/Emerson%20Electric%20Co_%20logo%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

Saint Louis, Missouri-based Emerson Electric Co. (EMR) is an industrial company that provides advanced automation solutions. Valued at a market cap of $80.9 billion, the company is expected to announce its fiscal Q1 earnings for 2026 in the near future.

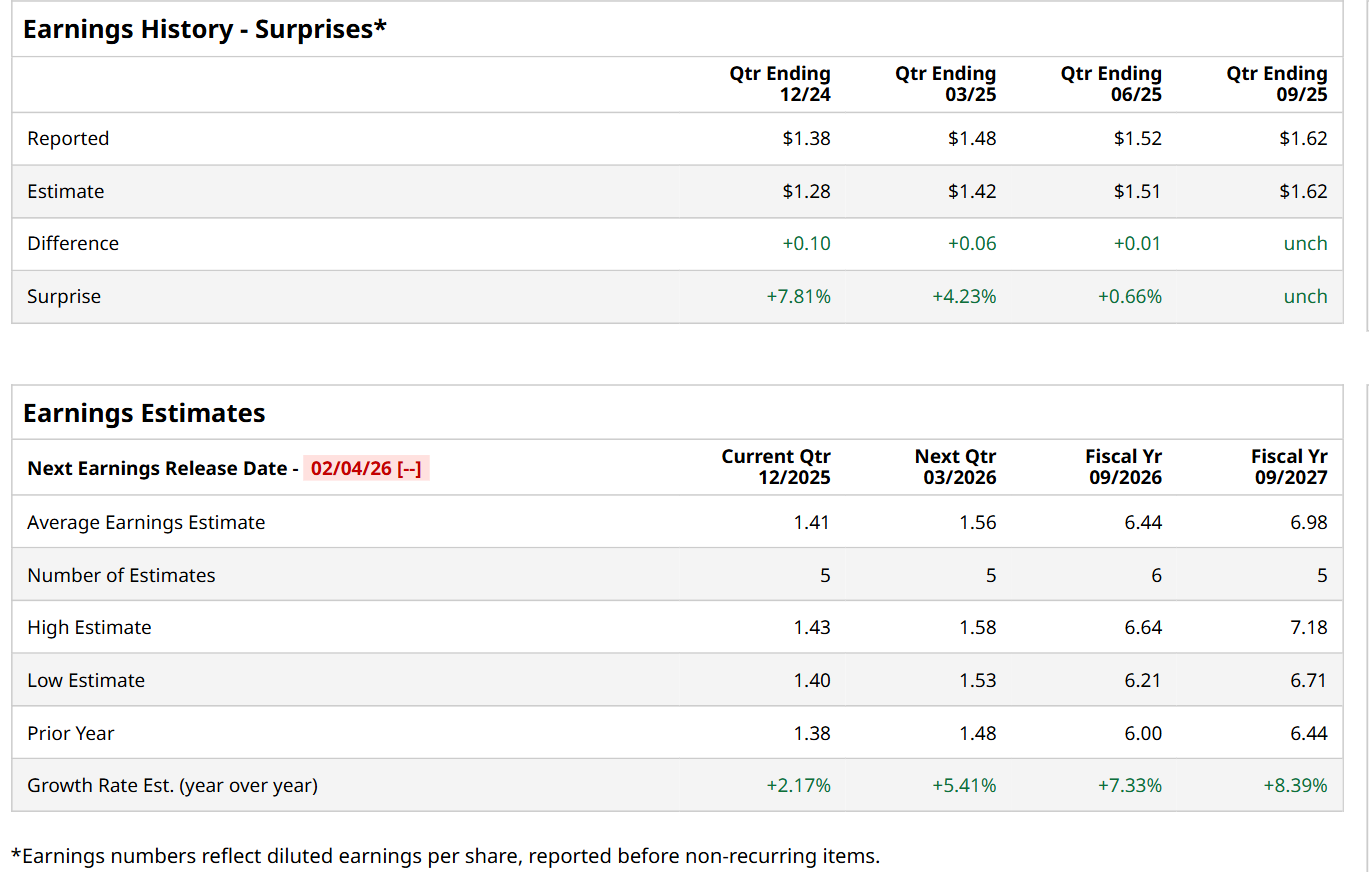

Ahead of this event, analysts expect this tech company to report a profit of $1.41 per share, up 2.2% from $1.38 per share in the year-ago quarter. The company has met or topped Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $1.62 per share in the previous quarter met the consensus estimates.

For fiscal 2026, ending in September, analysts expect EMR to report a profit of $6.44 per share, up 7.3% from $6 per share in fiscal 2025. Furthermore, its EPS is expected to grow 8.4% year-over-year to $6.98 in fiscal 2027.

Shares of EMR have gained 19.6% over the past 52 weeks, outperforming the S&P 500 Index's ($SPX) 17.5% return over the same time frame. However, it has lagged behind the State Street Industrial Select Sector SPDR ETF’s (XLI) 21.7% uptick over the same time period.

On Jan. 5, shares of EMR closed up 5.2% after UBS Group AG (UBS) upgraded the stock to “Buy” from “Neutral” and raised its price target to $168. The analyst expects EMR’s earnings growth to accelerate after a recent period of softness and also highlighted a clear pathway for the industrial company to deliver double-digit annual profit growth beyond 2026, underscoring confidence in its long-term outlook.

Wall Street analysts are moderately optimistic about EMR’s stock, with a "Moderate Buy" rating overall. Among 25 analysts covering the stock, 16 recommend "Strong Buy," one indicates a "Moderate Buy,” seven suggest "Hold,” and one advises a "Moderate Sell.” The mean price target for EMR is $153.92, indicating a 7% potential upside from the current levels.