/Expeditors%20International%20Of%20Washington%2C%20Inc_%20logo%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

Seattle, Washington-based Expeditors International of Washington, Inc. (EXPD) is a leading third-party logistics provider. With a market cap of $16.3 billion, Expeditors offers global logistics management, including international freight forwarding and consolidation, for both air and ocean freight.

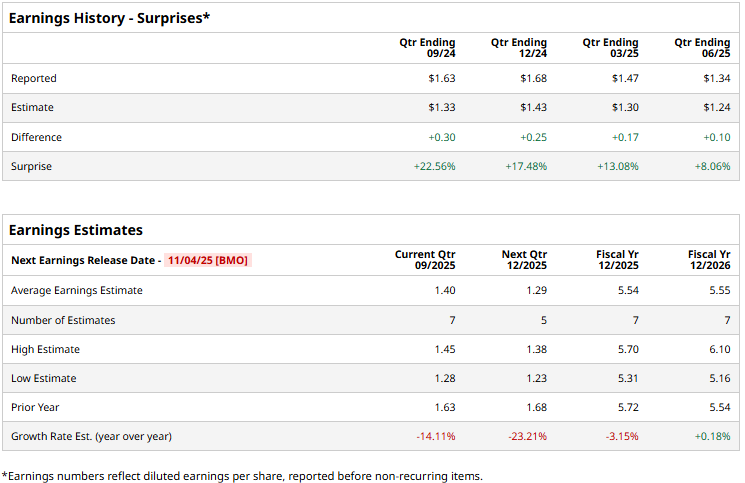

The logistics giant is set to announce its third-quarter results before the market opens on Tuesday, Nov. 4. Ahead of the event, analysts expect EXPD to deliver an adjusted profit of $1.40 per share, down 14.1% from $1.63 per share reported in the year-ago quarter. On a positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, EXPD is expected to report an adjusted EPS of $5.54, down 3.2% from $5.72 reported in 2024. While in fiscal 2026, its earnings are expected to observe a marginal uptick, growing to $5.55 per share.

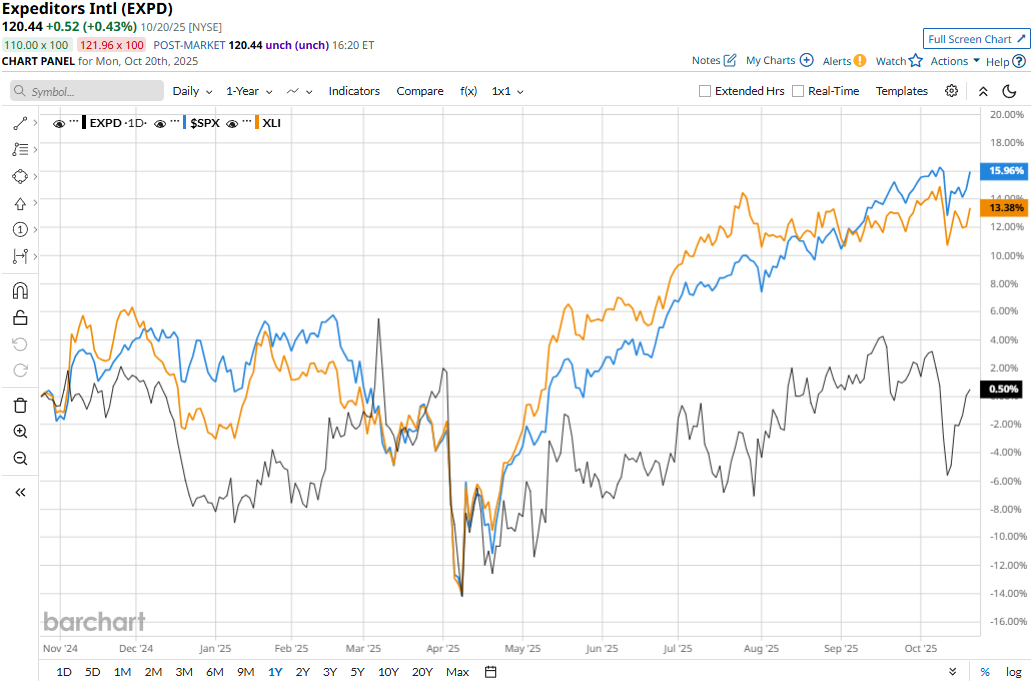

EXPD stock prices have observed a marginal 5 bps dip over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 14.8% surge and the Industrial Select Sector SPDR Fund’s (XLI) 10.2% gains during the same time frame.

Despite reporting better-than-expected results, Expeditors International’s stock prices observed a marginal dip in the trading session following the release of its Q2 results on Aug. 5. The company has observed notable operational gains across its businesses and registered substantial growth in the airfreight business. Overall, the company’s topline soared 8.7% year-over-year to $2.7 billion, beating the Street’s expectations by a double-digit figure. Meanwhile, its EPS grew 8.1% year-over-year to $1.34, surpassing the consensus estimates by a significant margin.

Following the initial dip, EXPD stock prices observed a 2.1% uptick in the subsequent trading session.

Analysts remain pessimistic about the stock’s prospects. EXPD maintains a consensus “Moderate Sell” rating overall. Of the 15 analysts covering the stock, opinions include eight “Holds,” one “Moderate Sell,” and six “Strong Sells.” As of writing, the stock is trading above its mean price target of $114.77.

.jpg?w=600)