shares of FRT rose 1.4% after its better-than-expected Q3 earnings release. Due to strong growth in rental income, the company’s total revenue increased 6.1% year-over-year to $322.3 million, surpassing consensus estimates by 2.7%. Moreover, its FFO per share of $1.77 improved 3.5% from the same period last year, topping Wall Street forecasts of $1.76.

Wall Street analysts are moderately optimistic about FRT’s stock, with a "Moderate Buy" rating overall. Among 19 analysts covering the stock, nine recommend "Strong Buy," one indicates a "Moderate Buy,” and nine suggest "Hold.” The mean price target for FRT is $110.69, indicating an 8.5% potential upside from the current levels.